FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

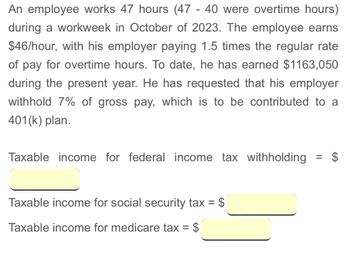

Transcribed Image Text:An employee works 47 hours (47 - 40 were overtime hours)

during a workweek in October of 2023. The employee earns

$46/hour, with his employer paying 1.5 times the regular rate

of pay for overtime hours. To date, he has earned $1163,050

during the present year. He has requested that his employer

withhold 7% of gross pay, which is to be contributed to a

401(k) plan.

Taxable income for federal income tax withholding = $

Taxable income for social security tax = $

Taxable income for medicare tax = $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Lee Financial Services pays employees monthly. Payroll information is listed below for January 2021, the first month of Lee’s fiscal year. Assume that none of the employees exceeded any relevant base of pay, such that all benefit percentages apply to the entire $440,000 payroll. Salaries $ 440,000 Federal income taxes to be withheld 88,000 Federal unemployment tax rate 0.60 % State unemployment tax rate (after SUTA deduction) 5.40 % Social security tax rate 6.20 % Medicare tax rate 1.45 % Required:Calculate the income and payroll taxes for the January 2021 pay period. Prepare the appropriate journal entries to record salaries expense and payroll tax expense for the January 2021 pay period.arrow_forward3: An employee works 50 hours (50-40 were overtime hours) during a workweek in December of 2021, He ears $9.500/month, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has earned $114,500 during the year. He has requested that his employer withhold 13% of gross pay to contribute to a 403(b) plan. Taxable income for federal income tax withholding-5 Taxable income for social security tax-$ Taxable income for medicare tax-Sarrow_forwardFelipe's Mexican Restaurant incurred salaries expense of $60,000 for 2024. The payroll expense includes employer FICA tax, in addition to state unemployment tax and federal unemployment tax. Of the total salaries, $19,000 is subject to unemployment tax. A provides the following benefits for employees: health insurance (cost to the company, $2,900), life insurance (cost to the company, $390), and retirement benefits (cost to the company, 8% of salaries expense). i (Click the icon to view payroll tax rate information.) Read the requirements. Requirement 1. Journalize Felipe's expenses for employee benefits and for payroll taxes. Explanations are not required. Begin with the entry to accrue Felipe's employer payroll taxes. (Round all amounts to the nearest cent. Record debits first, then credits. Exclude explanations from journal entries.) Date Accounts Debit Credit Now record the accrual of Felipe's employee benefit expenses. Date Accounts Debit C Credit Requirement 2. What was Felipe's…arrow_forward

- Lawrence Corp. has an employee benefit plan for compensated absences that gives each employee 10 paid vacation days and 10 paid sick days. Both vacation and sick days can be carried over indefinitely. Employees can elect to receive payment in lieu of vacation days; however, no payment is given for sick days not taken. At December 31, 2021, B's unadjusted balance of liability for compensated absences was $42,000. B estimated that there were 300 total vacation days and 150 sick days available at December 31, 2021. B's employees earn an average of $200 per day. In its December 31, 2021, balance sheet, what amount of liability for compensated absences is B required to report? A. $84,000. B. $60,000. C. $90,000. D. $144,000.arrow_forwardThe current Federal Unemployment Taxes (FUTA) tax rate is 0.6%, and the State Unemployment Taxes (SUTA) tax rate is 5.4%. Both taxes are applied to the first $7,000 of an employee's pay. Assume that an employee earned total wages of $3,060 in the current period and had cumulative pay for prior periods of $6,120. What is the amount of unemployment taxes the employer must pay on this employee's wages for the current period? Multiple Choice $420.00. $367.20. $52.80. O $183.60. $0.00.arrow_forwardMark has two jobs during 2018. One employer withheld and paid FICA taxes on $80,200 of Mark's salary and the other employer withheld and paid FICA taxes on $52,800 in salary paid to Mark. Calculate the amount of Mark's credit for the overpayment of Social Security taxes that he should claim on his 2018 Form 1040arrow_forward

- The payroll of Sheridan Company for September 2019 is as follows.Total payroll was $492,000, of which $118,000 is exempt from Social Security tax because it represented amounts paid in excess of $128,400 to certain employees. The amount paid to employees in excess of $7,000 was $402,000. Income taxes in the amount of $78,800 were withheld, as was $9,400 in union dues. The state unemployment tax is 3.5%, but Sheridan Company is allowed a credit of 2.3% by the state for its unemployment experience. Also, assume that the current FICA tax is 7.65% on an employee’s wages to $128,400 and 1.45% in excess of $128,400. No employee for Sheridan makes more than $125,000. The federal unemployment tax rate is 0.8% after state credit.Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately.arrow_forwardRick is employed by UT. In 2023 UT withheld $7,650 of payroll taxes from Rick's salary. What is the total combined employee and employer payroll tax that UT will be required to remit to the U.S. Treasury Department in 2023 as a result of employing Rick? Hint: The correct answer should be $15,300arrow_forwardJon Corp. has an employee benefit plan for compensated absences that gives each employee 10 paid vacation days and 10 paid sick days. Both vacation and sick days can be carried over indefinitely. Employees can elect to receive payment in lieu of vacation days; however, no payment is given for sick days not taken. At December 31, 2021, Jon 's unadjusted balance of liability for compensated absences was $42,000. B estimated that there were 300 total vacation days and 150 sick days available at December 31, 2021. Jon's employees earn an average of $200 per day. In its December 31, 2021, balance sheet, what amount of liability for compensated absences is B required to report? A. $60,000. B. $84,000. C. $90,000. D. $144,000. D. 9.7%.arrow_forward

- Felipe's Mexican Restaurant incurred salaries expense of $70,000 for 2024. The payroll expense includes employer FICA tax, in addition to state unemployment tax and federal unemployment tax. Of the total salaries, $23,000 is subject to unemployment tax. Also, the company provides the following benefits for employees: health insurance (cost to the company, $2,000), life insurance (cost to the company, $400), and retirement benefits (cost to the company, 8% of salaries expense). Requirement 1. Journalize Felipe's expenses for employee benefits and for payroll taxes. Explanations are not required. Begin with the entry to accrue Felipe's employer payroll taxes. (Round all amounts to the nearest cent. Record debits first, then credits. Exclude explanations from journal entries.) Date ages Get more help - Accounte [99+ More info Dabit Gradit For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: Employer: OASDI: 6.2% on first $132,900…arrow_forwardAn employee works 35 regular hours during a workweek in September of 2023. The employee was hired twelve years ago, earns a salary of $122,500/year, and is exempt from the overtime provisions of the FLSA. To date, he has received no compensation beyond his annual salary. He has requested that his employer withhold 10% of gross pay, which is to be contributed to a 403(b) plan. Taxable income for federal income tax withholding = $ Taxable income for social security tax = $ Taxable income for medicare tax = $arrow_forwardOn the December 31, 2015, payday, Jo is out sick. Prior to this $3,000 paycheck, her 2015 taxable wages were $120,000. If Jo picked up her paycheck on-January 4, 2016, how much FICA should Jo’s employer have withheld? $43.50 $169.50 $229.50 None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education