FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

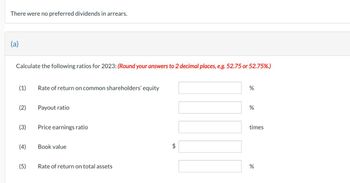

Transcribed Image Text:There were no preferred dividends in arrears.

(a)

Calculate the following ratios for 2023: (Round your answers to 2 decimal places, e.g. 52.75 or 52.75%.)

(1)

(2)

(4)

(5)

Rate of return on common shareholders' equity

Payout ratio

Price earnings ratio

Book value

Rate of return on total assets

LA

%

%

times

%

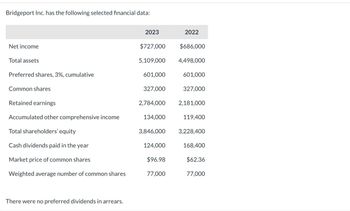

Transcribed Image Text:Bridgeport Inc. has the following selected financial data:

Net income

Total assets

Preferred shares, 3%, cumulative

Common shares

Retained earnings

Accumulated other comprehensive income

Total shareholders' equity

Cash dividends paid in the year

Market price of common shares

Weighted average number of common shares

There were no preferred dividends in arrears.

2023

$727,000

5,109,000

601,000

327,000

2,784,000

134,000

3,846,000

124,000

$96.98

77,000

2022

$686,000

4,498,000

601,000

327,000

2,181,000

119,400

3,228,400

168,400

$62.36

77,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 9 images

Knowledge Booster

Similar questions

- The following information (in millions of dollars) is available for Sarasota Sportswear for 2022: Sales revenue Stock price per share Average shares outstanding $6,300 Earnings per share $ $18.50 345.0 million Net income Preferred stock dividend $621.0 $0 Compute 2022 earnings per share for Sarasota Sportswear. (Round answer to 2 decimal places, e.g. 15.25.)arrow_forwardThe following financial information is available for Flintlock Corporation. (in millions) Average common stockholders' equity Dividends declared for common stockholders Dividends declared for preferred stockholders Net income BIU T₂ T² Ix !!! 111 2022 lil $2,532 298 40 504 Calculate the payout ratio and return on common stockholders' equity for 2022 and 2021. Comment on your findings. W 2021 $2,591 144 611 40 555 트 M II á TT ¶ O Word(s)arrow_forwardHolland Corporation's annual report is as follows. March 31, 2023 March 31, 2024 Net Income $359,000 $438,500 Preferred Dividends 0 0 Total Stockholders' Equity $4,230,000 $5,252,000 Stockholders' Equity attributable to Preferred Stock 0 0 Number of Common Shares Outstanding 288,000 202,000 Based on the information provided, find the rate of return on common stockholders' equity on March 31, 2024. (Round your final answer two decimal places.)arrow_forward

- Analyzing and Computing Issue Price, Treasury Stock Cost, and Shares Outstanding Following is the stockholders' equity section of the 2018 Merck & Co. Inc. balance sheet. Stockholders' Equity ($ millions, except par value) 2018 Common stock, $0.50 par value; 6,500,000 authorized shares; 3,577,107,522 issued shares $1,789 Other paid-in capital 31,046 Retained earnings 34,063 Accumulated other comprehensive loss (4,436) Stockholders' equity before deduction for treasury stock $62,103 Less treasury stock, at cost: 984,543,979 shares Total Merck & Co. Inc. stockholders' equity 40,743 $21,360 a. Show the computation of the $1,789 million in the common stock account. shares x $ per share is approximately $ million on the balance sheet. b. At what average price were the Merck common shares issued? Note: Round your answers to two decimal places (for example, enter 67.49 for 67.48555). per share c. At what average cost was the Merck treasury stock purchased? Note: Round your answers to two…arrow_forwardAssume that all balance sheet amounts for Sheridan Company represent average balance figures. Stockholders' equity - common Total stockholders' equity Sales revenue Net income Number of shares of common stock Common stock dividends Preferred stock dividends $ 371000 O $2.00 $1.40 $1.94 $2.10 811000 418000 81000 38000 32000 5000 What is the earnings per share for Sheridan? Assume that all balance sheet amounts for Sheridan Company represent average balance figures. What is the earnings per share for Sheridan? \(\ $ 200 \) \(\$ 1.40 \) \(\$ 1.94 \) \(\$ 2.10 \)arrow_forwardHow do I solve this?arrow_forward

- Gadubhaiarrow_forwardFinancial statement data for the current year for Hanz Corp. are as follows: Line Item Description Amount Net income $5,700,000 Preferred dividends $70,000 Average number of common shares outstanding 200,000 The earnings per share for the current year are? a.$28.15 b.$28.50 c.$28.85 d.$0.35arrow_forwardCH Sunland Corporation had the following information in its financial statements for the years ended 2025 and 2026: Cash dividends for the year 2026 $4700 Net income for the year 2026 97700 Market price of stock, 12/31/25 10 Market price of stock, 12/31/26 12 12 Common stockholders' equity, 12/31/25 1008000 Common stockholders' equity, 12/31/26 1192000 Outstanding shares, 12/31/26 100400 Preferred dividends for the year 2026 14000 What is the rate of return on common stock equity for Sunland Corporation for the year ended 12/31/2026? 7.6% O 6.6% 8.9% 07.0% eTextbook and Media W X SPM DELL 78°F Sunnyarrow_forward

- The following financial information is available for Wildhorse Corporation. (in millions) Average common stockholders' equity Dividends declared for common stockholders Dividends declared for preferred stockholders Net income Payout ratio 2022 Return on common stockholders' equity $2,526 $2,608 298 40 504 2021 2022 635 Calculate the payout ratio and return on common stockholders' equity for 2022 and 2021. (Round answers to 1 decimal place, e.g. 12.5%.) 40 556 % % 2021 % %arrow_forwardSuppose the following information is available for Callaway Golf Company for the years 2022 and 2021. (Dollars are in thousands, except share information.) Net sales Net income (loss) Total assets Share information Preferred dividends 2022 Shares outstanding at year-end 67,000,000 2022: $ $1,127,000 2021: 81,486 $ 855,338 0 2021 $1,134,600 66,447 There were 75,640,000 shares outstanding at the end of 2020. (a) 838,078 68,810,000 What was the company's earnings per share for each year? (Round answers to 2 decimal places, e.g. 15.25.) 0arrow_forwardwhat is the the quick ratio for both yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education