FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

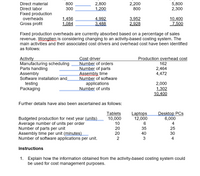

Transcribed Image Text:II. Wongtien Electronics Corp. in Hong Kong, SAR, China, manufactures tablets, laptops

and desktop PCs. Wongtien currently operates a standard absorption costing system.

Budgeted information for next year is given below (currency in one thousand Hong Kong

Dollars, HK$000):

Desktop PCs

9,880

2,200

800

Products

Sales revenue

Tablets

3,640

800

300

Laptops

12,480

2,800

Total

26,000

5,800

2,300

Direct material

Direct labor

Fixed production

overheads

1,456

1,084

4.992

3.488

3,952

2,928

10,400

7,500

Gross profit

Fixed production overheads are currently absorbed based on a percentage of sales

revenue. Wongtien is considering changing to an activity-based costing system. The

main activities and their associated cost drivers and overhead cost have been identified

as follows:

Cost driver

Production overhead cost

Activity

Manufacturing scheduling wNumber of orders

Parts handling

Assembly

Software installation and

testing

Packaging

162

Number of parts

Assembly time

wNumber of software

applications

Number of units

2,464

4,472

2,000

1,302

10,400

Further details have also been ascertained as follows:

Desktop PCs

6,000

4

Tablets

Laptops

12,000

Budgeted production for next year (units). 10,000

Average number of units per order

Number of parts per unit

Assembly time per unit (minutes)n

Number of software applications per unit.

10

20

35

25

20

40

30

3

4

Instructions

Transcribed Image Text:Direct material

800

2,800

t200

2,200

800

5,800

2,300

Direct labor

300

Fixed production

3,952

2,928

overheads

1,456

1,084

4,992

3.488

10,400

7,500

Gross profit

Fixed production overheads are currently absorbed based on a percentage of sales

revenue. Wongtien is considering changing to an activity-based costing system. The

main activities and their associated cost drivers and overhead cost have been identified

as follows:

Cost driver

Number of orders

Number of parts

Assembly time

Number of software

applications

Number of units

Production overhead cost

Activity

Manufacturing scheduling

Parts handling

Assembly

Software installation and

testing

Packaging

162

2,464

4,472

2,000

1,302

10,400

Further details have also been ascertained as follows:

Laptops Desktop PCs

6,000

4

Tablets

Budgeted production for next year (units). 10,000

Average number of units per order

Number of parts per unit

Assembly time per unit (minutes)m

Number of software applications per unit.

12,000

6

10

20

35

25

20

40

30

2

3

4

Instructions

1. Explain how the information obtained from the activity-based costing system could

be used for cost management purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- hello!! please help! I think this is rightarrow_forwardToy Plc. makes special toy cars which it sells to retailers for K25, 000 per toy car. Retailers sell the toy cars to consumers for K40, 000 each. Budgeted information for the following year: Production and sales 200, 000 toy cars Fixed overhead K2, 400, 000, 000 Variable costs per toy car K6, 500 Recently, the retailer has started using their buyer power over Toy Plc. demanding a discount off the existing price charged to them. Directors of Toy plc. fear that they may lose business if they do not offer some discount to their customers and have asked for advice from a market research consultancy firm. The consultants have suggested that Toy plc. need to reduce the selling price charged to retailers by a minimum of 10% if they are to retain existing customers. The consultants however, believe that Toy plc. can use some buyer power of their own over the suppliers of materials such that the variable cost per toy car would fall by 5%. Draw the…arrow_forwardToy Plc. makes special toy cars which it sells to retailers for K25, 000 per toy car. Retailers sell the toy cars to consumers for K40, 000 each. Budgeted information for the following year: Production and sales 200, 000 toy cars Fixed overhead K2, 400, 000, 000 Variable costs per toy car K6, 500 Recently, the retailer has started using their buyer power over Toy Plc. demanding a discount off the existing price charged to them. Directors of Toy plc. fear that they may lose business if they do not offer some discount to their customers and have asked for advice from a market research consultancy firm. The consultants have suggested that Toy plc. need to reduce the selling price charged to retailers by a minimum of 10% if they are to retain existing customers. The consultants however, believe that Toy plc. can use some buyer power of their own over the suppliers of materials such that the variable cost per toy car would fall by 5%. Based upon the…arrow_forward

- Gold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Percentage of total sales Sales Variable expenses Contribution margin Fixed expenses Net operating income White 48% $ 374,400 112,320 $ 262,080 Fragrant 20% 100% $ 156,000 30% 124,800 70% $ 31,200 Product 100% 80% 20% Loonzain 32% $ 249,600 137, 280 $ 112,320 100% 55% 45% Total 100% $ 780,000 374,400 405, 600 228,800 $ 176,800 Dollar sales to break-even = Fixed expenses ÷ CM ratio = $228,800 ÷ 0.52 = $440,000 As shown by these data, net operating income is budgeted at $176,800 for the month and the estimated break-even sales is $440,000. Assume actual sales for the month total $780,000 as planned; however, actual sales by product are White, $249,600; Fragrant, $312,000; and Loonzain, $218,400. Required: 1. Prepare a contribution format income statement for the month…arrow_forwardGold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Product Percentage of total sales White 48% Fragrant 20% Loonzain 32% Total 100% Sales Variable expenses $ 369,600 110,880 100% 30% $ 154,000 123,200 100% 80% Contribution margin Fixed expenses Net operating income $ 258,720 70% $ 30,800 20% $ 246,400 135,520 $ 110,880 100% 55% 45% $ 770,000 369,600 100% 48% 400,400 52% 226,720 $ 173,680 Dollar sales to break-even - Fixed expenses / CM ratio = $226,720/0.52 = $436,000 As shown by these data, net operating income is budgeted at $173,680 for the month and the estimated break-even sales is $436,000. Assume that actual sales for the month total $770,000 as planned; however, actual sales by product are: White, $246,400; Fragrant, $308,000; and Loonzain, $215,600. Required: 1. Prepare a contribution format income statement…arrow_forwardGold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Percentage of total sales Sales Variable expenses Contribution margin Fixed expenses Net operating income White 20% $ 150,000 108,000 $ 42,000 Fragrant 52% 100% $ 390,000 72% 28% $ 312,000 78,000 Required 1 Required 2 Product Loonzain 28% Complete this question by entering your answers in the tabs below. 100% $ 210,000 20% 84,000 80% $ 126,000 Required: 1. Prepare a contribution format income statement for the month based on the actual sales data. 2. Compute the break-even point in dollar sales for the month based on your actual data. 100% 40% 60% Tota 100% Dollar sales to break-even = Fixed expenses / CM ratio = $449,280 / 0.64 = $702,000 As shown by these data, net operating income is budgeted at $30,720 for the month and the estimated break-even sales is $702,000.…arrow_forward

- Jackson Company manufactures computer keyboards. The budgeted sales price is $60 per keyboard, the variable costs are $28 per keyboard, and budgeted fixed costs are $13,000. What is the budgeted operating income for 2,000 keyboards? OA. $58,000 OB. $51,000 OC. $67,000 OD. $64,000arrow_forwardWongtien Electronics Corp. in Hong Kong, SAR, China, manufactures tablets, laptops and desktop PCs. Wongtien currently operates a standard absorption costing system. Budgeted information for next year is given below (currency in one thousand Hong Kong Dollars, HK$000): Products Tablets Laptops Desktop PCs Total Sales revenue 3,640 12,480 9,880 26,000 Direct material 800 2,800 2,200 5,800 Direct labor 300 1,200 800 2,300 Fixed production overheads 1,456 4,992 3,952 10,400 Gross profit 1,084 3,488 2,928 7,500 Fixed production overheads are currently absorbed based on a percentage of sales revenue. Wongtien is considering changing to an activity-based…arrow_forwardGold Star Rice, Ltd., of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice—White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Product White Fragrant Loonzain Total Percentage of total sales 48 % 20 % 32 % 100 % Sales $ 374,400 100 % $ 156,000 100 % $ 249,600 100 % $ 780,000 100 % Variable expenses 112,320 30 % 124,800 80 % 137,280 55 % 374,400 48 % Contribution margin $ 262,080 70 % $ 31,200 20 % $ 112,320 45 % 405,600 52 % Fixed expenses 234,000 Net operating income $ 171,600 Dollar sales to break-even = Fixed expenses = $234,000 = $450,000 CM ratio 0.52 As shown by these data, net operating income is budgeted at $171,600 for the month and the estimated break-even sales is $450,000. Assume that actual sales for the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education