Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Question A

.

Full explain this question and text typing work only

We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this line

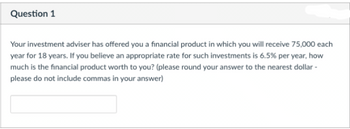

Transcribed Image Text:Question 1

Your investment adviser has offered you a financial product in which you will receive 75,000 each

year for 18 years. If you believe an appropriate rate for such investments is 6.5% per year, how

much is the financial product worth to you? (please round your answer to the nearest dollar -

please do not include commas in your answer)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I am struggling with the question listed below.arrow_forwardQuestion Z Short Answer (2 sentences or less) What are 3 benefits of reducing a client’s AGI? I. II. III. Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forwardHow to solve this?arrow_forward

- Question Z Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forwardnot use ai pleasearrow_forwardO Zoom Meeting You are viewing Rinki Maheshwari's screen View Options - Original Sound: Off * View DzL Chapter 6- Marginal costing x O Post Attendee - Zoom M Inbox (2,520) - rinkimahesh x O Dashboard - TimeClockWiz x O Managerial Accounting.pdf x O Dashboard - Instructor + i eastwestcollege.brightspace.com/d21/le/content/7747/viewContent/28312/View Error Prepared by- Aradhana Khera 4. From the following information, find out sales at BEP in units. Variable cost per unit = $15 Sales per unit = $20 Fixed expenses = $54,000 Solution- Contribution per unit = SP per unit - VC per unit= 20-15= $5 BEP IN UNITS = FC/CONTRIBUTION PER UNIT = 54000/5 ull Rinki Maheshwari = 10,800 UNITS 5. Calculate (i) BEP, and (ii) Margin of Safety based on the following information: Sales = $100,000 Total cost = $80,000 Fixed cost = $20,000 Net profit = 80,000 A Download A Print • 24 Leave Unmute Start Video Participants Chat Share Screen Record Reactions ENG 10:16 AM 令中 28 2022-03-04 USarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardes Exercise 4-8A (Static) Which of the following is true about fringe benefits? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wro answer. Any boxes left with a question mark will be automatically graded as incorrect.) ?They are only available for employees and their families. ? The amount of the fringe benefit is never subject to income tax. ?They represent additional cash paid directly to employees. ?They represent additional compensation given for services performed. ‒‒ Q Search Oarrow_forwardi need the answer quicklyarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education