FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

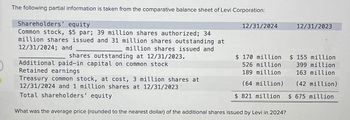

Transcribed Image Text:The following partial information is taken from the comparative balance sheet of Levi Corporation:

Shareholders' equity

Common stock, $5 par; 39 million shares authorized; 34

million shares issued and 31 million shares outstanding at

12/31/2024; and

million shares issued and

shares outstanding at 12/31/2023.

Additional paid-in capital on common stock

Retained earnings

Treasury common stock, at cost, 3 million shares at

12/31/2024 and 1 million shares at 12/31/2023

Total shareholders' equity

12/31/2024

12/31/2023

$ 170 million

526 million

$ 155 million

399 million

189 million

163 million

(64 million)

(42 million)

$ 821 million $ 675 million

What was the average price (rounded to the nearest dollar) of the additional shares issued by Levi in 2024?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The following information is available for Barone Corporation: January 1, 2022 Shares outstanding 1,250,000April 1, 2022 Shares issued 200,000July 1, 2022 Treasury shares purchased 75,000October 1, 2022 Shares issued in a 100% stock dividend 1,375,000 The number of shares to be used in computing earnings per ordinary share for 2022 isarrow_forwardThe stockholders' equity section of the January 1, 2031 balance sheet for XYZ Company is given below: Common stock, $14 par value ................. $525,000 Paid-in capital – common stock .............. $150,000 Treasury stock (14,000 shares @ $16 cost) ... $224,000 Paid-in capital – treasury stock ............ $ 13,000 Retained earnings ........................... $107,000 XYZ Company entered into the following transactions during 2031: a. Re-issued 2,000 of the treasury shares for $11 per share. b. Re-issued 3,000 of the treasury shares for $13 per share. c. Issued 5,000 shares of previously un-issued common stock for $21 per share. d. Re-issued 6,000 of the treasury shares for $19 per share. Calculate the balance in the retained earnings account after all four transactions above are recorded.arrow_forwardOn January 1, 2022, Sheffield Corporation purchased 6,500 shares of treasury stock. Other information regarding Sheffield Corporation is provided as follows. Net income Dividends on preferred stock Dividends on common stock Weighted-average number of common shares outstanding Common stockholders' equity beginning of year Common stockholders' equity end of year Earnings per share 2021 $ 2021 LA $130,000 $39,000 $26,000 65,000 $780,000 $975,000 (a) Compute earnings per share for each year. (Round answer to 2 decimal places, e.g. 10.50.) 2022 2022 $143,000 $39,000 $32,500 58,500 $975,000 $1,079,000arrow_forward

- The stockholders' equity accounts of Concord Corporation on January 1, 2022, were as follows. Preferred Stock (8%, $52 par, 11,000 shares authorized) Common Stock ($1 stated value, 2,000,000 shares authorized) 00 0,000 Paid-in Capital in Excess of Par-Preferred Stock Paid-in Capital in Excess of Stated Value-Common Stock 0000 Retained Earnings 1,750,000 Treasury Stock(10,000 common shares) 000'00 During 2022, the corporation had the following transactions and events pertaining to its stockholders' equity. 1. Issued 26,000 shares of common stock for $124,000. 14. p. Sold 5,600 shares of treasury stock-common for $32,400, 3. Issued 4,800 shares of common stock for a patent valued at $34,000. 10. Purchased 1,100 shares of common stock for the treasury at a cost of 56,100. Dec. 31. Determined that net income for the year was $435,000. No dividends were declared during the year. (e) Journalize the transactions and the closing entry for net income. (Listall debit entries before credit…arrow_forwardPlease correct Solution with Explanation and do not give image formatarrow_forwardsarrow_forward

- The following information is available for ConocoPhillips on December 31, 2022: Common Stock, $1.75 par, 400,000 shares authorized Additional Paid in Capital - Common Stock Retained Earnings Total Stockholders' Equity During 2023, ConocoPhillips completed these transactions (in chronological order): 1) Declared and issued a 2.0% stock dividend on the outstanding stock. At that time, the stock was quoted at a market price of $20 per share. 2) Issued 2,400 shares of common stock at the price of $18 per share. 3) Net Income for the year was $410,400. Determine the ending balance in the Additional Paid in Capital - Common Stock account on December 31, 2023: Select one: O O $651,000 840,000 756,000 $2,247.000 a. $1,014,780 b. $1,025,000 c. $1,032,000 d. $975,780 e. $879,000 4arrow_forwardShown below is information relating to the stockholders' equity of Perry Corporation as of December 31, Year 1: 5.5% cumulative preferred stock, $100 par value; authorized, ?? shares; issued and outstanding, ?? shares Common stock, $10 par value; authorized, 360,000 shares; issued and outstanding, 140,000 shares Additional paid-in capital: Common stock Retained earnings (Deficit) Dividends in arrears What was the original issue price per share of common stock?arrow_forwardThe shareholders' equity section of the balance sheet of TNL Systems Incorporated included the following accounts at December 31, 2023: Shareholders' Equity Common stock, 240 million shares at $1 par Paid-in capital-excess of par Paid-in capital-share repurchase Retained earnings Required: ($ in millions) $ 240 1,680 1 1,100 1. During 2024, TNL Systems reacquired shares of its common stock and later sold shares in two separate transactions. Prepare the entries for both the purchase and subsequent resale of the shares assuming the shares are (a) retired and (b) viewed as treasury stock. a. On February 5, 2024, TNL Systems purchased 6 million shares at $10 per share. b. On July 9, 2024, the corporation sold 2 million shares at $12 per share. c. On November 14, 2026, the corporation sold 2 million shares at $7 per share. 2. Prepare the shareholders' equity section of TNL Systems' balance sheet at December 31, 2026, comparing the two approaches. Assume all net income earned in 2024-2026…arrow_forward

- Selected information regarding the accounts of Infinity Minerals Corp. follows: Common shares, unlimited authorized, 51,000 shares issued and outstanding, December 31, 2022 Common dividends declared and paid during 2023 Cumulative effect of change in accounting estimate (net of $7,200 tax) Profit for the year ended December 31, 2023 Preferred dividends declared and paid during 2023 Preferred shares, $4.90 non-cumulative, 15,100 shares orized, issued, and outstanding, December 31, 2022 Retained earnings, December 31, 2022 (as originally reported) Balance, January 1 Balance, December 31 Next Prepare a statement of changes in equity for the year ended December 31, 2023, assuming 7,100 common shares were issued during 2023 at an average price of $21.94 per share and that no preferred shares were issued in 2023. (Negative answers should be indicated by a minus sign.) INFINITY MINERALS CORP. Statement of Changes in Equity For Year Ended December 31, 2023 Preferred Shares $ $1,075,000 121,000…arrow_forwardThe equity section of the December 31", 2025, balance sheet for BOOYA Inc. showed the following: BOOYA Inc. Equity Section of the Balance Sheet December 31, 2025 Contributed Capital: Preferred shares, $0.25 non-cumulative, 80,000 shares authorized, 60,000 shares issued and outstanding Common shares, 250,000 shares authorized, 120,000 shares issued and outstanding Total contributed capital Retained earnings Total equity $150,000 120.000 $270,000 92.500 $362,500 During the year 2026, BOOYA Inc had the following transactions affecting equity accounts: Sold 20,000 common shares for a total of $21,500 cash Sold 5,000 preferred shares for $3.00 each, cash. Issued and exchanged 7,000 common shares for equipment with a list price of $10,000 (fair value unknown). Common shares were trading at $1.42 on June 15th. Jan. 3 Mar. 1 June 15. Closed the Income Summary account, which showed a credit balance of $175,000. Dec. 31 The board of directors had not declared a dividend for the past two years…arrow_forward1- The following partial information is taken from the comparative balance sheet of Levi Corporation: Shareholders’ equity 12/31/2024 12/31/2023 Common stock, $5 par; 38 million shares authorized; 33 million shares issued and 29 million shares outstanding at 12/31/2024; and _____________blank million shares issued and _____________blank shares outstanding at 12/31/2023. $ 165 million $ 145 million Additional paid-in capital on common stock 525 million 402 million Retained earnings 190 million 162 million Treasury common stock, at cost, 4 million shares at 12/31/2024 and 2 million shares at 12/31/2023 (65 million) (43 million) Total shareholders’ equity $ 815 million $ 666 million What was the average price (rounded to the nearest dollar) of the additional shares issued by Levi in 2024? 2- Yellow Enterprises reported the following ($ in thousands) as of December 31, 2024. All accounts have normal balances. Deficit (debit balance in retained earnings) $ 2,300…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education