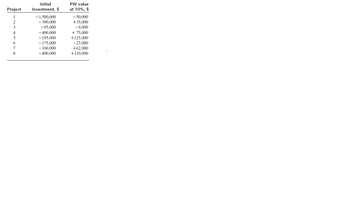

Eight projects are available for selection at Hum-Vee Motors. The listed PW values are

determined at the corporate MARR of 10% per year and rounded to the nearest $1000. Project

lives vary from 5 to 15 years. (Please see figure attached)

Project selection guidelines:

1. No more than $400,000 in investment capital is available.

2. No negative PW project may be selected.

3. At least one project, but no more than three, must be selected.

4. The following selection restrictions apply to specific projects:

• Project 4 can be selected only if project 1 is selected.

• Projects 1 and 2 are duplicative; don’t select both.

• Projects 8 and 4 are also duplicative.

• Project 7 requires that project 2 also be selected.

(a) Identify the viable project bundles and select the best economically justified projects. What is

the investment assumption for any remaining capital funds?

(b) If as much of the $400,000 as possible must be invested, use the same restrictions and

determine the project(s) to select. Is this a viable second choice for investing the $400,000?

Why?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- The estimated negative cash flows for three design alternatives are shown below. The MARR is 10% per year and the study period is four years. Which alternative is best based on the IRR method? Doing nothing is not an option. Capital investment Annual expenses OA. Alternative B OB. Alternative C OC. Alternative A EOY 0 1-4 A $85,700 8,500 Alternative B $64,500 Which alternative would you choose as a base one? Choose the correct answer below. 15,150 C $71,900 12,450arrow_forwardCould you please tell me answer to this question, a circled or highlighted answer would be appreciated, thank you.arrow_forwardCompare the alternatives below on the basis of their capitalized costs. Assume the MARR is 10% per year, compounded annually Project A Project B Project C First cost ($200,000) ($275,000) ($800,000) Annual income $60,000 $70,000 $80,000 Salvage value $40,000 $60,000 $500,000 Life, years 4 7 infinityarrow_forward

- Q4. The cash flow details of a public project is as follows = BD 250000 Initial cost /investment Annual benefits/revenues = BD 120000 Worth of annual cost Salvage value Interest rate per year 8% and useful lie 30 Years Use the three project evaluation methods( PW, FW, AW) = BD 12,000 = BD 150000arrow_forwardA city tnat operates automobile parking facilities is evaluating a proposal to erect and operate a structure for parking in its downtown area. Three designs for a facility to be built on available sites have been identified as follows, where all dollar figures are in thousands: Design A Design B Design C Cost of site $240 $180 $200 Cost of building $2,200 $700 $1,400 Annual fee collection $830 $750 $600 Annual maintenance cost $410 $360 $310 Service life 30 years 30 years 30 years At the end of the estimated service life, the selected facility would be torn down and the land would be sold. It is estimated that the proceeds from the resale of the land will be equal to the cost of clearing the site. If the city's interest rate is known to be 10%, which design alternative would be selected on the basis of the benefit-cost criterion?arrow_forwardThe following estimates (in $1000 units) have been developed for a new cybersecurity system at Chicago's O'Hare Airport. Calculate the conventional B/C ratio at a discount rate of 10% per year. First cost, $ AW of benefits, $ per year FW (in year 20) of disbenefits, $ M&O costs, $ per year Expected life, years O 1.21 <1.15 1.52 O 1.91 DOCUMENT.pdf 13,000 3,800 6,750 400 20arrow_forward

- Problem 05.024 Alternative Comparison - Different Lives You and your partner have become very interested in cross-country motorcycle racing and wish to purchase entry-level equipment. You have identified two alternative sets of equipment and gear. Package K has a first cost of $250,000, an operating cost of $5,500 per quarter, and a salvage value of $30,000 after its 2-year life. Package L has a first cost of $170,000 with a lower operating cost of $3,500 per quarter and an estimated $25,000 salvage value after its 4-year life. Which package offers the lower present worth analysis at an interest rate of 8% per year, compounded quarterly? The present worth of package K is $[ and that of package L is $[ (Click to select) offers the lower present worth.arrow_forwardWhich of the following interpretations would be best for the scenario analysis results shown below? Worst- case PW (18%) -$650,000 IRR 2.10% Most- likely case Best-case $58,000 $2,660,000 33% 14.60% a. Since the most-likely case has a PW <0, the project should be abandoned immediately b. Since the worst-case has a negative present worth, this project must be rejected. c. Since the average of the three cases is a positive present worth, the project is acceptable. d. Because only one of the scenarios shows the project as profitable, the project should be considered very risky, and, if accepted, should be subject to greater scrutiny in its planning and forecasting.arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education