FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

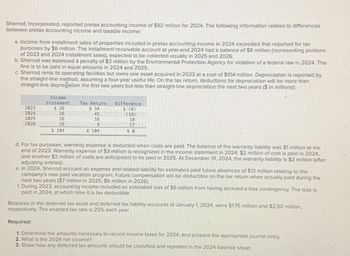

Transcribed Image Text:Sherrod, Incorporated, reported pretax accounting income of $92 million for 2024. The following information relates to differences

between pretax accounting income and taxable income:

a. Income from installment sales of properties included in pretax accounting income in 2024 exceeded that reported for tax

purposes by $6 million. The installment receivable account at year-end 2024 had a balance of $8 million (representing portions

of 2023 and 2024 installment sales), expected to be collected equally in 2025 and 2026.

b. Sherrod was assessed a penalty of $3 million by the Environmental Protection Agency for violation of a federal law in 2024. The

fine is to be paid in equal amounts in 2024 and 2025.

c. Sherrod rents its operating facilities but owns one asset acquired in 2023 at a cost of $104 million. Depreciation is reported by

the straight-line method, assuming a four-year useful life. On the tax return, deductions for depreciation will be more than

straight-line depreciation the first two years but less than straight-line depreciation the next two years ($ in millions):

Income

Statement

Tax Return

2023

2024

2025

2026

$ 26

$ 34

26

45

26

26

16

9

$ 104

$ 104

Difference

$ (8)

(19)

10

17

$ 0

d. For tax purposes, warranty expense is deducted when costs are paid. The balance of the warranty liability was $1 million at the

end of 2023. Warranty expense of $3 million is recognized in the income statement in 2024. $2 million of cost is paid in 2024,

and another $2 million of costs are anticipated to be paid in 2025. At December 31, 2024, the warranty liability is $2 million (after

adjusting entries).

e. In 2024, Sherrod accrued an expense and related liability for estimated paid future absences of $13 million relating to the

company's new paid vacation program. Future compensation will be deductible on the tax return when actually paid during the

next two years ($7 million in 2025; $6 million in 2026).

f. During 2023, accounting income included an estimated loss of $6 million from having accrued a loss contingency. The loss is

paid in 2024, at which time it is tax deductible.

Balances in the deferred tax asset and deferred tax liability accounts at January 1, 2024, were $1.75 million and $2.50 million,

respectively. The enacted tax rate is 25% each year.

Required:

1. Determine the amounts necessary to record income taxes for 2024, and prepare the appropriate journal entry.

2. What is the 2024 net income?

3. Show how any deferred tax amounts should be classified and reported in the 2024 balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use this information for parts A and B. In 2026, Goodfellas Company reported pretax GAAP income of $400,000. During 2026, Goodfellas had the following differences between GAAP and tax: Recognized $100,000 installment sale revenue under GAAP in 2026. This revenue will be recognized for tax purposes in equal amounts over the next four years. Recognized $50,000 of depreciation in 2026 for tax. Starting in 2027, GAAP depreciation is $10,000 per year for the next five years. Received $100,000 in unearned rent revenue in 2026. Rent will be earned in equal amounts in 2027 and 2028. The tax rate for 2026 is 30 percent and 20 percent thereafter. A) What journal entry does Goodfellas record for taxes in 2026?arrow_forwardIn 2022, NB, Incorporated's federal taxable income was $242,000. Compute the required installment payments of 2023 tax in each of the following cases: Required: a. NB's 2023 taxable income is $593,000. b. NB's 2023 taxable income is $950,000. c. NB's 2023 taxable income is $1,400,000. a. Total installment payments b. Total installment payments c. Total installment payments Amountarrow_forwardIn 2022 Charmed, Inc. recorded book income of $420,000. The company's only temporary difference relates to a $66,000 installment sale that it recorded for book purposes; there are no permanent differences. Charmed anticipates receiving payments equally over the following three years. The current enacted tax rate in 2022 is 39%. The substantively enacted tax rates for the following three years are 34%, 39%, and 47%, respectively.Under IFRS, what deferred tax amount should Charmed record for this temporary difference? Group of answer choices $31,020 $26,400 $24,640 $25,740arrow_forward

- Please do not give solution in image format ?.arrow_forwardHardevarrow_forwardFor 2022, MSU Corporation has $500,000 of adjusted taxable income, $22,000 of business interest income, and $120,000 of business interest expense. It has average annual gross receipts of more than $27,000,000 over the prior three taxable years. a. What is MSU's interest expense deduction for 2022? b. How much interest expense can be deducted for 2022 if MSU's adjusted taxable income is $300,000?arrow_forward

- Nirvana Corporation reports pretax financial income of $260,000 for 2022. The following items cause taxable income to be different than pretax financial income. Rental income on the 2022 tax return is $65,000 greater than on the income statement. Depreciation expense on the tax return is greater than depreciation on the income statement by $40,000. Interest on an investment in a municipal bond of $6,500 is reported on the income statement. Nirvana's tax rate is 25% for all years. There are no deferred taxes at the beginning of 2022. The company expects to realize only 40% of the benefit of any deferred tax assets. The fiscal year ends December 31, 2022. Required: 1. Prepare the journal entries to record i) income tax expense, income taxes payable, and deferred income taxes for 2022, and ii) any valuation allowance needed. 2. Indicate clearly what would be reported on the income statement beginning with income before income taxes for the year ended December 31, 2022 from just…arrow_forwardThe following information is available for Splish Corporation for 2020. 1. Depreciation reported on the tax return exceeded depreciation reported on the income statement by $116,000. This difference will reverse in equal amounts of $29,000 over the years 2021–2024. 2. Interest received on municipal bonds was $10,200. 3. Rent collected in advance on January 1, 2020, totaled $60,000 for a 3-year period. Of this amount, $40,000 was reported as unearned at December 31, 2020, for book purposes. 4. The tax rates are 40% for 2020 and 35% for 2021 and subsequent years. 5. Income taxes of $312,000 are due per the tax return for 2020. 6. No deferred taxes existed at the beginning of 2020. (a) Compute taxable income for 2020. Taxable income for 2020 $enter Taxable income for 2020 in dollarsarrow_forwardGreenville Industries uses the accrual basis to account for all sales transactions. Sales for 2022 total $500,000. Included in this amount is $70,000 in receivables from sales on installment. Installment sales are considered revenue for book purposes, but not for tax purposes. Operating expenses total $170,000 and are treated the same for book and tax purposes. Assuming a 40% tax rate, what is the amount of Greenville's deferred tax asset or liability? OA. $14,000 deferred tax liability B. $28,000 deferred tax liability OC. $28,000 deferred tax asset OD. $14,000 deferred tax assetarrow_forward

- Arndt, Incorporated reported the following for 2024 and 2025 ($ in millions): Revenues. Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $888 760 $128 $116 a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2024 for $60 million. The cost is tax deductible in 2024. Answer is complete but not entirely correct. Deferred tax amounts ($ in millions) Classification Net noncurrent deferred tax asset ✔ $ Net noncurrent deferred tax liability X $ 2025 $980 800 b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $33 million and $35 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $25 million ($10 million collected in 2023 but not recognized as revenue until 2024) and $33 million,…arrow_forwardThe information that follows pertains to Esther Food Products: a. At December 31, 2024, temporary differences were associated with the following future taxable (deductible) amounts: Depreciation Prepaid expenses Warranty expenses b. No temporary differences existed at the beginning of 2024. c. Pretax accounting income was $46,000 and taxable income was $9,000 for the year ended December 31, 2024. d. The tax rate is 25%. Required: Complete the following table given below and prepare the appropriate journal entry to record income taxes for 2024. Complete this question by entering your answers in the tabs below. Calculation General Journal $ 32,000 11,000 (6,000) Complete the following table given below to record income taxes for 2024. Note: Amounts to be deducted should be entered with a minus sign. Description Pretax accounting income Permanent differences Income subject to taxation Temporary Differences Income taxable in current year $ Amount 46,000 X Tax Rate = x X Recorded as:arrow_forwardBlossom Ltd. reported the following income for each of the years indicated. For each year, accounting income and income for tax purposes were the same. All tax rates indicated were enacted by the beginning of 2023. Blossom's policy is to carry back any tax losses first before carrying forward any remaining losses to future years. Year Income/(Loss) Tax Rate 2023 55,000 25% 2024 65,600 28% 2025 14,600 30% 2026 (145,700) 33% 2027 (73,800) 27% 2028 93,400 27% Prepare the journal entries for the years 2023 to 2028 to record income taxes. Assume that, at the end of each year, the loss carryforward benefits are judged more likely than not to be realized in the future. Blossom Ltd. follows IFRS. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and List all debit dit atrios)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education