FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

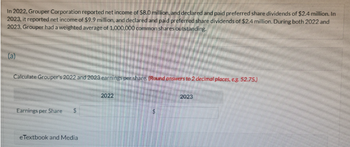

Transcribed Image Text:In 2022, Grouper Corporation reported net income of $8.0 million, and declared and paid preferred share dividends of $2.4 million. In

2023, it reported net income of $9.9 million, and declared and paid preferred share dividends of $2.4 million. During both 2022 and

2023, Grouper had a weighted average of 1,000,000 common shares outstanding.

(a)

Calculate Grouper's 2022 and 2023 earnings per share. (Round answers to 2 decimal places, e.g. 52.75.)

Earnings per Share

eTextbook and Media

2022

2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- At December 31, 2017 and 2018, Funk and Noble corporation had outstanding 760 million shares of common stock and 7 million shares of 4%, 100 par value cumulative perferred stock. No dividentds were declared on either the preferred or common stock in 2017 or 2018. Net income for 2018 was 788 million. the income tax rate is 40 percent. Calculate earning per share for the year ended December 31, 2018?arrow_forwardPet Boutique Corp, reported $4,365.410 of profit for 2023. On November 2, 2023, it declared and paid the annual preferred dividends of $283,560 On January 1, 2023, Pet Boutique had 111,410 and 567,000 outstanding preferred and common shares, respectively. The following transactions changed the number of shares outstanding during the year: Feb. 1 Declared and issued a 20% common share dividend. Apr.30 Sold 111,060 common shares for cash. May 1 Sold 45,550 preferred shares for cash. Oct. 31 Sold 32,760 common shares for cash. a. What is the amount of profit available for distribution to the common shareholders? Earnings available to common shareholders $ 4,081,850 Check my wark b. What is the weighted-average number of common shares for the year?arrow_forwardplease answer this with must explanation , computation for each part and steps answer in text formarrow_forward

- Please provide answer in text (Without image)arrow_forwardWhispering Inc. had net income for the current year ending December 31, 2023 of $1,063,260. During the entire year, there were 501,000 common shares outstanding. The company had two classes of preferred shares outstanding: the Class A preferred shares were $2.60 cumulative shares of which 12,000 were outstanding, and were convertible to common shares at a rate of 1:1. There were 107,000 $5.60 Class B non-cumulative preferred shares outstanding that were also convertible at a rate of 1:1. Whispering had outstanding a $1,000,000, 7% bond issued at par in 2012 that was convertible to 22,000 common shares. The company also had outstanding a $1,000,000, 6% bond issued at par in 2013 that was convertible to 26,000 common shares. No dividends were declared or paid this year. Whispering's tax rate is 37%. (a) Calculate the income effect of the dividends for the Class A preferred shares. (b) Your answer is correct. Dividends on Class A preferred shares $ (c) eTextbook and Media Your answer is…arrow_forwardConcord Inc. had net income for 2020 of $5,920,000. The company had 2,200,000 of common shares outstanding throughout the year. During 2020, Concord paid dividends on the common shares of $0.12 per share. Average common shareholder equity was $39,600,000, and the market value of the shares on December 31, 2020 was $27 per share.Concord Inc. also had 100,000 shares outstanding of cumulative, $7, no-par value preferred shares. The shares were outstanding for the full year, and dividends had been kept current for the past several years.Calculate the following ratios for Concord Inc.: (Round answers to 2 decimal places, e.g. 25.15 or 25.15%. Round earnings per share to 3 decimal places for intermediate calculations, e.g. 1.253.) Rate of return on common shareholders’ equity%, Payout ratio%Price earnings ratio, timesBook value per share$ per share Please share how to do in Excelarrow_forward

- Bonita Corporation had net income of $218000 and paid dividends to common stockholders of $44000 in 2020. The weighted average number of shares outstanding in 2020 was 50000 shares. Bonita Corporation's common stock is selling for $95.92 per share on the New York Stock Exchange. Bonita Corporation's price-earnings ratio is O 22.0 times. 3.5 times. O 27.6 times. O 19.4 times.arrow_forwardSunland Limited reported the following items in shareholders' equity on December 31, 2024: Share capital: Preferred shares, $5 cumulative dividend, 145,000 shares issued and outstanding. $14,500,000 Share capital: Common shares, 711,000 issued and outstanding. $28,440,000 Retained earnings. $26,830,000arrow_forwardHorticultural Products Inc. reported $545,863 profit in 2023 and declared preferred dividends of $47,200. The following changes in common shares outstanding occurred during the year. Jan. 1 39,000 common shares were outstanding. Mar. 1 Declared and issued a 30% common share dividend. Aug. 1 Sold 20,000 common shares. Nov. 1 Sold 40,000 common shares. Calculate the weighted - average number of common shares outstanding during the year and earnings per share. (Round the "Earnings per share" answer to 2 decimal places.)arrow_forward

- Vihnoarrow_forwardPina Colada Corp. had net income of $1612000 and paid dividends to common stockholders of $403000 in 2022. The weighted average number of shares outstanding in 2022 was 1047800 shares. Pina Colada Corp.'s common stock is selling for $30 per share on the NASDAQ. Pina Colada Corp.'s payout ratio for 2022 isarrow_forwardVeritox at January 1, 2020, had 450,000 common shares outstanding (no preferred shares issued). During 2020, the company has issued 60,000 shares on May 1, purchased 36,000 treasury shares on September 1, and issued 42,000 more shares on November 1. Find the weighted average of common shares outstanding for 2020.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education