FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

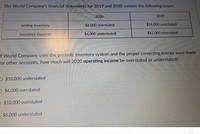

Transcribed Image Text:The World Company's financial statements for 2019 and 2020 contain the following errors:

| | 2020 | 2019 |

|------------|------------------------|------------------------|

| ending inventory | $6,000 overstated | $16,000 overstated |

| insurance expense | $4,000 understated | $12,000 overstated |

Question:

If World Company uses the periodic inventory system and the proper correcting entries were made for other accounts, how much will 2020 operating income be overstated or understated?

Options:

- $10,000 understated

- $6,000 overstated

- $10,000 overstated

- $6,000 understated

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sh30arrow_forwardView Policies Current Attempt in Progress The following information applied to Marigold Corp. for 2020: Merchandise purchased for resale $411000 Freight-in 8100 Freight-out 4700 Purchase returns 1900 Marigold's 2020 inventoriable cost was O $413800. O $417200. O $411000. O $421900. Save for Later Attempts: 0 of 2 used Submit Ararrow_forwardPROBLEM 10 The inventory of Juan Company on December 31, 2020, consists of the following items: Inventory No. Quantity Cost per Unit NRV A1001* 1,000 4,100 P56 P6 A1005 61 59 A1010 500 98 85 A1014 1,200 15 16 A1021 37 3,250 750 35 A1022 20 26 A1030 1,350 39 35 *Inventory A1001 is slow-moving and was acquired four years ago. It will be sold as scrap with a realizable value of P6.00 Requirement: 1. Determine the valuation of the inventory as of December 31, 2020.arrow_forward

- Qw.13.arrow_forward2023 2022 2021 Beginning Inventory $25,900 $24,750 $25,750 Ending Inventory 24,965 25,900 24,750 Beginning Accounts Receivable $5,350 $7,850 $7,950 Ending Accounts Receivable 7,850 7,950 $8,950 Beginning Assets 198,750 195,000 $175,000 Ending Assets 199,750 198,750 $195,000 Gross sales (all on credit) 52,800 56,400 58,650 Discounts 1,255 1,800 $1,500 Returns and allowances 2,545 1,400 2,000 Cost of goods sold 30,250 27,800 28,750 Operating expenses 4,750 6,250 7,500 Calculate Your Company's accounts receivable turnover for each year. 2021: 2022: 2023:arrow_forward2023 2022 2021 Beginning Inventory $25,900 $24,750 $25,750 Ending Inventory 24,965 25,900 24,750 Beginning Accounts Receivable $5,350 $7,850 $7,950 Ending Accounts Receivable 7,850 7,950 $8,950 Beginning Assets 198,750 195,000 $175,000 Ending Assets 199,750 198,750 $195,000 Gross sales (all on credit) 52,800 56,400 58,650 Discounts 1,255 1,800 $1,500 Returns and allowances 2,545 1,400 2,000 Cost of goods sold 30,250 27,800 28,750 Operating expenses 4,750 6,250 7,500 Calculate the gross margin percentage (ratio) for each year. 2021: 2022: 2023:arrow_forward

- Question 2 Grouper Company began operations on January 1, 2018, and uses the average-cost method of pricing inventory. Management is contemplating a change in inventory methods for 2021. The following information is available for the years 2018-2020. 2018 2019 2020 Net Income Computed Using Average-Cost Method FIFO Method $15,910 $19.060 21,170 25,200 2018 (a) Prepare the journal entry necessary to record a change from the average cost method to the FIFO method in 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation 2019 18,170 $ 19,880 $ (b) Determine net income to be reported for 2018, 2019, and 2020, after giving effect to the change in accounting principle. 2020 $ LIFO Method $12,010 14,110 17,040 Net Income Debit Account Titles and Explanation Credit (c) Assume Grouper Company used the LIFO method instead…arrow_forwardProblem 10-9 (AICPA Adapted)Hero Company reported inventory on December 31, 2020 atP6,000,000 based on a physical count of goods priced at cost,and before any necessary year-end adjustment relating to thefollowing:* Included in the physical count were goods billed to acustomer FOB shipping point on December 31, 2020.These goods had a cost of P125,000 and were picked up bythe carrier on January 10, 2021.Goods shipped FOB shipping point on December 28, 2020from a vendor to Hero Company were received on January4, 2021. The invoice cost was P300,000.What amount should be reported as inventory on December31, 2020?a. 5,875,000b. 6,000,000c. 6,175,000d. 6,300,000arrow_forwardA 105.arrow_forward

- 2023 2022 2021 Beginning Inventory $25,900 $24,750 $25,750 Ending Inventory 24,965 25,900 24,750 Beginning Accounts Receivable $5,350 $7,850 $7,950 Ending Accounts Receivable 7,850 7,950 $8,950 Beginning Assets 198,750 195,000 $175,000 Ending Assets 199,750 198,750 $195,000 Gross sales (all on credit) 52,800 56,400 58,650 Discounts 1,255 1,800 $1,500 Returns and allowances 2,545 1,400 2,000 Cost of goods sold 30,250 27,800 28,750 Operating expenses 4,750 6,250 7,500 Calculate “accounts receivable days outstanding” for each year. 2021: 2022: 2023:arrow_forwardProblem 10-9 (AICPA Adapted) Hero Company reported inventory on December 31, 2020 at P6,000,000 based on a physical count of goods priced at cost, and before any necessary year-end adjustment relating to the following: Included in the physical count were goods billed to a customer FOB shipping point on December 31, 2020. These goods had a cost of P125,000 and were picked up by the carrier on January 10, 2021. Goods shipped FOB shipping point on December 28, 2020 from a vendor to Hero Company were received on January 4, 2021. The invoice cost was P300,000. What amount should be reported as inventory on December 31, 2020? a. 5,875,000 b. 6,000,000 c. 6,175,000 d. 6,300,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education