Concept explainers

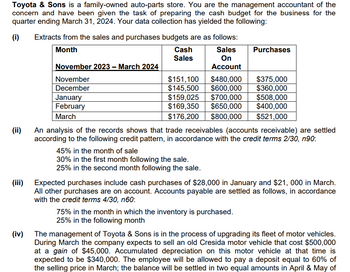

(ii) An analysis of the records shows that trade receivables (

according to the following credit pattern, in accordance with the credit terms 2/30, n90:

45% in the month of sale

30% in the first month following the sale.

25% in the second month following the sale.

(iii) Expected purchases include cash purchases of $28,000 in January and $21, 000 in March.

All other purchases are on account. Accounts payable are settled as follows, in accordance

with the credit terms 4/30, n60:

75% in the month in which the inventory is purchased.

25% in the following month

(iv) The management of Toyota & Sons is in the process of upgrading its fleet of motor vehicles.

During March the company expects to sell an old Cresida motor vehicle that cost $500,000

at a gain of $45,000.

expected to be $340,000. The employee will be allowed to pay a deposit equal to 60% of

the selling price in March; the balance will be settled in two equal amounts in April & May of

2024.

(v) An air conditioning unit, which is estimated to cost $300,000, will be purchased in February.

The manager has planned with the suppliers to make a cash deposit of 40% upon signing of

the agreement in February. The balance will be settled in four (4) equal monthly instalments

beginning March 2024.

(vi) A long-term bond purchased by Toyota & Sons 4 years ago, with a face value of $500,000

will mature on January 20, 2024. To meet the financial obligations of the business,

management has decided to liquidate the investment upon maturity. On that date quarterly

interest computed at a rate of 5½% per annum is also expected to be collected.

(vii) Fixed operating expenses which accrue evenly throughout the year, are estimated to be

$2,016,000 per annum, [including depreciation on non-current assets of $42,000 per month]

and are settled monthly.

(viii) Other operating expenses are expected to be $177,000 per quarter and are settled monthly.

(ix) The management of Toyota & Sons has negotiated with a tenant to rent office space to her

beginning February 1. The rental is $540,000 per annum. The first month’s rent along with

one month’s safety deposit is expected to be collected on February 1. Thereafter, monthly

rental income becomes due at the beginning of each month.

(x) Wages and salaries are expected to be $2,976,000 per annum and will be paid monthly.

(xi) As part of its investing activities, the management of Toyota & Sons has just concluded an

expansion project relating to the business’s storage facilities. The project required capital

outlay of $1,800,000 and was funded by a loan from a family member, who is a partner in

the business. $340,000 of the principal along with interest of $35,000 will become due and

payable in January 2024.

(xii) The cash balance on March 31, 2024, is expected to be an overdraft of $98,000.

Prepare/ answer with working:

(a) The business needs to have a sense of its future cashflows and therefore requires the

preparation of the following:

▪ A schedule of budgeted cash collections for trade receivables for each of the months

January to March.

▪ A schedule of expected cash disbursements for accounts payable for each of the months

January to March.

▪ A

expected cash receipts and payments for each month and the ending cash balance for each

of the three months, given that no financing activities took place.

(b) Another team member who is preparing the Budgeted

the same quarter and has asked you to furnish him with the figures for the expected trade

receivables and payables to be included in the statement. Is that a reasonable request? If

yes, what should these amounts be?

(c) Upon receipt of the budget, the team manager, Hilux James, has now informed you that, in

keeping with industry players, the management of Toyota & Sons have indicated an industry

requirement to maintain a minimum cash balance of $155,000 each month. He has also

noted that management is very keen on keeping the gearing ratio of the business as low as

possible and would therefore prefer to cushion any gaps internally using equity financing.

Based on the budget prepared, will the business be achieving this desired target? Suggest

three (3) internal strategies that may be employed by management to improve the

organization’s monthly

reflected in the budget prepared. Each strategy must be fully explained.

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 8 images

- A credit card balance at the beginning of November is $4,000. On Nov. 3 a $300 charge is made. On Nov. 8 a $1000 charge is made. On Nov. 15 a $900 payment is made. On Nov. 17 a $200 charge is made. On Nov. 21 a $800 charge is made. using the average daily balance method, Caculate the interest charged if the account has a 17.5% rate and the billing period is 30 days.arrow_forwardheridan Company had net credit sales during the year of $1047750 and cost of goods sold of $484000. The balance in accounts receivable at the beginning of the year was $110400 and at the end of the year was $143600. What was the accounts receivable turnover?arrow_forwardA company reports the following: Line Item Description Amount Sales $1,069,085 Average accounts receivable (net) 105,850 Determine (a) the accounts receivable turnover and (b) the days’ sales in receivables. When required, round your answers to one decimal place. Assume a 365-day year.arrow_forward

- Please help mearrow_forwardThe following information is available for Market, Incorporated and Supply, Incorporated at December 31: Accounts Market, Incorporated Supply, Incorporated $ 58,600 $ 79,600 Accounts receivable Allowance for doubtful accounts 3,148 Sales revenue 636,960 2,556 917,100 Required: 1. What is the accounts receivable turnover for each of the companies? 2. What is the average days to collect the receivables? 3. Assuming both companies use the percent of receivables allowance method, what is the estimated percentage of uncollectible accounts for each companyarrow_forwardMarie's Clothing Store had an accounts receivable balance of $410,000 at the beginning of the year and a year-end balance of $610,000. Net credit sales for the year totaled $3,000,000. The average collection period of the receivables was: (Round any intermediary calculations to two decimal places and your final answer to the nearest day) OA 74 days OB. 50 days OC. 12 days OD. 62 daysarrow_forward

- The financial statements of the Sunland Company report net sales of $384000 and accounts receivable of $50400 and $33600 at the beginning of the year and the end of the year, respectively. What is the average collection period for accounts receivable in days?arrow_forwardI Need help finding the number of days of sales.....arrow_forwardcompany reported credit sale of 6252900 and cost of goods sold of 3300000 for the year. the acconunt receivable balance at the beginning and end of the year were 516000 and 581000. receivables turnover ratio is 1. 10.8 2. 6.0 3. 11.4 4. 5.7arrow_forward

- Activity measures: m. Calculate the accounts receivable turnover and number of days' sales in accounts receivable (based on a 365-day year) for the most recent year. n. Based on your analysis in m, do you believe that the company is doing an effective job at managing accounts receivable? What would you estimate the industry averages to be for the accounts receivable turnover and number of days' sales in accounts receivable? Explain. o. Calculate the inventory turnover and number of days' sales in inventory (based on a 365-day year) for the most recent year. p. Based on your analysis in o, to what extent does the company need to be concerned about its inventory management policies? In assessing the inventory management policies, would you be more interested in knowing current ratio or acid-test ratio information? Explain.arrow_forwardAccounts receivable turnover and days’ sales in receivables Financial statement data for years ending December 31 for Schultze-Solutions Company follow: 20Y2 20Y1 Sales $1,848,000 $1,881,000 Accounts receivable: Beginning of year 195,300 184,700 End of year 224,700 195,300 a. Determine the accounts receivable turnover for 20Y2 and 20Y1. If required, round the final answers to one decimal place. AccountsReceivableTurnover 20Y2 fill in the blank 1 20Y1 fill in the blank 2 b. Determine the days’ sales in receivables for 20Y2 and 20Y1. Use 365 days, if required round the final answers to one decimal place. Days’ Salesin Receivables 20Y2 fill in the blank 3 days 20Y1 fill in the blank 4 days c. Does the change in accounts receivable turnover and the days’ sales in receivables from 20Y1 to 20Y2 indicate a favorable or unfavorable changearrow_forwardA recent annual report for FedEx contained the following data: Numerator Denominator Numerator Denominator (dollars in thousands) Accounts receivable Less: Allowances Net accounts receivable Net sales (assume all on credit) Required: 1. Determine the receivables turnover ratio and average days sales in receivables for the current year. Note: Use 365 days a year. Enter your answers in thousands not in dollars. Current Year $ 9,416,000 293,000 $9,123,000 $ 69,703,000 Receivables Turnover Ratio Net sales Average net trade accounts receivable Receivables turnover Average Days Sales in Receivables 365 Previous Year $ 88,452,000 397,000 $ 88,055,000 365 1.43 0 times 255.24 daysarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education