FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

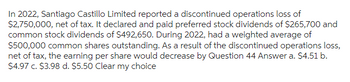

Transcribed Image Text:In 2022, Santiago Castillo Limited reported a discontinued operations loss of

$2,750,000, net of tax. It declared and paid preferred stock dividends of $265,700 and

common stock dividends of $492,650. During 2022, had a weighted average of

$500,000 common shares outstanding. As a result of the discontinued operations loss,

net of tax, the earning per share would decrease by Question 44 Answer a. $4.51 b.

$4.97 c. $3.98 d. $5.50 Clear my choice

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For the year ended December 31, 2020, Ivanhoe Company reported the following: Net income Preferred dividends declared Common dividend declared Unrealized holding loss, AFS debt security Retained earnings Common stock Accumulated Other Comprehensive Income, Beginning Balance $310000 $30600 $25300 $20000 $5300 49900 10700 5300 391000 210000 25300 What would Ivanhoe report as its ending balance of Accumulated Other Comprehensive Income?arrow_forwardPlease prepare fords single step income statement for year ended December 31 2018 i closing EPS. Fenton had one million shares of common stock and no preferred stock outstanding during the year based on data below.arrow_forward3arrow_forward

- Income Statement and Earnings per Share for Discontinued Operations Apex Inc. reports the following for a recent year: Income from continuing operations before income tax expense $1,000,000 Loss from discontinued operations $240,000* Weighted average number of shares outstanding 20,000 Applicable tax rate 40% *Net of any tax effect. a. Prepare a partial income statement for Apex Inc., beginning with income from continuing operations before income tax expense.arrow_forwardThe Esposito Import Company had 1 million shares of common stock outstanding during 2024. Its income statement reported the following items: income from continuing operations, $5 million; loss from discontinued operations, $1.8 million. All of these amounts are net of tax. Required: Prepare the 2024 EPS presentation for the Esposito Import Company. Note: Amounts to be deducted should be indicated with a minus sign. Round your answers to 2 decimal places. Earnings per share: Income from continuing operations Loss from discontinued operations Net incomearrow_forwardIncome Statement and Earnings per Share for Discontinued Operations Apex Inc. reports the following for a recent year: Income from continuing operations before income tax expense $1,000,000 Loss from discontinued operations $240,000* Weighted average number of shares outstanding 20,000 Applicable tax rate 40% *Net of any tax effect. Question Content Area a. Prepare a partial income statement for Apex Inc., beginning with income from continuing operations before income tax expense.arrow_forward

- A portion of the combined statement of income and retained earnings of Blue Inc. for the current year follows. Income before extraordinary item $15,060,000 Loss from discontinued operations, net of applicable income tax (Note 1) 1,320,000 Net income 13,740,000 Retained earnings at the beginning of the year 84,220,000 97,960,000 Dividends declared: On preferred stock—$6.00 per share $300,000 On common stock—$1.75 per share 15,050,000 15,350,000 Retained earnings at the end of the year $82,610,000 Note 1. During the year, Blue Inc. suffered a major loss from discontinued operations of $1,320,000 after applicable income tax reduction of $1,220,000.At the end of the current year, Blue Inc. has outstanding 8,670,000 shares of $10 par common stock and 50,000 shares of 6% preferred. On April 1 of the current year, Blue Inc. issued 980,000 shares of common stock for $32 per share to help…arrow_forwardAt the beginning of 2021, Sunland Company had retained earnings of $409000. During the year Sunland reported net income of $108000, sold treasury stock at a “gain” of $35000, declared a cash dividend of $61800, and declared and issued a small stock dividend of 3050 shares ($10 par value) when the fair value of the stock was $20 per share. The amount of retained earnings available for dividends at the end of 2021 was?arrow_forwardProvide Answer with calculation and explanationarrow_forward

- Please do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forwardCrane Inc. a publicly traded company, had 195,000 common shares outstanding on December 31, 2022. During 2023, the company issued 6,000 shares on May 1 and retired 18,000 shares on October 31. For 2023, the company reported net income of $186,200 after a loss from discontinued operations of $35,280 (net of tax). Assume that Crane issued a 3-for-1 stock split on January 31, 2024, and that the company's financial statements for the year ended December 31, 2023, were issued on February 15, 2024. Calculate earnings per share for 2023 as it should be reported to shareholders.arrow_forwardanswer must be in table format or i will give down votearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education