FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

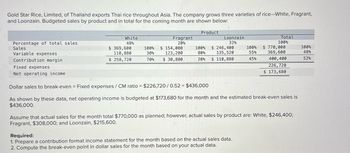

Transcribed Image Text:Gold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant,

and Loonzain. Budgeted sales by product and in total for the coming month are shown below:

Product

Percentage of total sales

White

48%

Fragrant

20%

Loonzain

32%

Total

100%

Sales

Variable expenses

$ 369,600

110,880

100%

30%

$ 154,000

123,200

100%

80%

Contribution margin

Fixed expenses

Net operating income

$ 258,720

70%

$ 30,800

20%

$ 246,400

135,520

$ 110,880

100%

55%

45%

$ 770,000

369,600

100%

48%

400,400

52%

226,720

$ 173,680

Dollar sales to break-even - Fixed expenses / CM ratio = $226,720/0.52 = $436,000

As shown by these data, net operating income is budgeted at $173,680 for the month and the estimated break-even sales is

$436,000.

Assume that actual sales for the month total $770,000 as planned; however, actual sales by product are: White, $246,400;

Fragrant, $308,000; and Loonzain, $215,600.

Required:

1. Prepare a contribution format income statement for the month based on the actual sales data.

2. Compute the break-even point in dollar sales for the month based on your actual data.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Quilcene Oysteria farms and sells oysters in the Pacific Northwest. The company harvested and sold 7,300 pounds of oysters in August. The company's flexible budget for August appears below: Actual pounds (q) Revenue ($4.15q) Expenses: Packing supplies ($0.35q) Oyster bed maintenance ($3,400) Wages and salaries ($2,400 + $0.40g) Shipping ($0.55q) Utilities ($1,240) Quilcene Oysteria Flexible Budget For the Month Ended August 31 Other ($470 + $0.01g) Total expenses Net operating income The actual results for August were as follows: Actual pounds Revenue Expenses: Quilcene Oysteria Income Statement For the Month Ended August 31 Packing supplies Oyster bed maintenance Wages and salaries Shipping Utilities Other Total expenses Net operating income 7,300 $ 30,295 2,555 3,400 5,320 4,015 1,240 543 17,073 $ 13,222 7,300 $ 27,000 2,725 3,260 5,730 3,745 1,050 1,163 17,673 $ 9,327arrow_forwardQuilcene Oysteria farms and sells oysters in the Pacific Northwest. The company harvested and sold 7,100 pounds of oysters in Augus The company's flexible budget for August appears below: Quilcene Oysteria Flexible Budget For the Month Ended August 31 Actual pounds (q) Revenue ($4.15q) Expenses: Packing supplies ($0.35q) Oyster bed maintenance ($3,100) Wages and salaries ($2,500 + $0.35q) Shipping ($0.55q) Utilities ($1,290) Other ($480 + $0.019) Total expense Net operating income The actual results for August appear below: Quilcene Oysteria Income Statement For the Month Ended August 31 7,100 $ 29,465 2,485 3,100 4,985 3,905 1,290 551 16,316 $ 13,149 Actual pounds 7,100 Revenue $ 27,000 Expenses: Packing supplies 2,655 Oyster bed maintenance 2,960 Wages and salaries 5,395 3,635 1,100 1,171 16,916 Shipping Utilities Other Total expense Net operating income. Required: $ 10,084 Calculate the company's revenue and spending variances for August. (Indicate the effect of each variance by…arrow_forwardRed Canyon T-shirt Company operates a chain of T-shirt shops in the southwestern United States. The sales manager has provided a sales forecast for the coming year, along with the following information: Quarter 1 Quarter 2 Quarter 3 Quarter 4 Budgeted unit sales 34,000 54,000 27,000 54,000 Each T-shirt is expected to sell for $18. The purchasing manager buys the T-shirts for $7 each. The company needs to have enough T-shirts on hand at the end of each quarter to fill 28 percent of the next quarter’s sales demand. Selling and administrative expenses are budgeted at $68,000 per quarter plus 14 percent of total sales revenue. Required:. Determine budgeted cost of merchandise purchased for quarters 1, 2, and 3.. Determine budgeted cost of good sold for quarters 1, 2, and 3.. Determine selling and administrative expenses for quarters 1, 2, and 3.. Complete the budgeted income statement for quarters 1, 2, and 3.arrow_forward

- Quilcene Oysteria farms and sells oysters in the Pacific Northwest. The company harvested and sold 7,300 pounds of oysters in August. The company's flexible budget for August appears below: Quilcene Oysteria Flexible Budget For the Month Ended August 31 Actual pounds (q) 7,300 Revenue ($4.20q) $ 30, 660 Expenses: Packing supplies ($0.40q) 2,920 Oyster bed maintenance ($3,100) 3, 100 Wages and salaries ($2,600 + $0.30q) 4,790 Shipping ($0.65q) 4,745 Utilities ( $1,200) 1,200 Other ($420 + $0.01q) 493 Total expense 17,248 Net operating income $ 13,412 The actual results for August appear below: Quilcene Oysteria Income Statement For the Month Ended August 31 Actual pounds 7,300 Revenue $ 27,400 Expenses: Packing supplies 3,090 Oyster bed maintenance 2,960 Wages and salaries 5,200 Shipping 4,475 Utilities 1,010 Other 1,113 Total expense 17,848 Net operating income $ 9,552 Required: Calculate the company' s revenue and spending variances for August. (Indicate the effect of each variance by…arrow_forwardSmithen Company, a wholesale distributor, has been operating for only a few months. The company sells three products-sinks, mirrors, and vanities. Budgeted sales by product and in total for the coming month are shown below based on planned unit sales as follows: Sinks Mirrors Vanities Total Percentage of total sales Sales Variable expenses Contribution margin unit Units Percentage 50% 600 300 300 1,200 Contribution margin per Fixed expenses Operating income 25% 25% 100% S Sinks 46% 319.99 $239,992.00 100% $157,200 100% $126,808.00 100% $524,000.00 100% 47,998.40 20% 125,760 80% 63,404.00 50% 237,162.40 45% $191,993.60 80% $ 31,440 20% $63,404.00 50% 286,837.60 55% Break-even point in sales dollars - Product Mirrors 30% S 104.80 Fixed expenses Overall CM ratio $248,050 $239.03* $248,050 0.55 Vanities 24% 1,037.73 units $ 211.35 Total 100% =$451,000 Break-even point in unit sales: Total Fixed expenses Weighted average CM per unit *($319.99 x 0.50) + ($104.80 x 0.25)+($211.35 × 0.25)…arrow_forwardGold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Percentage of total sales Sales Variable expenses Contribution margin Fixed expenses Net operating income White 48% $ 374,400 112,320 $ 262,080 Fragrant 20% 100% $ 156,000 30% 124,800 70% $ 31,200 Product 100% 80% 20% Loonzain 32% $ 249,600 137, 280 $ 112,320 100% 55% 45% Total 100% $ 780,000 374,400 405, 600 228,800 $ 176,800 Dollar sales to break-even = Fixed expenses ÷ CM ratio = $228,800 ÷ 0.52 = $440,000 As shown by these data, net operating income is budgeted at $176,800 for the month and the estimated break-even sales is $440,000. Assume actual sales for the month total $780,000 as planned; however, actual sales by product are White, $249,600; Fragrant, $312,000; and Loonzain, $218,400. Required: 1. Prepare a contribution format income statement for the month…arrow_forward

- Gold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Percentage of total sales Sales Variable expenses Contribution margin Fixed expenses Net operating income White 20% $ 150,000 108,000 $ 42,000 Fragrant 52% 100% $ 390,000 72% 28% $ 312,000 78,000 Required 1 Required 2 Product Loonzain 28% Complete this question by entering your answers in the tabs below. 100% $ 210,000 20% 84,000 80% $ 126,000 Required: 1. Prepare a contribution format income statement for the month based on the actual sales data. 2. Compute the break-even point in dollar sales for the month based on your actual data. 100% 40% 60% Tota 100% Dollar sales to break-even = Fixed expenses / CM ratio = $449,280 / 0.64 = $702,000 As shown by these data, net operating income is budgeted at $30,720 for the month and the estimated break-even sales is $702,000.…arrow_forwardRed Canyon T-shirt Company operates a chain of T-shirt shops in the southwestern United States. The sales manager has provided a sales forecast for the coming year, along with the following information: ● Quarter 1 Quarter 2 Quarter 3 Quarter 4 38,000 58,000 29,000 58,000 Budgeted unit sales Each T-shirt is expected to sell for $13. The purchasing manager buys the T-shirts for $5 each. The company needs to have enough T-shirts on hand at the end of each quarter to fill 23 percent of the next quarter's sales demand. Selling and administrative expenses are budgeted at $76,000 per quarter plus 18 percent of total sales revenue. Required: 1. Determine budgeted sales revenue for each quarter. 2. Determine budgeted cost of merchandise purchased for each quarter. 3. Determine budgeted cost of good sold for each quarter. 4. Determine selling and administrative expense for each quarter. 5. Complete the budgeted income statement for each quarter.arrow_forwardRed Canyon T-shirt Company operates a chain of T-shirt shops in the southwestern United States. The sales manager has provided a sales forecast for the coming year, along with the following information: Quarter 1 Quarter 2 Quarter 3 Quarter 4 Budgeted unit sales 40,000 60,000 30,000 60,000 Each T-shirt is expected to sell for $15. The purchasing manager buys the T-shirts for $6 each. The company needs to have enough T-shirts on hand at the end of each quarter to fill 25 percent of the next quarter’s sales demand. Selling and administrative expenses are budgeted at $80,000 per quarter plus 10 percent of total sales revenue. Required: Determine budgeted sales revenue for each quarter. Determine budgeted cost of merchandise purchased for each quarter. Determine budgeted cost of good sold for each quarter. Determine selling and administrative expense for each quarter. Complete the budgeted income statement for each quarter.arrow_forward

- Wongtien Electronics Corp. in Hong Kong, SAR, China, manufactures tablets, laptops and desktop PCs. Wongtien currently operates a standard absorption costing system. Budgeted information for next year is given below (currency in one thousand Hong Kong Dollars, HK$000): Products Tablets Laptops Desktop PCs Total Sales revenue 3,640 12,480 9,880 26,000 Direct material 800 2,800 2,200 5,800 Direct labor 300 1,200 800 2,300 Fixed production overheads 1,456 4,992 3,952 10,400 Gross profit 1,084 3,488 2,928 7,500 Fixed production overheads are currently absorbed based on a percentage of sales revenue. Wongtien is considering changing to an activity-based…arrow_forwardWongtien Electronics Corp. in Hong Kong, SAR, China, manufactures tablets, laptops and desktop PCs. Wongtien currently operates a standard absorption costing system. Budgeted information for next year is given below (currency in one thousand Hong Kong Dollars, HK$000): Products Tablets Laptops Desktop PCs Total Sales revenue 3,640 12,480 9,880 26,000 Direct material 800 2,800 2,200 5,800 Direct labor 300 1,200 800 2,300 Fixed production- overheads 1,456 4,992 3,952 10,400 Gross profit 1,084 3,488 2,928 7,500 Fixed production overheads are currently absorbed based on a percentage of sales revenue. Wongtien is considering changing to an…arrow_forwardToblerone Chocolate Company produces high quality chocolates and candles for sales throughout the world. It's budgeted production for ned year as Multiple Choice O 63,200 pounds First 10,000 62,400 pounds Quarter Production in units Four pounds of raw materials are required for each unit produced. Raw materials on hand at the start of the year total 4,000 pounds. The raw materials mventory at the end of each quarter should equal 10% of the next quarter's production needs. Budgeted purchases of raw materials in the third quarter would be: Second 12,000 Third 16,000 Fourth 14,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education