Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Q8

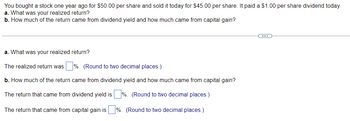

Transcribed Image Text:You bought a stock one year ago for $50.00 per share and sold it today for $45.00 per share. It paid a $1.00 per share dividend today.

a. What was your realized return?

b. How much of the return came from dividend yield and how much came from capital gain?

a. What was your realized return?

The realized return was%. (Round to two decimal places.)

b. How much of the return came from dividend yield and how much came from capital gain?

The return that came from dividend yield is%. (Round to two decimal places.)

The return that came from capital gain is %. (Round to two decimal places.)

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 3:43 اليوم e 12:34 تحریر Problem 7 Illustrate which of the following sentences is true or false: ve 95% the following sentearrow_forwardPlease Introduction and explanation no plagiarism pleasearrow_forwardSohr Corporation processes sugar beets that it purchases from farmers. Sugar beets are processed in batches. A batch of sugar beets costs $51 to buy from farmers and $10 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $21 or processed further for $11 to make the end product industrial fiber that is sold for $59. The beet juice can be sold as is for $42 or processed further for $24 to make the end product refined sugar that is sold for $59. How much profit (loss) does the company make by processing one batch of sugar beets into the end products industrial fiber and refined sugar? Multiple Choice O $(4) $8arrow_forward

- Find v in question c and find c in question darrow_forwardHow to solve:S= 1/1.06[1-1/(1.06)^20]/1-1/1.06arrow_forwardACC 10 X McGraw-Hill Edu Xx 3:05 C ezto.mheducation.com/ext/map/index.html?_con=con&ext... Q d Applicati.... WP WileyPLUS B Bloomberg for Edu... Frontline - Sign In R myRutgers Portal Multiple Choice $800,000. $1,200,000. $480,000. Question 10 - EX Forrester Company is considering buying new equipment that would decrease monthly fixed costs from $360,000 to $360,000 and would decrease the current variable costs of $70 by $10 per unit. The selling price of $100 is not expected to change. Forrester's current break-even sales are $1,200,000 and current break-even units are 12,000. If Forrester purchases this new equipment, the revised break-even point in dollars would be: $1,500,000. Save & Exit ☐ B Submit X : >>>arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education