FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

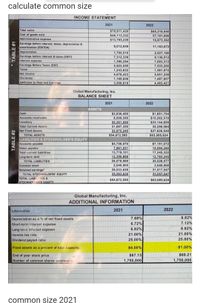

Transcribed Image Text:calculate common size

INCOME STATEMENT

2021

2022

Total sales

Cost of goods sold

Administrative expense

$70,911,420

$48,113,332

$13,785,239

$85,218,840

57,181,806

16,873,362

Earnings before interest, taxes, depreciation &

amortization (EBITDA)

Depreciation

Earnings before interest & taxes.(EBIT)

Interest expense

Earnings Before Taxes (EBT)

9,012,849

11,163,672

2,027,160

9,136,512

1,700,510

7,312,339

1,390,284

1,603,312

5,922,055

7,533,200

Taxes

Net Income

Dividends

Additions to Reta!ned Earnings

1,243,632

4,678,423

1,169,606

1,581,972

5,951,228

1,487,807

4,463,421

3,508,818

Global Manufacturing, Inc.

BALANCE SHEET

2021

2022

ASSETS

Cash

Accounts recelvable

Inventory

Total Current Assets

Net Fixed Assets

$2,836,450

8,509,350

20,351,550

$1,851,754

$10,262,510

$23,144,820

35,259,084

$27,826,540

$63,085,624

31,697,350

22,975,245

$54,672,595

TOTAL ASSETS

LIABILITIES & STOCKHOLDER'S EQUITY

$7,151,072

10,094,260

17,245,332

12,783,245

30,028,577

2,040,000

31,017,047

33,057.047

Accounts payable

Notes payable

$5,758,070

7,961,031

Total current liabilities

13,719,101

12,359,868

26,078,969

2,040,000

Long-term debt

TOTAL UABIITIES

Common stock

Retained earnings

26,553,626

TOTAL STOCKHOLDERS' EQUITY

28.593.626

TOTAL UABILÍTIES &

STOCKHOLDER'S EQUITY

$63,085,624

$54,672,595

Global Manufacturing, Inc.

ADDITIONAL INFORMATION

Information

2021

2022

8.82%

7.68%

6.72%

6.92%

21.00%

25.00%

Depreciation as a % of net fixed assets

Short-term interest expense

7.12%

Long-term Intarest expense

6.92%

Income tax rate

21.00%

Dividend payout ratio

25.00%

Fixed assets as a percent of total capacity.

84.00%

91.00%

End of year stock price

$67.13

$69.21

Number of common shares outstanding

1,750,000

1,750,000

common size 2021

TABLE #2

TABLE #1

Transcribed Image Text:B

D

LINE BY LINE ANALYSIS OF

2021 BALANCE SHEET

COMPARED TO

Global

BENCHMARK

Manufacturing

FIRM

THE BENCHMARK FIRM

(BETTER, SAME AS, WORSE

than the Benchmark firm)

14

2021 COMMON SIZE BALANCE SHEET

2021

2021

s ASSETS

26 Cash

0.0%

6.7%

7 Accounts receivable

0.0%

16.4%

28 Inventory

0.0%

30.6%

29

Total Curren! Assets

0.0%

53.7%

30 Net fixed assets

0.0%

46.3%

31

TOTAL ASSETS

0.0%

100.0%

32 LIABILITIES & STOCKHOLDERS' EQUITY

33 Accounts payable

0.0%

12.1%

34 Notes payable

0.0%

15.4%

35

Total Current Liabilities

0.0%

27.5%

36 Long-term debt

0.0%

15.8%

37

TOTAL LIABILITIES

0.0%

43.3%

38 Common stock

0.0%

4.5%

39 Retained earnings

0.0%

52.2%

40 TOTAL STOCKHOLDERS' EQUITY

0.0%

56.7%

41 TOTAL LIABILITIES & STOČKHOLDERS' EQUITY

0.0%

100.0%

D

2021 COMMON SIZE STATEMENT CALCULATIONS AND ANALYSIS

LINE BY LINE ANALYSIS OF

2021 INCOME STATEMENT

Global

BENCHMARK

Manufacturing

COMPARED TO

THE BENCHMARK FIRM

FIRM

2021 COMMON SIZE INCOME STATEMENT

(BETTER, SAME AS, WORSE

than the Benchmark firm)

2021

2021

Total sales

0.0%

100.0%

Cost of goods sold

0.0%

69.2%

Administrative expense

0.0%

9.6%

Eamings before interest, taxes, depreciation & amortization

(EBITDA)

0.0%

21.2%

Depreciation

0.0%

2.2%

Earnings before interest & taxes.(EBIT)

0.0%

19.0%

Interest expense

0.0%

2.2%

Earnings Before Taxes (EBT)

0.0%

16.8%

Taxes

0.0%

Net income

0.0%

13.7%

Dividends

0.0%

1.4%

Additions to Retained Earnings

0.0%

12.3%

calculate common size

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

How should you compute the number that appears as "cost of good sold" in a common-size income statement?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

How should you compute the number that appears as "cost of good sold" in a common-size income statement?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the common size percentages and answer the questions below.arrow_forwardCan you do 2022 income statement of this table? Statement of Profit or Loss and Other Comprehensive Income Presentation Currency Nature of Financial Statements Revenue Revenue from Finance Sector Operations Total Revenue Cost of Sales Cost of Finance Sector Operations Total Costs Gross Profit (Loss) from Commercial Operations Gross Profit (Loss) from Finance Sector Operations Gross Profit (Loss) Profit (Loss) From Operating Activities Profit (Loss) Before Financing Income (Expense) Profit (Loss) from Continuing Operations, Before Tax Profit (Loss) from Continuing Operations Profit (Loss) from Discontinued Operations Net Profit (Loss) Profit (Loss) Attributable To, Non- controlling Interests Profit (Loss) Attributable To, Owners of Parent Other Comprehensive Income (Loss) Total Comprehensive Income (Loss) Total Comprehensive Income Attributable To, Non-controlling Interests Total Comprehensive Income Attributable To, Owners of Parent 2020/12 1000TL Consolidated 21.529.210 37.824.578…arrow_forwardProblem 13-2A (Algo) Ratios, common-size statements, and trend percents LO P1, P2, P3 [The following information applies to the questions displayed below] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 2019 Sales Cost of goods sold $ 402,346 $ 308,230 242,212 $ 213,900 194,493 136,896 Gross profit 160,134 113,737 77,004 Selling expenses 57,133 42,536 28,235 Administrative expenses 36,211 27,124 17,754 Total expenses 93,344 69,660 45,989 Income before taxes Income tax expense 66,790 44,077 31,015 12,423 9,036 6,296 Net income $ 54,367 $ 35,041 $ 24,719 KORBIN COMPANY Comparative Balance Sheets December 31 Assets Current assets Long-term investments Plant assets, net Total assets Current liabilities Liabilities and Equity Common stock Other paid-in capital Retained earnings Total liabilities and equity $ 180,932 2021 $ 63,959 116,973 0 2020 $ 42,808 800 106,691 $ 180,932 $ 150,299 $…arrow_forward

- 2023 Income Statement Sales Cost of Goods Sold $ 770,000 $ 340,000 Depreciation Expense $ 95,000 Earnings before Interest and Taxes $ 335,000 Interest Expense $ 19,800 Taxable Income Tax Expense Net Income Dividends Paid Retained Earnings $ 315,200 $ 104,016 $ 211,184 $ 10,300 $ 200,884 Balance Sheet End of 2023 Beginning of 2023 Cash $ 280,000 $ 122,000 Accounts Receivable $ 50,000 $ 22,300 Inventory $ 188,000 $ 119,000 Net Fixed Assets $ 630,000 $ 630,000 Total Assets $1,148,000 $ 893.300 Accounts Payable Long-term Debt $ 158,000 $ $ 14,116 $ 71,800 121,500 Common Stock $ 375,000 $ 300,000 Accumulated Retained Earnings $ 600,884 $ 400,000 Total Liabilities & Shareholders' Equity $1,148,000 $ 893,300 Consider the financial statements displayed above. Based on these statements, calculate the firm's quick ratio as of the end of 2023. Note: Report your answer as a number rounded to two decimal points.arrow_forward(Profitability Ratio)What is the Return on Asset Ratio in 2020?arrow_forwardNeed help calculating: A. Economic value added and B. Return on Capitalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education