FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

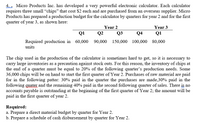

Transcribed Image Text:4. . Micro Products Inc. has developed a very powerful electronic calculator. Each calculator

requires three small “chips" that cost $2 each and are purchased from an overseas supplier. Micro

Products has prepared a production budget for the calculator by quarters for year 2 and for the first

quarter of year 3, as shown here:

Year 3

Q1

Year 2

Q1

Q2

Q3

Q4

Required production in 60,000

units

90,000 150,000 100,000 80,000

The chip used in the production of the calculator is sometimes hard to get, so it is necessary to

carry large inventories as a precaution against stock outs. For this reason, the inventory of chips at

the end of a quarter must be equal to 20% of the following quarter's production needs. Some

36,000 chips will be on hand to start the first quarter of Year 2. Purchases of raw material are paid

for in the following patter: 30% paid in the quarter the purchases are made,30% paid in the

following guater and the remaining 40% paid in the second following quarter of sales. There is no

accounts payable is outstanding at the beginning of the first quarter of Year 2; the amount will be

paid in the first quarter of year 2.

Required:

a. Prepare a direct material budget by quarter for Year 2.

b. Prepare a schedule of cash disbursement by quarter for Year 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Haverhill Electronics (HE) has offered to supply the county government with one model of its security screening device at “cost plus 25 percent.” HE operates a manufacturing plant that can produce 22,000 devices per year, but it normally produces 20,000. The costs to produce 20,000 devices follow. Total Cost Cost per Device Production costs: Materials $ 4,600,000.00 $ 230.00 Labor 5,600,000.00 280.00 Supplies and other costs that will vary with production 1,680,000.00 84.00 Indirect cost that will not vary with production 1,680,000.00 84.00 Variable marketing costs 760,000.00 38.00 Administrative costs (will not vary with production) 19,280,000.00 964.00 Totals $ 33,600,000.00 $ 1,680.00 Based on these data, company management expects to receive $2,100.00 (= $1,680.00 × 125 percent) per device for those sold on this contract. After completing 200 devices, the company sent a bill (invoice) to the government for $33,600,000 (= 200 devices × $2,100.00 per…arrow_forwardScholar Suppliers manufactures backpacks for students. The backpacks come in two sizes: Small, and Large. Scholar Suppliers anticipates the following sales volumes and prices for the coming period: Size Sales Volume Selling Price Small 3,000 backpacks $25 each Large 6,000 backpacks $75 each What is the budgeted level of revenue for the coming period?arrow_forwardRed Canyon T-shirt Company operates a chain of T-shirt shops in the southwestern United States. The sales manager has provided a sales forecast for the coming year, along with the following information: ● Quarter 1 Quarter 2 Quarter 3 Quarter 4 38,000 58,000 29,000 58,000 Budgeted unit sales Each T-shirt is expected to sell for $13. The purchasing manager buys the T-shirts for $5 each. The company needs to have enough T-shirts on hand at the end of each quarter to fill 23 percent of the next quarter's sales demand. Selling and administrative expenses are budgeted at $76,000 per quarter plus 18 percent of total sales revenue. Required: 1. Determine budgeted sales revenue for each quarter. 2. Determine budgeted cost of merchandise purchased for each quarter. 3. Determine budgeted cost of good sold for each quarter. 4. Determine selling and administrative expense for each quarter. 5. Complete the budgeted income statement for each quarter.arrow_forward

- The Charmatz Corporation has a central copying facility. Its offices can supply up to 800,000 copies per year. The copying facility has only two users, Department A and Department B. The following data apply to the coming budget year: Budgeted costs of Copy Support Department are: Fixed costs per year $70,000 per year Variable costs $0.02 per copy The operating departments have estimated their usage as follows: Department A 120,000 copies Department B 480,000 copies Actual usage for the year was: Department A 150,000 copies Department B 450,000 copies Budgeted amounts are used to calculate the allocation rates. Actual usage is used to allocate costs under the single-rate method. Actual usage is used to allocate variable costs and budgeted usage is used to allocate fixed costs under the dual-rate method. How will…arrow_forwardTeletronics is going to introduce a combination phone/tablet product. Design and testing will take 8 months. Teletronics expects to sell 24,000 units during the first 6 months of sales. Sales over the next 12 months are expected to be less robust at 20,000. And, sales in the final 6 months of the expected life cycle are expected to be 9,000. Teletronics is budgeting for this product as follows: LOADING... (Click the icon to view the cost information.) Read the requirements LOADING... . Requirement 1. If Teletronics prices the phone/tablets at $280 each, how much operating income will the company make over the product's life cycle? What is the operating income per unit? Begin by preparing the life cycle income statement in order to determine how much operating income the company will make over the product's life cycle. Projected Life Cycle Income Statement Revenues Variable costs: Months 9-14 Months 15-26…arrow_forwardVaughn Chemicals has developed a new window cleaner that requires two ingredients, AM972 and CA38. Based on forecasted sales, Vaughn has developed the following budgeted production for the coming year. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 1st QuarterNext Year Forecasted production (gallons) 5,000 7,000 9,000 12,500 6,000 Each gallon of window cleaner requires 100 ounces of AM972 and 28 ounces of CA38. An ounce of AM972 costs Vaughn $0.15. An ounce of CA38 costs the company $0.25. Vaughn's inventory policy requires ending inventory equal to 20% of the next quarter's production needs. At the beginning of the year, Vaughn expects to have 80,000 ounces of AM972 and 30,000 ounces of CA38 on hand.Prepare Vaughn's AM972 purchases budget for the coming year. (Enter price per ounce to 2 decimal places, e.g. 0.35.) 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Annual select an opening purchase…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education