FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

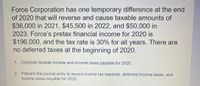

Transcribed Image Text:Force Corporation has one temporary difference at the end

of 2020 that will reverse and cause taxable amounts of

$36,000 in 2021, $45,500 in 2022, and $50,000 in

2023. Force's pretax financial income for 2020 is

$196,000, and the tax rate is 30% for all years. There are

no deferred taxes at the beginning of 2020.

1. Compute taxable income and income taxes payable for 2020.

2. Prepare the journal entry to record income tax expense, deferred income taxes, and

income taxes payable for 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Grace Corporation's pretax fınancial income is $600,000 and taxable income is $550,000 for year 2020. Its beginning deferred tax liability account has a balance of $75,000. Its cumulative temporary differences for year-end 2020 is equal to $300,000 and will reverse and result in taxable amounts as follows: Year Таxable Amount $100,000 $ 75,000 $125,000 The tax rate is 30% for all 2021 2022 2023 years.arrow_forwardShwonson Industries reported a deferred tax asset of $775 million for the year ended December 31, 2020, related to a temporary difference of $31 million. The tax rate was 25%. The temporary difference is expected to reverse in 2022, at which time the deferred tax asset will reduce taxable income. There are no other temporary differences in 2020-2022. Assume a new tax law is enacted in 2021 that causes the tax rate to change from 25% to 15% beginning in 2022. (The rate remains 25% for 2021 taxes.) Taxable income in 2021 is $41 million. Required: 1. Prepare the appropriate journal entry to record Shwonson's income tax expense in 2021. 2. What effect, will enacting the change in the 2022 tax rate, have on Shwonson's 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the appropriate journal entry to record Shwonson's income tax expense in 2021. (If no entry is required for a transaction/event, select "No journal entry required"…arrow_forwardDineshbhaiarrow_forward

- Omskirt Company reported an excess of warranty expense over warranty deductions of P720,000 for the year ended December 31, 2019. This temporary difference will reverse in equal amounts over the years 2020 through 2022. The enacted tax rates are as follows: 2019 - 30% 2020 - 32% 2021 - 34% 2022 - 36% The reporting for this temporary difference at December 31, 2019 would be: a. deferred tax liability of P216,000. b. deferred tax asset of P244,800. c. deferred tax liability of P244,800. d. deferred tax asset of P216,000.arrow_forwardDuring 2020, Marigold Co.’s first year of operations, the company reports pretax financial income at $247,300. Marigold’s enacted tax rate is 45% for 2020 and 20% for all later years. Marigold expects to have taxable income in each of the next 5 years. The effects on future tax returns of temporary differences existing at December 31, 2020, are summarized as follows. Future Years 2021 2022 2023 2024 2025 Total Future taxable (deductible) amounts: Installment sales $33,800 $33,800 $33,800 $101,400 Depreciation 5,800 5,800 5,800 $5,800 $5,800 29,000 Unearned rent (47,000) (47,000) (94,000) Complete the schedule below to compute deferred taxes at December 31, 2020. (Negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)…arrow_forwardThe following information is taken from Igado Company’s 2020 financial records: Pretax accounting income- P1,500,000 Accrued warranty in excess of actual warranty expenditures- P24,500 Excess tax depreciation- P45,000 Taxable income- P1,479,500 The temporary differences were created entirely in 2020. The future deductible amount is expected to reverse in 2021 and the future taxable amount will reverse in equal amounts in the next three years. Tax rates are: 30% in 2020; 32% in 2021; 34% in 2022 and 35% in 2023. How much should Igado Company report as deferred tax asset and deferred tax liability, respectively, at December 31, 2020? A. P7,840 and P14,400 B. P7,350 and P15,150 C. P7,350 and P14,400 D. P7,840 and P15,150arrow_forward

- Swifty Corporation recorded warranty accruals as at December 31, 2020 in the amount of $151,800. This reversing difference will cause deductible amounts of $50,300 in 2021, $36,000 in 2022, and $65,500 in 2023. No other reversing difference exists. Swifty’s accounting income for 2020 is $144,000 and $175,000 in each of 2021 and 2022 and the tax rate is 25%. There are no deferred tax accounts at the beginning of 2020. Swifty Corporation was informed on December 31, 2021 that the enacted rate for 2022 and subsequent years is 28%. Calculate the deferred tax balances at December 31, 2021, and 2022. 2021 2022 Deferred tax asset $ $ eTextbook and Media List of Accounts Calculate taxable income and income tax payable for 2021 and 2022. 2021 2022 Taxable income $ $ Income tax payable $ $arrow_forwardSheridan Corporation reported $230000 in revenues in its 2021 financial statements, of which $91100 will not be included in the tax return until 2022. The enacted tax rate is 40% for 2021 and 35% for 2022. What amount should Sheridan report for deferred income tax liability in its balance sheet at December 31, 2021? O $55560 O $48615 O $36440 O $31885arrow_forwardDhapaarrow_forward

- Shwonson Industries reported a deferred tax asset of $5.50 million for the year ended December 31, 2020, related to a temporary difference of $22 million. The tax rate was 25%. The temporary difference is expected to reverse in 2022, at which time the deferred tax asset will reduce taxable income. There are no other temporary differences in 2020-2022. Assume a new tax law is enacted in 2021 that causes the tax rate to change from 25% to 15% beginning in 2022. (The rate remains 25% for 2021 taxes.) Taxable income in 2021 is $32 million. Required: 1. Prepare the appropriate journal entry to record Shwonson's income tax expense in 2021. 2. What effect, will enacting the change in the 2022 tax rate, have on Shwonson's 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the appropriate journal entry to record Shwonson's income tax expense in 2021. (If no entry is required for a transaction/event, select "No journal entry…arrow_forwardSarasota Corporation has one temporary difference at the end of 2020 that will reverse and cause taxable amounts of $56,400 in 2021, $61,800 in 2022, and $66,400 in 2023. Sarasota’s pretax financial income for 2020 is $278,300, and the tax rate is 30% for all years. There are no deferred taxes at the beginning of 2020. Compute taxable income and income taxes payable for 2020. Taxable income $enter a dollar amount Income taxes payable $enter a dollar amount Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Prepare the income tax expense section of the income statement for 2020, beginning with the line “Income before income taxes.”. (Enter negative amounts using either a negative sign preceding the number e.g. -45…arrow_forwardBlossom Corporation began 2020 with a $57,040 balance in the Deferred Tax Liability account. At the end of 2020, the related cumulative temporary difference amounts to $434,000, and it will reverse evenly over the next 2 years. Pretax accounting income for 2020 is $651,000, the tax rate for all years is 20%, and taxable income for 2020 is $502,200. Compute income taxes payable for 2020. Income taxes payable $enter Income taxes payable in dollars Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title enter a debit amount enter a credit amount enter an account title enter a debit amount…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education