FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

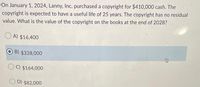

Transcribed Image Text:On January 1, 2024, Lanny, Inc. purchased a copyright for $410,000 cash. The

copyright is expected to have a useful life of 25 years. The copyright has no residual

value. What is the value of the copyright on the books at the end of 2028?

O A) $16,400

B) $328,000

C) $164,000

O D) $82,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello Corporation purchased a patent for $90,000 on September 1, 2020. It had a useful life of 10 years. On January 1, 2022, Hello spent $22,000 to successfully defend the patent in a lawsuit. Hello feels that as of that date, the remaining useful life is 5 years. Calculate the amount that should be reported for patent amortization expense for 2022.arrow_forwardKyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2022. During that time, he earned $58,000 of self-employment income. On April 1, 2022, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $172,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year?arrow_forwardCompany A purchased a patent from Company B on 6/30/2021 for $660,000. The useful life of the patent is estimated to be six years. On 12/31/2024 the fair market value of the patent was $250,000, while the undiscounted future net cash flows related to the patent were $300,000. Q1. Please record the journal entry, if necessary, to record impairment of the patent on 12/31/2024arrow_forward

- Taylor Swift Corporation purchases a patent from Salmon Company on January 1, 2017, for $54,000. The patent has a remaining legal life of 16 years. Taylor Swift feels the patent will be useful for 10 years. Prepare Taylor Swift’s journal entries to record the purchase of the patent and 2017 amortization.arrow_forwardMyron Corp has the following information available related to the equipment it uses in its business. Description Information Purchase Date January 1, 2020 Original Capitalized Cost $800,000 Original Useful Life 5 years Original Residual Value $40,000 On January 1, 2022, Myron made $100,000 worth of extraordinary repairs on this equipment. It financed these repairs by taking out a two-year, 12% note. These repairs are expected to extend the useful life of the equipment by an additional three (3) years past its original five (5) year life (to a new total life of 8 years). There is no change expected to the asset’s residual value. Myron uses the straight-line depreciation method for all its depreciable assets. Part A: Record the journal entry Myron should make on 1/1/22 for the cost of the extraordinary repair.arrow_forwardOn January 1, 2007, Taft Co. purchased a patent for 714,000. The patent is being amortized over its remaining legal life of fifteenyears expiring on January 1, 2022. During 2010, Taft determined that the economic benefits of the patent would not last longer than ten years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2010?a.428,400b.489,600c.504,000d.523,600arrow_forward

- On January 1, 2019, MLW Company purchased a copyright for $1,000,000, having an estimated useful life of 16 years. In January 2023, MLW paid $150,000 for legal fees in a successful defense of the copyright. What should be the amount of copyright amortization expense for the year ended December 31, 2023?arrow_forwardD1.arrow_forwardOn October 12, 2023, Simarov, Inc. purchases a Copyright to a song, written by a person who died on October 12, 1963 for $50,000 cash. Simarov believes they will be able to generate revenue from the Copyright for the remaining useful life. Prepare the journal entry to record the purchase. DR: CR: What is the remaining useful life of the Copyright? How much amortization expense will Simarov record each year? years Prepare the adjusting journal entry to record one year's amortization. DR: CR: What is the Net Book Value of the Copyright on October 1, 2027?arrow_forward

- Indigo Corporation purchases a patent from Sandhill Company on January 1, 2020, for $54,000. The patent has a remaining legal life of 12 years. Indigo feels the patent will be useful for 10 years. Prepare Indigo’s journal entries to record the purchase of the patent and 2020 amortization.arrow_forwardRobotix Company purchases a patent for $21,000 on January 1. The patent is good for 18 years, after which anyone can use the patent technology. However, Robotix plans to sell products using that patent technology for only 5 years. Prepare the intangible asset section of the year end balance sheet after amortization expense for the year is recorded.arrow_forwardOn January 2, 2025, Ivanhoe Co. bought a trademark from Rice, Inc. for $1641000. An independent research company estimated that the remaining useful life of the trademark was 10 years. Its unamortized cost on Rice's books was $1969200. Ivanhoe expects that the trademark will produce 25% of its cash flows in year 1, 20% in year 2, 15% in year 3, and 10% in the remaining years. In Ivanhoe's 2025 income statement, what amount should be reported as amortization expense? Select answer from the options below - $410250 $318200 $273500 $164100arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education