Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

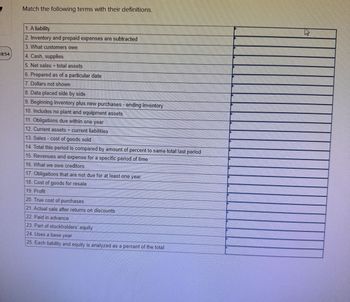

Please help: options for matching answers are trend analysis, vertical analysis, retained analysis prepaid expense, net sales, net purchase, net income merchandise inventory, long term liabilities, income statement, horizontal analysis, gross profit, current ratio, current liabilities, current assets, cost of merchandise sold, comparative statements, common size statements,

Transcribed Image Text:48:54

Match the following terms with their definitions.

1. A liability

2. Inventory and prepaid expenses are subtracted

3. What customers owe

4. Cash, supplies

5. Net sales - total assets

6. Prepared as of a particular date

7. Dollars not shown

8. Data placed side by side

9. Beginning inventory plus new purchases - ending inventory

10. Includes no plant and equipment assets

11. Obligations due within one year

12. Current assets = current liabilities

13. Sales - cost of goods sold

14. Total this period is compared by amount of percent to same total last period

15. Revenues and expense for a specific period of time

16. What we owe creditors

17. Obligations that are not due for at least one year

18. Cost of goods for resale

19. Profit

20. True cost of purchases

21. Actual sale after returns on discounts

22. Paid in advance

23. Part of stockholders' equity

24. Uses a base year

25. Each liability and equity is analyzed as a percent of the total

25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- how to prepare the income statement for the above transactionsarrow_forwardIncome statmentBalance sheetNo statmentarrow_forwardWhich of the following groupings of accounts includes only accounts that carry a normal credit balance? a.Customer Refunds Payable, Estimated Returns Inventory, and Sales b.Sales Tax Payable, Cost of Goods Sold, and Sales c.Inventory, Delivery Expense, and Sales d.Sales Tax Payable, Customer Refunds Payable, and Salearrow_forward

- Indicate the effect of the transactions listed in the following table on total current assets, current ration, and net income. Use (+) to indicate an increase, (-) to indicate a decrease, and (0) to indicate either no effect or an indeterminate effect. Be prepared to state any necessary assumptions and assume an initial current ratio of more than 1.0. Payment is made to trade creditors for previous purchasesarrow_forwardSales Returns and Allowances account is report it like a. contra-revenue account on the income statement. b. current liability on the balance sheet. c. deduction from accounts receivable on the balance sheet. d. selling expense on the income statement.arrow_forwardThe accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2: Cash Beginning inventory Common stock Retained earnings The following five transactions occurred in Year 2: 1. First purchase (cash) 120 units @ $90 2. Second purchase (cash) 205 units @ $98 3. Sales (all cash) 350 units @ $197 4. Paid $13,950 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes $16, 800 17,600 (200 units @ $88) 15, 700 18,700 Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. b. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.) Complete this question by entering your answers in the tabs below. Req A Req B1 Cost of goods sold Ending inventory Req…arrow_forward

- Indicate the effect of the transactions listed in the following table on total current assets, current ration, and net income. Use (+) to indicate an increase, (-) to indicate a decrease, and (0) to indicate either no effect or an indeterminate effect. Be prepared to state any necessary assumptions and assume an initial current ratio of more than 1.0. b Merchandise is sold for cash.arrow_forwardPlease solve using Excel and show formulas. You have decided to buy a car with price tag of $60,000 but you are able to negotiate the price down to $58,000. You have $5,000 saved, so you need to borrow $53,000 in a 5-year loan from your bank (your bank offers lower rates than the auto-dealer) at a 4.5% APR (annual rate). How much will you owe to the bank after 3 years?arrow_forwardPreparing an income statement) Prepare an income statement and a common-sized income statement from the following information. Click on the following icon in order to copy its contents into a spreadsheet.) Sales Cost of goods sold General and administrative expense Depreciation expense Interest expense Income taxes Complete the income statement below. (Round to the nearest dollar. NOTE: You may input expense acc as negative values.) Income Statement Gross profits Total operating expenses Operating income (EBIT) Earnings before taxes Net income $525,863 199,246 60,236 8,305 11,860 98,486 $ SSarrow_forward

- Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. Then, compute the income tax expense for each method. Use a vertical model to show the 2018 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.)arrow_forwardWhen using the Spreadsheet (work sheet) method to analyze noncash accounts, it is best to start with Group of answer choices cash net income retained earnings revenuearrow_forwardwhich comes first when preparing a income statement? please put in order salaries expense cost of goods sold net income total expenses gross profit miscellsneous expense salesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education