Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

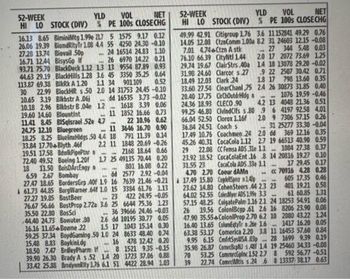

Transcribed Image Text:YLD

NET

VOL

PE 100s CLOSECHG

BiminiMtg 1.99e 217 5 1575 9.17 0.12

BiomdRityTr 1.08 4.4 55 4250 24.30 -0.10

24 16514 24.83 1.10

WE

Biovail 50p

BisysGp If

BlackDeck 1.12

26

6970 14.22 0.21

***

1.3 13

9554 87.89 0.93

BlackHills 1.28

BikRk A 1.20

3.6 45

3350 35.25 0.64

0.52

901109

BlockHRs.50 2.0 14 31753 24.45 -0.10

1.1 34

dd 16535 3.73 -0.02

52-WEEK

HI LO STOCK (DIV)

16.13 8.65

26.06 19.39

27.28 13.74

16.71 12.44

93.71 75.70

44.63 29.19

113.87 69.38

30 22.99

10.65 3.19 Bikbstr A.06)

10.18 2.96 Blkbstr B.04e

19.60 14.60 Blountint

W

11.41 8.45 BISqlsrael 52e 4.7

Bluegreen

24.75 12.10

11

www

18.25 8.25 BluelinHidgs 50 4.4 18

33.84 17.704Blyth .46f

2.2 11

19.51 17.58 BdwikPipePtar

72.40 49.52

18 11.50

A

1.2

1618 3.39 0.06

1852 16.66 0.73

22 10.96 0.62

3646 16.70 0.90

791 11.39 0.14

1848 20.69 -0.26

2168 18.64 0.66

1.7 25 49135 70.44 0.20

ww

www. ***

6.59 2.67

dd

***

Boeing 1.20f

BoisDArcEngy n

Bombay

BordersGrp 40f 19 16

BorgWarner 641 1.0 15

27.27 19.85 BostBeer

23 422 24.95 -0.05

76.67 56.66 BostProp 2.72a 3.6 25 6644 75.36 1.23

35.50 22.80 BosSci

27.47 18.65

61.73 44.35

801 16.08 0.22

2577 2.92-0.04

7639 21.46 -0.21

3384 61.76 1.13

M

44.40 24.73 Bowater 30

16.16 11.65+Bowne .22

59.25 37.34 BoydGaming.50 10 24

15.48 8.83 Boykini dg

18.50 7.47 BrdleyPharm If 8

39.90 26.30 Brady A s.52 14 20

33.42 25.38 BrodyanRity 1.75 6.1 51

36 39666 24.46 -0.03

2.6 dd 10195 30.77 0.05

1.5 1043 15.14 0.30

8633 48.40 0.74

478 12.42 0.20

1521 9.35 -0.15

1723 37.06 0.88

4422 28.94 1.03

16

11

52-WEEK

HI LO STOCK (DIV)

49.99 42.91

14.05 12.08

7.01 4.74

76.10 66.39

29.74 19.67

31.98 24.60

18.49 12.03

33.60 27.54

20.40 17.75

24.36 18.93

YLD

VOL

NET

PE 100s CLOSECHG

-

CityNtl 1.44

ClairStrs 40a

Clarcor s 27

Clark .24

ClearChanl ,75

CrChOutdrHidg a

CLECO .90

ClvindCifs s.80

Clorox 1.16f

Coach s

Coachmen .24

CocaCola 1.12

CC Femsa ADS 31e 1.1

Citigroup 1.76 3.6 11152841 49.29 0.76

(tznComm 1.00a 8.2 31 24603 12.15 -0.08

Ctzn A stk

27 344 5.48 0.03

2.0 17 2072 73.69 1.25

14 18 13078 29.20 -0.02

9 22 2507 30.42 0.71

18 17 798 13.60 0.35

24 26 30873 31.85 0.40

1076 19.59-0.46

42 13 4043 21.36 0.51

9 6 4197 92.58 4.01

2.0 9 7306 57.15 0.26

31 25277 33.30 -0.04

2.0 dd 369 12.16 0.35

27 19 66513 40.90 0.59

1084 27.38 0.37

CocaColaEnt 16 8 14 20816 19.27 0.10

CocaCola ADS.33e 11

-

17 29.45 0.17

99.25 46.80

66.04 52.50

36.84 24.51

17.49 10.76

45.26 40.31

29 22.08

23.92 18.52

31.55 23

-

4.70 2.70

17.49 15.80

1

Coeur dAMn cc 70916 4.28 0.28

CogdellSpnar n1.40p

605 17.35 0.46

23.62 14.80 CohenSteers 44 23 23 401 19.21 0.58

61 60.85 1.31

64.02 52.55 Coleslyer ADS 1.99 3.3

57.15 48.25 ColgatePalm 1.16 2.1 24 18253 54.91 0.06

26 19.56 ColonlBcgp.61 26 16 8206 23.90 0.08

47.90 35.55+ColonlProp 2.70 6.2 10 2080 43.22

16.40 13.65 ColumEgtyle n.26e 1.6

1.24

1417 16.20 0.05

H

63.38 53.17 Comerica 2.20 3.8 11 16453 57.60 0.84

9.95 6.15 CmfitSysUSA.03p 28 1699 9.39 0.19

35.98 26.87 ComicBpN s A8f 14 19 25460 34.33 -0.08

70 53.25 CommrcGplnc 1.52 2.7

39 22.74 ComeciMtis s.24 6

8 592 56.77 -0.51

8 13337/38.17 0.63

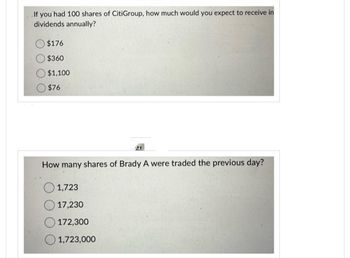

Transcribed Image Text:If you had 100 shares of CitiGroup, how much would you expect to receive in

dividends annually?

$176

$360

$1,100

$76

How many shares of Brady A were traded the previous day?

1,723

17,230

172,300

1,723,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Question 1: Suppose you own 100 shares of General Motors stock, and the company earned $6 per share during the last reporting period. Suppose also that GM could either pay all of its earnings out as dividends (in which case you would receive $600) or retain the earnings in the business, buy more assets, and cause the price of the stock to increase by $6 per share (in which case the value of your stock would rise by $600). a. How would the tax laws influence what you, as a typical stockholder, would want the company to do? b. Would your choice be influenced by how much other income you had? Why might the desires of a 35-year-old doctor differ with respect to corporate dividend policy from the desires of a retiree living on a small income? c. How might the corporation’s decision with regard to the dividends it pays influence the price of its stock?arrow_forwardYou purchased 400 ordinary shares of GE Corporation at $60 per share. The initial margin is 60%. What is your initial equity in this investment? Select one: $12,000 $14,400 $14,800 $15,600 $12,800 Give typing answer with explanation and conclusionarrow_forwardWhat is the total annual dividend received from owning 100 shares of stock A, if Company A issues a $0.20 quarterly dividend to its shareholders? total annual dividend = [ ? ] Round to the nearest hundredth. Enterarrow_forward

- Six months ago, you purchased 3,000 shares of ABC stock for $47.06 a share. You have received dividend payments equal to $0.80 a share. Today, you sold all of your shares for $49.74 a share. What is your total dollar return on this investment? $2,400 $10,050 $8,040 $10,440 $20,880arrow_forward34arrow_forwardYou purchased 500 shares of stock at $27.00 per share. Later that stock paid a $3.00 per share dividend. What was your return for the year? purchased 500 shares of stock Per share 27,00 Later the stock paid 3.00arrow_forward

- You own 350 shares of Maslyn Tours stock that sells for $52.48 per share. If the stock has a dividend yield of 2.4 percent, how much do you expect to receive next year in dividend income from this investment? Multiple Choice $468.38 $489.81 $429.35 $455.53 $440.83arrow_forwardQ9 You invested $7500 of your own money and borrowed $7500 from your broker to purchase shares of a company trading at a share price of $2. You paid 10% interest on your borrowed money for one year. You sold the stock one year later for $1.28. How much money in total did you lose on this transaction including the interest you paid?arrow_forwardklp.4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education