Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

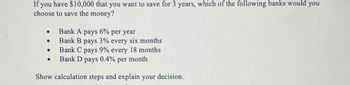

Transcribed Image Text:If you have $10,000 that you want to save for 3 years, which of the following banks would you

choose to save the money?

Bank A pays 6% per year

Bank B pays 3% every six months

Bank C pays 9% every 18 months

per month

Bank D pays 0.4%

Show calculation steps and explain your decision.

●

●

●

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Question 8 You want to be able to withdraw $50,000 each year for 15 years. Your account earns 7% interest. a) How much do you need in your account at the beginning? b) How much total money will you pull out of the account? c) How much of that money is interest?arrow_forwardDo not give answer in image and hand writingarrow_forwardQUESTION 5 You wish to have $4,000 in 2 years to purchase a new entertainment system. How much money (to the nearest dollar) should you deposit each quarter into an account paying 8% compounded quarterly? Summarize the information provided, stating the interest rate in a decimal form. PN = 4000 r = 0.08 N = 2 k = 4 Identify the formula you will to solve by writing the letter of the formula here: use A. A=P.(1+rt) В. P. = P.1+ rNk 1+ С. PN = D. P. -[1+ Solve the problem and give your answer here:arrow_forward

- Help plsarrow_forwardPlease show all work for 5 & 6arrow_forwardA Moving to another question will save this response. Question 9 How much less is a perpetuity of $2,000 worth than an annuity due of the same amount for 30 payments (in $ dollars)? Assume an interest rate of 1096. $ A Moving to another question will save this response. search F2 F3 F4 F5 F6 F7 F8 F9 F10 F11 F12 Home Enc 41I & 5 6 8. W R Y D F G H J. Karrow_forward

- A 1. pla help intrest ratesarrow_forwardquestion 2arrow_forwardSub : FinancePls answer very faast.I ll upvote. Thank You Bobbie has $6,000 that she wants to invest today to grow into $50,000. She finds an investment that earns 8.5% with quarterly compounds. How many years will she wait till she has the $50,000? Group of answer choices 25.99 years 28.00 years 25.21 years 100.83 year Please answer using excel function for NPERarrow_forward

- Please don't give image format and no chatgpt answerarrow_forwardHi I need the answer to this question Thanksarrow_forward< CO T R E # 3 Problem Set 1: Finance Progr Score: 19.8/50 8/20 answered Question 15 You want to be able to withdraw $35,000 from your account each year for 25 years after you retire. You expect to retire in 15 years. If your account earns 6% interest, how much will you need to deposit each year until retirement to achieve your retirement goals? 24 Question Help: D Video Submit Question MacBook Air 08 F3 DD F2 F4 F5 F8 & $ 2 5. Marrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education