FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Dd.26.

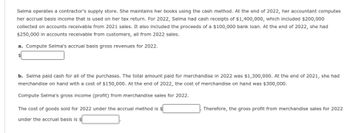

Transcribed Image Text:Selma operates a contractor's supply store. She maintains her books using the cash method. At the end of 2022, her accountant computes

her accrual basis income that is used on her tax return. For 2022, Selma had cash receipts of $1,400,000, which included $200,000

collected on accounts receivable from 2021 sales. It also included the proceeds of a $100,000 bank loan. At the end of 2022, she had

$250,000 in accounts receivable from customers, all from 2022 sales.

a. Compute Selma's accrual basis gross revenues for 2022.

b. Selma paid cash for all of the purchases. The total amount paid for merchandise in 2022 was $1,300,000. At the end of 2021, she had

merchandise on hand with a cost of $150,000. At the end of 2022, the cost of merchandise on hand was $300,000.

Compute Selma's gross income (profit) from merchandise sales for 2022.

The cost of goods sold for 2022 under the accrual method is $

under the accrual basis is $

Therefore, the gross profit from merchandise sales for 2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Refer to the following selected financial information from Texas Electronics. Compute the company's acid-test ratio for Year 2. Year 2 $ 38,400 Year 1 $ 33,150 64,500 99,000 90,000 84,000 125,500 129,500 13,000 10,600 392,500 342,500 108,900 112,300 715,500 680,500 394,500 379,500 Cash Short-term investments. Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets Accounts payable Net sales. Cost of goods soldarrow_forwardWhat is the difference between a Form 10–K and a Form 10–Q?arrow_forwardWhat is the solution to 0.5x - 2 < 5.5? O A. X < 7 о В. х< 9 С. X < 13 D. x < 15arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education