Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

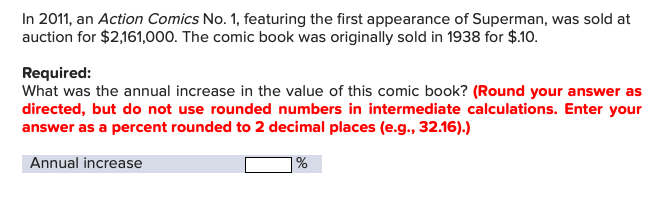

Transcribed Image Text:In 2011, an Action Comics No. 1, featuring the first appearance of Superman, was sold at

auction for $2,161,000. The comic book was originally sold in 1938 for $.10

Required:

What was the annual increase in the value of this comic book? (Round your answer as

directed, but do not use rounded numbers in intermediate calculations. Enter your

answer as a percent rounded to 2 decimal places (e.g., 32.16).)

Annual increase

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- 1. Compute the requested value(s) for each scenario. Show all component numbers that factor into determination of the final answer(s) a. On January 1, 1963, a kid from Sioux Falls purchased a limited edition Superman comic at the original market price of 12 cents. On January 1, 1997 (34 years later), the comic was sold at auction for $2,500. What annual rate of return did this kid earn on the comic? Give typing answer with explanation and conclusionarrow_forwardAlfredo Company purchased a new 3-D printer for $90,000. This printer is expected to last for ten years, at which time, Alfredo believes it will be able to sell the printer for $15,000. Calculate yearly depreciation using the double-declining-balance method. PLEASE NOTE: All whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). Year 1 Depreciation: _________________ Year 2 Depreciation: _________________ Year 3 Depreciation: _________________ Year 4 Depreciation: _________________ Year 5 Depreciation: _________________ Year 6 Depreciation: _________________ Year 7 Depreciation: _________________ Year 8 Depreciation: _________________ Year 9 Depreciation: _________________ Year 10 Depreciation: _________________arrow_forwardAn automotive company purchased equipment for $84,000. What is the fifth year's depreciation on the 7-year property if the property is placed in service in July 2011? Click the icon to view a table of MACRS rates. The fifth year's depreciation is $ (Round to the nearest cent as needed.) MACRS Table Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 PEPP8 15 16 17 18 19 20 3-Year 33.33% 44.45 14.81 7.41 Depreciation rate for recovery period 5-Year 7-Year 10-Year 15-Year 20.00% 14.29% 10.00% 32.00 24.49 18.00 19.20 17.49 14.40 11.52 12.49 11.52 11.52 5.76 8.93 8.92 8.93 4.46 9.22 7.37 6.55 6.55 6.56 6.55 3.28 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 20-Year 3.750% 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461arrow_forward

- Assume that in 2018, the first edition of a comic book was sold at auction for $585,400. The comic book was originally sold in 1935 for $.05. For this to have been true, what was the annual increase in the value of the comic book? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Annual increase %arrow_forwardplease help answerarrow_forwardAssume that in 2020, the first edition of a comic book was sold at auction for $691,600. The comic book was originally sold in 1936 for $.10. What was the annual increase in the value of the comic book? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Annual increase = %arrow_forward

- Calico Inc. purchased a patent on a new drug. The patent cost $26,000. The patent has a life of 25 years, but Calico only expects to be able to sell the drug for 20 years. A. Calculate the amortization expense. $ B. Record the journal for the first-year expense. If an amount box does not require an entry, leave it blank. Accounts Receivable Amortization Expense Cash Factoring Expense Patentarrow_forwardA small company purchased a state-of-the-art copier machine in 2012 for $5,995. Five years later the company sold the used copier for $3650. Find the absolute change in the value of the copier. Show your work. Find the relative change in the value of the copier. Show your work. The value of the copier has _________________________ by _________%.arrow_forwardAssume that in 2018, the first edition of a comic book was sold at auction for $632,600. The comic book was originally sold in 1935 for $.10. For this to have been true, what was the annual increase in the value of the comic book? Annual increase: ____%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education