FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

## Additional Information for Income Statement Construction

- **Sales for 2021**: $448,650,000

- **EBITDA**: 14% of sales

- **Depreciation and Amortization**:](https://content.bartleby.com/qna-images/question/4119fedc-b5ba-442d-99f8-6b329401f211/59aa7f3c-3c19-40f5-9f44-e070fa1ec6ef/xn3i4uh_thumbnail.jpeg)

Transcribed Image Text:# Laiho Industries Financial Overview: 2020 and 2021

## Balance Sheets as of December 31 (thousands of dollars)

| Account | 2021 | 2020 |

|--------------------------|------------|------------|

| **Cash** | $103,013 | $89,685 |

| **Accounts Receivable** | 103,108 | 85,708 |

| **Inventories** | 37,155 | 33,809 |

| **Total Current Assets** | 243,276 | 209,202 |

| **Net Fixed Assets** | 66,107 | 41,616 |

| **Total Assets** | 309,383 | 250,818 |

| **Accounts Payable** | 30,823 | 22,190 |

| **Accruals** | 30,366 | 21,920 |

| **Notes Payable** | 15,132 | 12,782 |

| **Total Current Liabilities** | 76,321 | 56,892 |

| **Long-term Debt** | 76,643 | 63,593 |

| **Total Liabilities** | 152,964 | 120,485 |

| **Common Stock** | 95,000 | 85,000 |

| **Retained Earnings** | 61,419 | 45,333 |

| **Total Common Equity** | 156,419 | 130,333 |

| **Total Liabilities and Equity** | 309,383 | 250,818 |

The data mentioned above has been collected in a Microsoft Excel file, which can be accessed through the link below. Please follow the instructions for the analysis, ensuring accuracy by not rounding intermediate calculations. Outputs should be in thousands. For example, $1,000 should be entered as 1. Round to the nearest whole number and use a minus sign for negative values.

[Download spreadsheet Financial Statements, Cash Flow, and Taxes](#)

## Additional Information for Income Statement Construction

- **Sales for 2021**: $448,650,000

- **EBITDA**: 14% of sales

- **Depreciation and Amortization**:

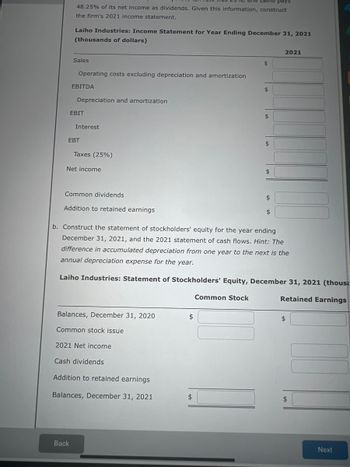

Transcribed Image Text:**Laiho Industries: Income Statement for Year Ending December 31, 2021 (thousands of dollars)**

- **Sales**

- (Blank for input) $

- **Operating costs excluding depreciation and amortization**

- (Blank for input) $

- **EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)**

- (Blank for input) $

- **Depreciation and amortization**

- (Blank for input) $

- **EBIT (Earnings Before Interest and Taxes)**

- (Blank for input) $

- **Interest**

- (Blank for input) $

- **EBT (Earnings Before Tax)**

- (Blank for input) $

- **Taxes (25%)**

- (Blank for input) $

- **Net Income**

- (Blank for input) $

- **Common dividends**

- (Blank for input) $

- **Addition to retained earnings**

- (Blank for input) $

**b. Construct the statement of stockholders' equity for the year ending December 31, 2021, and the 2021 statement of cash flows.**

*Hint:* The difference in accumulated depreciation from one year to the next is the annual depreciation expense for the year.

**Laiho Industries: Statement of Stockholders' Equity, December 31, 2021 (thousands of dollars)**

| | Common Stock | Retained Earnings |

|----------------------|--------------|-------------------|

| Balances, December 31, 2020 | (Blank for input) $| (Blank for input) $|

| Common stock issue | (Blank for input) $| |

| 2021 Net income | | (Blank for input) $|

| Cash dividends | | (Blank for input) $|

| Addition to retained earnings | | (Blank for input) $|

| **Balances, December 31, 2021** | (Blank for input) $| (Blank for input) $|

The document serves as a template for calculating financial statements, with spaces provided for inputting data for analysis.

Expert Solution

arrow_forward

Step 1

Answer to the above first part a)

statement showing the Computaton of NET INCOME

Laiho Industries: Income Statement for Year Ending December 31, 2021 (thousands of dollars)

| Particulars |

(in thousands) |

| Sales |

$448,650 |

| Multiply by:% of EBITDA |

14%. |

| EBITDA |

$62,811 |

| Depreciation and amortization ($66,107 x 19%) |

-$12,560 |

| EBIT |

$50,251 |

| Interest expense |

-$8806 |

| EBT |

$41,445 |

| Taxes ($41445 x 25%) |

-$10361 |

| Net income |

$31084 |

| Multiply by: Dividend pay out ratio |

48.25% |

| DIVIDENDS |

$14998 |

Answer to the question b)

Compute the stockholders equity

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 9 Comparative balance sheets of Belch Ltd for 2022 and 2021 are as follows. Assets Current assets Cash Accounts receivable Notes receivable Inventories Total current assets Noncurrent assets Land Machinery Accumulated depreciation Total noncurrent assets Total assets Liabilities and shareholders' equity Current liabilities Accounts payable Interest payable Total current liabilities Long-term debt Total liabilities Belch Ltd Comparative Statement of Financial Position Dec. 31, 2022 Dec. 31, 2021 Shareholders equity Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 200,000 160,000 70,000 399.000 829,000 525,000 483,000 (143,000) 865,000 $1,694,000 $ 145,000 17,500 162,500 350.000 512,500 650,000 531.500 1.181,500 $1,694,000 $ 188,000 133,000 61,000 326,000 708,000 500,000 238,000 (97,500) 640,500 $1,348.500 $ 153,000 15,000 168,000 200,000 368,000 550,000 430,500 980,500 $1,348,500 Additional information: 1. Net income is…arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

- Help | System Announcements Balance Sheet As of 12/31/19 Assets: Liabilities and Equity: Cash and marketable securities $28,987 Accounts payable and accruals $154,807 Accounts receivable $142,845 Short-term notes payable $21,639 Inventory $212,722 Total current liabilities $176,446 Total current assets $384,554 Long term debt $155,510 Net plant and equipment $602,309 Total liabilities $331,956 Goodwill and cther assets $42,422 Common stock $314,932 Retained earnings $382,397 Total assets $1,029,285 Total liabilities and equity $1,029,285 In addition, it was reported that the firm had a net income of: $158,531 and net sales of: $4,338,283 Calculate the following ratios for this firm (Use 365 days for calculation. Round answers to 2 decimal places, e.g. 52.75.): Current Ratio times Quick Ratio times Average Collection Period days Total Asset Turnever times Fixed Asset Turnover times Questionarrow_forwardExamine the balance sheet of commercial banks in the following table. $ Billion % Total 201.2 28.9 230.1 Assets Real assets Equipment and premises Other real estate Total real assets Financial assets Cash Investment securities Loans and leases Other financial assets Total financial assets Other assets Intangible assets Other Total other assets Total $ Ratio of real assets to total assets $ $ 876.3 2,032.1 6,627.3 1,201.2 $10,736.9 $ 416.4 780.7 $ 1,197.1 $12,164.1 1.7% 0.2 1.9% 7.2% 16.7 54.5 9.9 88.3% 3.4% 6.4 9.8% 100.0% Liabilities Deposits Liabilities and Net Worth Debt and other borrowed funds Federal funds and repurchase agreements Other Total liabilities Net worth Balance sheet of FDIC-insured commercial banks and savings institutions Note: Column sums may differ from total because of rounding error. Source: Federal Deposit Insurance Corporation, www.fdic.gov, October 2018. a. What is the ratio of real assets to total assets? (Round your answer to 4 decimal places.) $ Billion %…arrow_forwardWhich of the following statements is TRUE about Verizon's financial statements? verizon Consolidated Balance Sheets (In millions of dollars) As of As of Dec 31, 2020 $ 22,171 Dec 31, 2019 $ 2,594 ASSETS Cash and cash equivalents Accounts receivable 23,917 25,429 Inventories 1,796 1,422 Prepaid expenses and other current assets 6,710 8,028 Total current assets 54,594 37,473 Property and equipment, net Intangible assets Other long-term assets 94,833 91,915 152,814 151,640 10,699 $ 291,727 14,240 Total assets $ 316,481 LIABILITIES & EQUITY Debt maturing within one year $ 5,889 $ 10,777 Accounts payable and accrued liabilities 20,658 21,806 Other current liabilities 13,113 12,285 Total current liabilities 39,660 44,868 Long-term debt 123,173 100,712 Other long-term liabilities 84,376 83,312 Total liabilities 247,209 228,892 Common stock and additional paid in capital 13,833 13,858 Retained earnings 60,464 53,147 Accumulated other comprehensive income (5,025) (4,170) Total shareholders'…arrow_forward

- Huluduey Corporation's comparative balance sheet for current assets and liabilities was as follows: Line Item Description Dec. 31, 20Y2 Dec. 31, 20Y1 Accounts receivable $17,500 $12,500 Inventory 51,650 44,200 Accounts payable 8,480 5,100 Dividends payable 9,480 6,100 Adjust net income of $75,800 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.arrow_forwardWe are given the following information for Pettit Corporation. Sales (credit) Cash Inventory Current liabilities Asset turnover Current ratio Debt-to-assets ratio Receivables turnover $2,068,000 150,000 923,000 763,000 a. Accounts receivable b. Marketable securities c. Capital assets. d. Long-term debt $ Current assets are composed of cash, marketable securities, accounts receivable, and inventory. Calculate the following balance sheet items: LA LA LA $ $ 1.00 times 2.60 times $ 40 % 4 times 517000arrow_forwardAssets Line Item Description Amount Cash and short-term investments $42,572 Accounts receivable (net) 33,774 Inventory 37,691 Property, plant, and equipment 215,705 Total assets $329,742 Liabilities and Stockholders’ Equity Line Item Description Amount Current liabilities $68,960 Long-term liabilities 98,919 Common stock, $10 par 64,740 Retained earnings 97,123 Total liabilities and stockholders’ equity $329,742 Income Statement Line Item Description Amount Sales $91,805 Cost of goods sold (41,312) Gross profit $50,493 Operating expenses (28,002) Net income $22,491 Number of shares of common stock 6,474 Market price of common stock $28 What is the current ratio?arrow_forward

- Given the following financial statement information: $ in millions Income Statement Net Income: $578 Depreciation Expense: $50 Balance Sheet Accounts Receivable Total Inventory Dec. 31, 2022 $38 $112 Accounts Payable $85 Calculate the cash from operating activities. Dec. 31, 2023 $63 $157 $108arrow_forwardPlease help me fastarrow_forwardUse the information below for Harding Company to answer the question that follow. Harding Company Accounts payable $36,767 Accounts receivable 74,993 Accrued liabilities 6,681 Cash 17,378 Intangible assets 41,965 Inventory 83,039 Long-term investments 90,147 Long-term liabilities 70,154 Marketable securities 39,256 Notes payable (short-term) 24,477 Property, plant, and equipment 689,894 Prepaid expenses 1,932 Based on the data for Harding Company, what is the amount of working capital?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education