FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

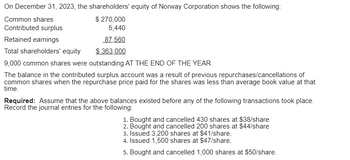

Transcribed Image Text:On December 31, 2023, the shareholders' equity of Norway Corporation shows the following:

Common shares

$ 270,000

Contributed surplus

5,440

Retained earnings

87,560

Total shareholders' equity

$363,000

9,000 common shares were outstanding AT THE END OF THE YEAR.

The balance in the contributed surplus account was a result of previous repurchases/cancellations of

common shares when the repurchase price paid for the shares was less than average book value at that

time.

Required: Assume that the above balances existed before any of the following transactions took place.

Record the journal entries for the following:

1. Bought and cancelled 430 shares at $38/share.

2. Bought and cancelled 200 shares at $44/share

3. Issued 3,200 shares at $41/share.

4. Issued 1,500 shares at $47/share.

5. Bought and cancelled 1,000 shares at $50/share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An invoice number is: a.added to the Post Ref. column of the ledger account. b.mentioned in the explanation of the related journal entry. c.added to the Post Ref. column of the journal. d.mentioned in the ledger accounts related to the journal entry.arrow_forwardInstructions Adele Corp., a wholesaler of music equipment, issued $31,400,000 of 20-year, 5% callable bonds on March 1, 20Y1, at their face amount, with interest payable on March 1 and September 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions Refer to the Chart of Accounts for exact wording of account fifles 20Y1 Mar. Sept. 20Y5 Sept. Chart of Accounts Journal 1 Issued the bonds for cash at their face amount. Paid the interest on the bonds 1 1 Called the bond issue at 103, the rate provided in the bond indenture. (Omit entry for payment of interest.) Xarrow_forwardect of each transaction and the balances after each transaction:arrow_forward

- How does the data flow from the transaction (e.g. MRI scan) to financial statements? Use the following key terms in your response: transaction, journal entry, general ledger, financial statement.arrow_forwardDefine Permanent accountsarrow_forwardWhich of the following dates do NOT require a journal entry? Group of answer choices All dividend dates require a journal entry Date of payment Date of declaration Date of recordarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education