ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

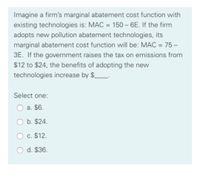

Transcribed Image Text:Imagine a firm's marginal abatement cost function with

existing technologies is: MAC = 150 – 6E. If the firm

adopts new pollution abatement technologies, its

marginal abatement cost function will be: MAC = 75 –

3E. If the government raises the tax on emissions from

$12 to $24, the benefits of adopting the new

technologies increase by $_.

Select one:

a. $6.

b. $24.

c. $12.

d. $36.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider two firms with the following marginal abatement costs (MAC) as a function of emissions (E): MAC1 = 10 - 2E1 MAC2 = 4 - E2 If both firms cut their emissions to zero, then total abatement costs (TAC) for both firms is ____. THE ANSWER IS NOT 17arrow_forwarddo fast. i will 5 upvotearrow_forwardImagine a firm with a marginal abatement cost (MAC) function equal to: MAC = 120 10E. The government introduces a per-unit tax on emissions equal to $20. For a profit- maximizing firm, total compliance costs (total abatement costs plus tax payment) are $arrow_forward

- Suppose that a firm's marginal abatement cost function with existing technologies is MAC = 12 - E. If the firm adopts new pollution abatement technologies, then its marginal abatement cost function will become MAC = 6 - 0.5E. With an emissions tax of $3, the benefits of adopting the new technologies equal $__. Please round your final answer to two decimal places if necessary. Answer:arrow_forwardThe table below shows current carbon emissions and the cost of reducing carbon emissions for three industrial firms. The government introduces a cap-and-trade policy to regulate carbon emissions. The total cap on emissions is 180 tonnes of carbon, and each firm receives an initial allocation of tradable permits for 60 tonnes of carbon emissions. Current carbon emissions Firm A B C (tonnes) 80 100 70 a. Firm A will buy 40 emission ✓ Firm C. Cost of reducing emissions by 1 ton ($) 150 200 50 Firm B will sell 20 emissior Firm C. Instructions: Round your answer to the nearest whole number. b. To break even, the selling firm must receive $ 150arrow_forwardMB = 50 - 2A MC = A Draw a graph for conducting a benefit cost analysis using marginal analysis. Solve for the efficient level of abatement and calculate the net benefits. Solve for the deadweight loss present at A = 10.arrow_forward

- cap-and-trade and windfall profitsA city called Seoul is suffering from high concentrations of mercury in the air, caused by burningcoal in power plants. There are two of these plants close to the city. The city’s mayor wants touse cap-and-trade to reduce emissions to a reportedly “safe” level of 60 tons. The two firms havethe following marginal benefits of emissions: MB1 = 100 – 2e1, MB2 = 25 – 0.5e2.a. How much mercury will each firm emit? What allowance price will prevail in themarket?Firm 2 hires a smart lobbyist who convinces the government that its profits are relatively low andthat it therefore deserves a generous allowance allocation. The government agrees and allocatesa1 = 20 allowances to firm 1 (for free) and a2 = 40 allowances to firm 2 (for free).b. What are the firms’ profits? Do any of the firms earn windfall profits? [Hint: compareprofits with and without regulation.] Windfall profits have been sharply criticized by consumer advocacy groups and politicians.c. What can…arrow_forwardPlease help me with this question ASAParrow_forwardHow large should a Pigovian tax be to achieve efficiency?arrow_forward

- n order to create more jobs in the region, the local government gave permission to a foreign investor to build a chemical plant not far from a residential area. Analysts predict that real estate prices will drop by 15%15%. Currently, the total value of real estate is $40$40 million.Calculate the potential external cost for the residents in this area of building the chemical plant. Write the exact answer. Do not round.arrow_forwardImagine a firm with a marginal abatement cost (MAC) function equal to: MAC = 27-3E. The government introduces a per-unit tax on emissions equal to $6. For a profit-maximizing firm, total compliance costs (total abatement costs plus tax payment) are $ Answer:arrow_forwardSuppose that a firm's marginal abatement cost function with existing technologies is MAC = 12 - E. If the firm adopts new pollution abatement technologies, then its marginal abatement cost function will become MAC = 6 - 0.5E. With an emissions tax of $4, the benefits of adopting the new technologies equal $____. Please round your final answer to two decimal places if necessary. THE ANSWER IS NOT 16 Maybe 4?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education