FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

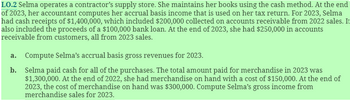

Transcribed Image Text:LO.2 Selma operates a contractor's supply store. She maintains her books using the cash method. At the end

of 2023, her accountant computes her accrual basis income that is used on her tax return. For 2023, Selma

had cash receipts of $1,400,000, which included $200,000 collected on accounts receivable from 2022 sales. It

also included the proceeds of a $100,000 bank loan. At the end of 2023, she had $250,000 in accounts

receivable from customers, all from 2023 sales.

a. Compute Selma's accrual basis gross revenues for 2023.

b. Selma paid cash for all of the purchases. The total amount paid for merchandise in 2023 was

$1,300,000. At the end of 2022, she had merchandise on hand with a cost of $150,000. At the end of

2023, the cost of merchandise on hand was $300,000. Compute Selma's gross income from

merchandise sales for 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- n 2021 Betty loaned her son, Juan, $10,000 to help him buy a car. In 2023, before he repaid the $10,000, Betty to Juan that she was "tearing up" the $10,000 note as a graduation present. How should Juan treat the amount forgi O A. taxable income in year of forgiveness B. excludible gift in year of forgiveness OC. taxable income in year of loan O D. excludible gift in year of loanarrow_forwardDorothie paid the following amounts during the current year: Interest on her home mortgage (pre-12/16/17) $9,250 Service charges on her checking account 48 Credit card interest 168 Auto loan interest 675 Interest from a home equity line of credit (HELOC) 2,300 Interest from a loan used to purchase stock 1,600 Credit investigation fee for loan 75 Dorothie's residence has a fair market value of $250,000. The mortgage is secured by the home at the time of purchase and has a balance of $180,000. Dorothie used the same home to secure her HELOC with a balance of $50,000. Dorothie used the proceeds of her HELOC to pay for college and to buy a new car. Dorothie has $1,000 of net investment income. Compute Dorothie's interest deduction in the following scenarios: a. Calculate Dorothie's interest deduction (on Schedule A) for 2021. b. Same as part a, and Dorothie used the HELOC proceeds to add a new bedroom to her home. c. Same as part a, but Dorothie's home is valued at $1,200,000 and her…arrow_forwardTyler, a self-employed taxpayer, travels from Denver to Miami primarily on business. He spends five days conducting business and two days sightseeing. His expenses are $685 (airfare), $200 per day (meals at local restaurants), and $145 per night (lodging). If required, round your answers to the nearest dollar. What are Tyler's deductible expenses in the below year: 2023 2022arrow_forward

- • Cynthia is an electrician, age 29, and single. • Cynthia has investment income and has a consolidated broker’s statement.• Cynthia began a cleaning service business in 2020. She was paid on Form 1099-NEC for 2021. She also received additional cash receipts of $400 not reported on the Form 1099-NEC. • Cynthia uses the cash method of accounting. She uses business code 561720.• Cynthia has receipts for the following expenses:- $350 for cleaning supplies- $225 for business cards - $450 for a mop, broom, and vacuum cleaner - $150 for work gloves - $125 for lunches - $175 for work clothes suitable for everyday use • Cynthia has a detailed mileage log reporting for 2021:- Mileage from her home to her first client’s home and mileage from her last client’s home to her home – 750 miles- In addition, on the days Cynthia worked for multiple clients, she kept track of the mileage from the first client’s home to the second client’s home in case that mileage was also deductible. She logged 450…arrow_forwardM 1 Mindy is single with AGI of $250,000. Mindy made the following payments in 2020: 2 Medical expenses 5,000 3 State income tax withholdings 7,500 4 State sales tax payments 1,500 5 Real estate taxes 6,000 6 Interest on qualified home mortgage 12,000 7 Charitable contribution XYZ Corporation stock 8 Mindy purchased her home in 2020 and the original mortgage on the home has a principal balance of $800,000. 9 Mindy purchased XYZ stock for $2,000 in 2017 and the stock had a fair market value of $3,000 when she made the donation to a public charity in 2020. 10 Calculate the amount of Mindy's2020 itemized deductions. 8 points 11 A calculations must be shownarrow_forwardDuring 2023, Anmol Frank had the following transactions: Alimony received (divorce occured in 2017) Interest income on IBM bonds She borrowed money to buy a new car Value of BMW received as a gift from aunt Federal income tax withholding payments The taxpayer's AGI is: a. $74,000. b. $76,000. c. $79,000. d.) $81,000. e. $90,000.arrow_forward

- T4.arrow_forwardManiarrow_forwardMr. Babu Kamil is a married person and have a net income of $85,000 in 2021. His spouse has a net income of $4500 and she has no mental or physical infirmity. Calculate the spousal amount to be claimed in Line 30300 $13808 – 4500 = $9,308 Calculate the spousal credit (how much credit Mr. Babu gets from this amount). $9308*15% = $1396.20arrow_forward

- Leslie and Jason, who are married filing jointly, paid the following expenses during 2022: Interest on a car loan $ 130 Interest on lending institution loan (used to purchase municipal bonds) 3,150 Interest on home mortgage (home mortgage principal is less than $750,000) 2,210 Required: What is the maximum amount that they can use in calculating itemized deductions for 2022?arrow_forwardProblem 4-32 (LO. 2) Selma operates a contractor's supply store. She maintains her books using the cash method. At the end of 2021, her accountant computes her accrual basis income that is used on her tax return. For 2021, Selma had cash receipts of $1,400,000, which included $200,000 collected on accounts receivable from 2020 sales. It also included the proceeds of a $100,000 bank loan. At the end of 2021, she had $250,000 in accounts receivable from customers, all from 2021 sales. a. Compute Selma's accrual basis gross revenues for 2021. $4 b. Selma paid cash for all of the purchases. The total amount paid for merchandise in 2021 was $1,300,000. At the end of 2020, she had merchandise on hand with a cost of $150,000. At the end of 2021, the cost of merchandise on hand was $300,000. Compute Selma's gross income (profit) from merchandise sales for 2021. The cost of goods sold for 2021 under the accrual method is $ Therefore, the gross profit from merchandise sales for 2021 under the…arrow_forwardWai Yeung is a self-employed insurance Salesperson. She started her business on January 1, 2022, and ended her first taxation year on December 31, 2022. On July 1, she purchased a car for $36,000 plus 13% HST. The car is financed with a bank loan and interest costs amounted to $1,970 from July 1 to December 31. Wai incurred the following additional expenses relating to her automobile: Repairs and maintenance $ 400 Insurance 1,200 Gasoline 1,900 Parking while on business 500 During the period, Wai drove 16,000 Km, of which 12,000 Km were for business. Assume the car is not designated as immediate expensing property. Required: Complete the table below to answer the following questions. a. Determine the maximum amount that Wai can deduct from her business income for tax purposes in 2022. Show expenses as negative numbers. b. Calculate the maximum CCA that Wai can deduct in 2023 and 2024, assuming that business kilometres driven and total kilometres driven both remain constant and that she…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education