Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

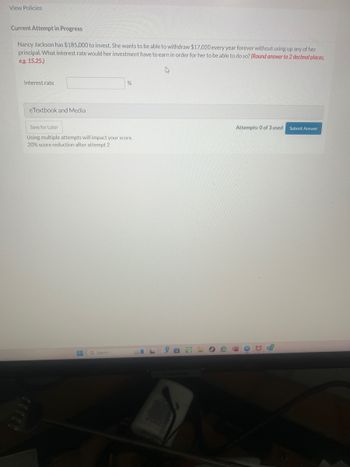

Transcribed Image Text:View Policies

Current Attempt in Progress

Nancy Jackson has $185,000 to invest. She wants to be able to withdraw $17,020 every year forever without using up any of her

principal. What interest rate would her investment have to earn in order for her to be able to do so? (Round answer to 2 decimal places,

e.g. 15.25.)

Interest rate

eTextbook and Media

%

Save for Later

Using multiple attempts will impact your score.

20% score reduction after attempt 2

Search

ما

Attempts: 0 of 3 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- solve practice problemarrow_forwardSaving Later Plan 2: Invest $350 at the end of each month into an account paying 7.5% compounded monthly for 15 years then leave the money in the account earning interest until retirement (making no additional withdrawals or investments until retirement). Using the assumptions above, write down your answer to each of the following questions. 19. Create the following table of values for this investment plan. Saving Later Plan 2, tuho table should be handwritten) to find the amount available after 15 years. Write N/A next to any variable that does not apply and write Solve next to the appropriate varlable. P%3D r = A = M = n = 20. Indicate the best formula to use to compute the amount available after 15 years. 21. Substitute the values into the formula and compute how much money will be available after 15 years.arrow_forwardMansukh Don't upload image pleasearrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardV A ALEKS-Harley Biltoc - Learn O Exponential and Logarithmic Functions Finding the present value of an investment earning compound interest www-awu.aleks.com $ myPascoConnect Ć 0/5 Portal Harley Lena is going to invest to help with a down payment on a home. How much would she have to invest to have $46,900 after 9 years, assuming an interest rate of 1.65% compounded annually? Do not round any intermediate computations, and round your final answer to the nearest dollar. If necessary, refer to the list of financial formulas.arrow_forwardework - 3 attempts You want to buy a house in 5 years and expect to need $25000 for a down payment. If you have $14000 to invest, how much interest do you have to earn (compounded annually) to reach your goal? (Enter your answers as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0.0843 instead of 8.43%) 0:arrow_forward

- Sub : FinancePls answer very faast.I ll upvote. Thank You Bobbie has $6,000 that she wants to invest today to grow into $50,000. She finds an investment that earns 8.5% with quarterly compounds. How many years will she wait till she has the $50,000? Group of answer choices 25.99 years 28.00 years 25.21 years 100.83 year Please answer using excel function for NPERarrow_forwardQno5 need only fastarrow_forwarddont uplode any imagesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education