FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ms awa

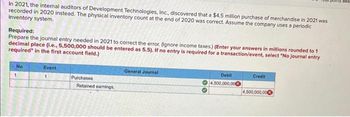

In 2021, the internal auditors of Development Technologies, Inc., discovered that a $4.5 million purchase of merchandise in 2021 was

recorded in 2020 instead. The physical inventory count at the end of 2020 was correct. Assume the company uses a periodic

Inventory system.

Required:

Prepare the journal entry needed in 2021 to correct the error, (ignore income taxes.) (Enter your answers in millions rounded to 1

decimal place (i.e., 5,500,000 should be entered as 5.5). If no entry is required for a transaction/event, select "No journal entry

required" in the first account field.)

Event

General Journal

Credit

No

1

Debit

4,500,000,000

Purchases

4,500,000,000

Retained earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (S) porins) An audit of Antwren revealed four errors that were made but never corrected. In 2021, ending inventory was overstated by $201, 000 and depreciation was overstated by $44,000. In 2022, nding inventory was understated by $111, 000 and wages expens as understated by $86, 000. What effect did these errors have 0 htwren's 2022 net income? (RE&CF 6) understated by $226, 000 overstated by $132, 000 pverstated by $157,000 inderstated by $25,000arrow_forwardI could use some help with homework can you explain how to do this? A mistake was made when counting the ending inventory at December 31, 2018: it was recorded incorrectly as $50,000 (not the correct $60,000). Ending inventory for 2019 was recorded correctly. The effect of this error on the firm's income would be: Group of answer choices -2018 income would be overstated by $10,000. -2018 and 2019 income would be understated by $10,000 for each year. -2018 income would be correct but 2019 would be overstated. -2018 income would be understated by $10,000 and 2019 income would be overstated by $10,000, the errors cancel each other out after 2 years. -None of the above.arrow_forwardDuring 2021, P Company discovered that the ending inventories reported on its financial statements were incorrect by the following amounts: 2019 $ 120,000 understated 2020 $ 150,000 overstated *Note any error of 2019 ending inventory is carried over to 2020 as an error of the beginning inventory. P uses the periodic inventory system to ascertain year-end quantities that are converted to dollar amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income taxes, P's retained earnings at January 1, 2021, would be: O Correct. O $30,000 overstated O $150,000 overstated. O $270,000 overstated.arrow_forward

- In January 2020, Susquehanna Inc. requested and secured permission from the commissioner of the Internal Revenue Service to compute inventories under the last-in, first-out (LIFO) method and elected to determine inventory cost under the dollar- value LIFO method. Susquehanna Inc. satisfied the commissioner that cost could be accurately determined by use of an index number computed from a representative sample selected from the company's single inventory pool. Instructions a. Why should inventories be included in (1) a balance sheet and (2) the computation of net income? b. The Internal Revenue Code allows some accountable events to be considered differently for income tax reporting purposes and financial accounting purposes, while other accountable events must be reported the same for both purposes. Discuss why it might be desirable to report some accountable events differently for financial accounting purposes than for income tax reporting purposes. c. Discuss the ways and…arrow_forwardPatel Bros. Grocery store recently completed their 2020 Inventory and realized that a truckload of merchandise that is valued at $18,000 was included in inventory, however this merchandise had yet to be received and was sold FOB destination. (a) What is the effect on 2020 Financial Statements including amounts (b) the effects on the 2021 financial statements including amounts; assume no errors are made in 2021.arrow_forwardVaiarrow_forward

- You have been hired as the new controller for the Ralston Company. Shortly after joining the company in 2024, you discover the following errors related to the 2022 and 2023 financial statements: a. Inventory at 12/31/2022 was understated by $6,400. b. Inventory at 12/31/2023 was overstated by $9,800. c. On 12/31/2023, inventory was purchased for $3,400. The company did not record the purchase until the inventory was paid for early in 2024. At that time, the purchase was recorded by a debit to purchases and a credit to cash. The company uses a periodic inventory system. Required: 1. Assuming that the errors were discovered after the 2023 financial statements were issued, analyze the effect of the errors on 2023 and 2022 cost of goods sold, net income, and retained earnings. (Ignore income taxes.) 2. Prepare a journal entry to correct the errors.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education