FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

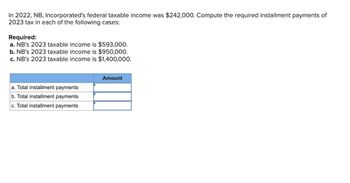

Transcribed Image Text:In 2022, NB, Incorporated's federal taxable income was $242,000. Compute the required installment payments of

2023 tax in each of the following cases:

Required:

a. NB's 2023 taxable income is $593,000.

b. NB's 2023 taxable income is $950,000.

c. NB's 2023 taxable income is $1,400,000.

a. Total installment payments

b. Total installment payments

c. Total installment payments

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- Since the SUTA rates change at the end of each year, the available 2023 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate for employers. Example 5-6 Park Company has a $70,000 federal and state taxable payroll and has earned a reduced state tax rate timely, the FUTA tax calculation is as follows: Gross FUTA tax ($70,000 x 0.060) Less 90% credit for state taxes paid late ($70,000 x 0.04 x 90%) $2,520 Less additional credit for state tax if rate were 5.4% [$70,000 x (0.054 - 0.04)] 980 Total credit Net FUTA tax If Park Company had made its SUTA payments before the due date of Form 940, the credit for the paym would have provided a total credit of $3,780 and a FUTA tax savings of $280. Peroni Company paid wages of $170,900 this year. Of this amount, $114,000 was taxable for net FUTA and SUTA purposes. The state's contribution tax rate is 3.1% for Peroni Company. Due to cash flow problems, the company did not make any SUTA…arrow_forwardHardevarrow_forwardA company made $49,000 in installment sales in 2021 and will receive payment from customers in 2022-2025. Taxable income for 2021 is $588,000, the enacted tax rate is 20% for all years, this is the only difference between pretax financial income and taxable income, and there were no deferred taxes at the beginning of 2021. What amount of income tax expense should the company report at the end of 2021?arrow_forward

- For 2022, MSU Corporation has $500,000 of adjusted taxable income, $22,000 of business interest income, and $120,000 of business interest expense. It has average annual gross receipts of more than $27,000,000 over the prior three taxable years. a. What is MSU's interest expense deduction for 2022? b. How much interest expense can be deducted for 2022 if MSU's adjusted taxable income is $300,000?arrow_forward) Information for Kent Corp. for the year 2022: Reconciliation of pretax accounting income and taxable income: Pretax accounting income $ 180,000 Permanent differences (15,000 ) 165,000 Temporary difference-depreciation (12,000 ) Taxable income $ 153,000 The enacted tax rate was 30% for 2022 and thereafter. What would Kent's income tax expense be in the year 2022? A) $42,300. B) $45,900. C) $49,500. D) None of these answer choices are correct.arrow_forwardForce Corporation has one temporary difference at the end of 2020 that will reverse and cause taxable amounts of $36,000 in 2021, $45,500 in 2022, and $50,000 in 2023. Force's pretax financial income for 2020 is $196,000, and the tax rate is 30% for all years. There are no deferred taxes at the beginning of 2020. 1. Compute taxable income and income taxes payable for 2020. 2. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020.arrow_forward

- Case Development began operations in December 2021. When property is sold on an installment basis, Case recognizes installment income for financial reporting purposes in the year of the sale. For tax purposes, installment income is reported by the installment method. 2021 installment income was $870,000 and will be collected over the next three years. Scheduled collections and enacted tax rates for 2022–2024 are as follows: 2022 $ 290,000 20 % 2023 320,000 25 2024 260,000 25 Case also had product warranty costs of $335,000 expensed for financial reporting purposes in 2021. For tax purposes, only the $80,000 of warranty costs actually paid in 2021 was deducted. The remaining $255,000 will be deducted for tax purposes when paid over the next three years as follows: 2022 $ 95,000 2023 84,000 2024 76,000 Pretax accounting income for 2021 was $1,005,000, which includes interest revenue of $25,000 from municipal bonds. The…arrow_forward1.The Mosaic Company organized on January 2, 2021, had pretax accounting income of $8,000,000 and taxable income of $11,600,000 for the year ended December 31, 2021. The 2021 tax rate was 25%. The only difference between book and taxable income is estimated warranty costs. Expected payments and scheduled enacted tax rates are as follows: 2022 $ 1,200,000 30 % 2023 600,000 30 % 2024 600,000 30 % 2025 1,200,000 35 % Required:Prepare one compound journal entry to record Mosaic's provision for taxes for the year 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardThe following information is taken from Igado Company’s 2020 financial records: Pretax accounting income- P1,500,000 Accrued warranty in excess of actual warranty expenditures- P24,500 Excess tax depreciation- P45,000 Taxable income- P1,479,500 The temporary differences were created entirely in 2020. The future deductible amount is expected to reverse in 2021 and the future taxable amount will reverse in equal amounts in the next three years. Tax rates are: 30% in 2020; 32% in 2021; 34% in 2022 and 35% in 2023. How much should Igado Company report as deferred tax asset and deferred tax liability, respectively, at December 31, 2020? A. P7,840 and P14,400 B. P7,350 and P15,150 C. P7,350 and P14,400 D. P7,840 and P15,150arrow_forward

- Swifty Corporation recorded warranty accruals as at December 31, 2020 in the amount of $151,800. This reversing difference will cause deductible amounts of $50,300 in 2021, $36,000 in 2022, and $65,500 in 2023. No other reversing difference exists. Swifty’s accounting income for 2020 is $144,000 and $175,000 in each of 2021 and 2022 and the tax rate is 25%. There are no deferred tax accounts at the beginning of 2020. Swifty Corporation was informed on December 31, 2021 that the enacted rate for 2022 and subsequent years is 28%. Calculate the deferred tax balances at December 31, 2021, and 2022. 2021 2022 Deferred tax asset $ $ eTextbook and Media List of Accounts Calculate taxable income and income tax payable for 2021 and 2022. 2021 2022 Taxable income $ $ Income tax payable $ $arrow_forwardDhapaarrow_forwardAt December 31, 2022, Ivanhoe Corporation had a temporary difference (related to pensions) and reported a related deferred tax asset of $32,700 on its balance sheet. At December 31, 2023, Ivanhoe has five temporary differences. An analysis reveals the following: Future (Taxable) Deductible Amounts emporary Difference oks; deductible when funded for tax purposes 2024 2025 2026 $32,700 $22,700 $10,000 earned for accounting purposes and when received for tax purposes 76,000 accounting purposes and recognized for tax purposes when paid alment sales when sold for book purposes, and as collected for tax purposes 24,000 (36,300) (36,300) (36,300) iting purposes, and CCA for tax purposes (90,300) (50,000) (40,000) $6,100 ($63,600) ($66,300) The enacted tax rate has been 30% for many years. In November 2023, the rate was changed to 28% for all periods after January 1, 2025. Assume that the company has income tax due of $180,000 on the 2023 tax return and that Ivanhoe follows IFRS. (a) Indicate…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education