FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

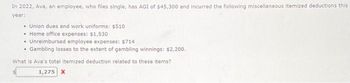

Transcribed Image Text:In 2022, Ava, an employee, who files single, has AGI of $45,300 and incurred the following miscellaneous itemized deductions this

year:

• Union dues and work uniforms: $510

• Home office expenses: $1,530

• Unreimbursed employee expenses: $714

.

• Gambling losses to the extent of gambling winnings: $2,200.

What is Ava's total itemized deduction related to these items?

1,275 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- For each situation listed indicate the amount to be included in income for current year. The federal interest rate of 5.5% is in effect. Linda collected $42,000 on a life insurance policy from her husband, Leon's death. The insurance policy was provided by Leon's employer, and the premiums were excluded from Leon's gross income as group term life insurance. The policy face value was $40,000.arrow_forwardFor calendar year 2023, Stuart and Pamela Gibson file a joint return reflecting AGI of $369,400. Their itemized deductions are as follows: Note: All expenses are before any applicable limitations, unless otherwise noted. Casualty loss in a Federally declared disaster area (not covered by insurance; before the 10%-of-AGI limitation but after the $100 floor) Home mortgage interest (loan qualifies as acquisition indebtedness) Credit card interest Property taxes on home Charitable contributions State income tax Tax return preparation fees $54,400 21,760 1,088 16,320 29,920 19,040 1,632 Round your final answers to the nearest whole dollar. Calculate the amount of itemized deductions the Gibsons may claim for the year.arrow_forwardOn the December 31, 2015, payday, Jo is out sick. Prior to this $3,000 paycheck, her 2015 taxable wages were $120,000. If Jo picked up her paycheck on-January 4, 2016, how much FICA should Jo’s employer have withheld? $43.50 $169.50 $229.50 None of the abovearrow_forward

- For calendar year 2023, Giana was a self-employed consultant with no employees. She had $80,000 of net profit from consulting and paid $7,000 in medical insurance premiums on her policy covering 2023. How much of these premiums may Giana deduct as a deduction for AGI? As an itemized deduction? If an amount is zero, enter "0". Self-employed persons can deduct fill in the blank 1 % of their medical insurance premiums as a deduction for AGI in 2023. Thus, Giana may deduct $fill in the blank 2 as a deduction AGI and she may deduct $fill in the blank 4 as an itemized deduction (subject to the AGI floor).arrow_forwardLSG Company is a calendar year, cash basis taxpayer. On November 1, 2021, LSG paid $9,450 to the janitorial service that cleans their offices. How much of this expenditure can LSG deduct in 2021 assuming that: The expenditure is a prepayment for 6 months of cleaning services from November 2021 through April 2022? _____________________________________________________________________________________ _____________________________________________________________________________________ The expenditure is a prepayment for 18 months of cleaning services from November 2021 through April 2023? _________arrow_forwardDuring 2019, Rachael Parkins, president of Mathieson Company, was paid a semimonthly salary of $8,000. Compute the amount of FICA taxes that should be withheld from herarrow_forward

- A man earned wages of $38,100, received $1800 in interest from a savings account, and contributed $3400 to a tax-deferred retirement plan. He was entitled to a personal exemption of $4050 and had deductions totaling $6350. Find his gross income, adjusted gross income, and taxable income. His gross income was $ (Simplify your answer.) Carrow_forwardAmir, who files single, has AGI of $58,000 and incurred the following miscellaneous itemized deductions this year:Union dues and work uniforms: $350Home office expenses: $1,200Unreimbursed employee expenses: $415Gambling losses to the extent of gambling winnings: $890.Amir's total miscellaneous itemized deduction after any limitation isarrow_forwardAn employee works 47 hours (47 - 40 were overtime hours) during a workweek in October of 2023. The employee earns $46/hour, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has earned $1163,050 during the present year. He has requested that his employer withhold 7% of gross pay, which is to be contributed to a 401(k) plan. Taxable income for federal income tax withholding = $ Taxable income for social security tax = $ Taxable income for medicare tax = $arrow_forward

- a. Harriet Pandel, an employer, is subject to FICA taxes but exempt from FUTA and SUTA taxes. During the last quarter of the year, her employees earned monthly wages of $16,900, all of which is taxable. The amount of federal income taxes withheld each month is $1,698. Journalize the payment of wages, and record the payroll tax on November 29. For a compound transaction, if an amount box does not require an entry, leave it blank. Round your answers to the nearest cent. Account Debit Credit Payment of wages Payroll tax b. Prior to posting the November 29 payroll transaction, FICA Taxes Payable-OASDI, FICA Taxes Payable-HI, and Employees FIT Payable had zero balances. Pandel must pay the FICA taxes and income taxes withheld on the November 29 payroll. Journalize the electronic transfer of the payroll taxes on December 16. If an amount box does not require an entry, leave it blank. Round your…arrow_forwardMonty's gross earnings for the week were $1450, his federal income tax withholding was $318,and his fica total was $111. There were no state income taxes journalise the entry for the recording of his pay in the general journalarrow_forwardMinette's Québec payroll totals for the 2022 taxation year were as follows: salary of $51,900.00, vacation pay of $4,760.00, wages in lieu of notice of $8,250.00, employer-paid medical benefits of $742.70, eligible retiring allowance of $15,500.00 and non-eligible retiring allowance of $8,000.00. What amount will be reported in Box A of her RL-1?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education