FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

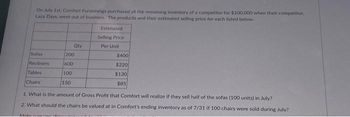

Transcribed Image Text:On July 1st. Comfort Furnishings purchased all the remaining inventory of a competitor for $100,000 when their competitor,

Lazy Days, went out of business. The products and their estimated selling price for each listed below.

Estimated

Selling Price

Per Unit

Sofas

Recliners

Tables

Chairs

Maku

200

600

100

Qty

150

$400

$220

$130

$85

1. What is the amount of Gross Profit that Comfort will realize if they sell half of the sofas (100 units) in July?

2. What should the chairs be valued at in Comfort's ending inventory as of 7/31 if 100 chairs were sold during July?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Company sells 3 different items regularly. At the end of the current year, only one of each item is still on the shelf. There are no selling costs associated with these items. Below is a summary of information about each item. Item A Item B Item C Cost $8,100 $9,300 $7,500 Replacement cost as of end of year $8,600 $8,200 $7,100 Expected selling price (no disposal costs) $8,800 $9,000 $7,200 Normal profit $1,200 $600 $300 Box 1: Assume the company uses FIFO. At what dollar amount is item A stated on the balance sheet? Box 2: Assume the company uses FIFO. At what dollar amount is item B stated on the balance sheet? Box 3: Assume the company uses LIFO. At what dollar amount is item C stated on the balance sheet? Note: Provide the amount that will show up on the BALANCE SHEET for each item. There is one of each item left in stock. I am NOT looking for a computation of gain or loss-- these items have not been sold. Please do not use any punctuation in your answers. Each…arrow_forwardABC Company sells clothes. They sold a coat for $100. It cost them $60 to get the coat from the manufacturer. Cost of Goods Sold would be: Group of answer choices $100 cannot be determined $40 $60arrow_forwardIn its first month of operation, Waterway Industries purchased 340 units of inventory for $9, then 440 units for $10, and finally 380 units for $11. At the end of the month, 420 units remained.Compute the amount of phantom profit that would result if the company used FIFO rather than LIFO. Phantom Profit =?arrow_forward

- On December 1, Kiyak Electronics Ltd. has three DVD players left in stock. All are identical, all are priced to sell at $150. One of the three DVD players left in stock, with serial #1012, was purchased on June 1 at a cost of $100. Another, with serial #1045, was purchased on November 1 for $88. The last player, serial #1056, was purchased on November 30 for $80. Instructions a. Calculate the cost of goods sold using the FIFO periodic inventory method assuming that two of the three players were sold by the end of December, Kiyak Electronics’ year-end. b. If Kiyak Electronics used the specific identification method instead of the FIFO method, how might it alter its earnings by “selectively choosing” which particular players to sell to the two customers? What would Kiyak’s cost of goods sold be if the company wished to minimize earnings? Maximize earnings? c. Which of the two inventory methods do you recommend that Kiyak use? Explain why.arrow_forwardDiapers.com is an online specialty retailer for baby products (including diapers) that specialized in delivering consumables, such as diapers, wipes, and formula. Diapers.com was selling a pack of Pampers for $18 on its website, while same pack was acquired from P&G for $9. The % margin (percent of Diapers' selling price) is equal to A. $9 B. 100% C. 50% D. $18arrow_forwardponts) Ponchard, a chain of candy stores, purchases it's candy in bulk. In a recent shipment, Ponchard received 149,240 candies for $13,500. The candy is broken into two groups. One group of 44,550 pieces that will sell for $0.15 each and the rest that will sell for $0.41 each. Using this information, how much profit will Ponchard record for each candy they sell from the first group? Please round your calculations to the nearest penny! O $0.06 O $0.11 O $0.30 O $0.04arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education