FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

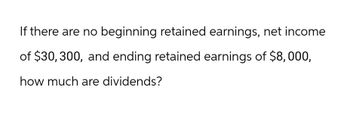

Transcribed Image Text:If there are no beginning retained earnings, net income

of $30, 300, and ending retained earnings of $8,000,

how much are dividends?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- which of the following transactions and events would result in an improvement in Dividends per share ?A. acquiring cash proceeds from a 5-year interest-only bank loan. B. The recognition of income tax expense owing at the end of the periodC. the receipt of cash for dividends from other entities (increase financing cash flow)A and B onlyA and C onlyB and C onlyAll of the aboveNone of the abovearrow_forwardd) A company has current assets of $560,000 and current liabilities of $233,000. The board of directors declares a cash dividend of $169,000. What is the current ratio after the declaration but before payment? What is the current ratio after the payment of the dividend? (Round answers to 2 decimal places, e.g. 2.50.) Current ratio after the declaration but before payment enter the ratio rounded to 2 decimal places :1 Current ratio after the payment of the dividend enter the ratio rounded to 2 decimal places :1arrow_forwardIf a companys assets decreased $50,000 and it's liabilites decreased $90,000, how much does the stockholders equity increase or decrease? Please explain why as well. Thank you!arrow_forward

- For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that the change in total assets must agree with the change in total equity. How would I complete the table?arrow_forwardShould $1,300 dividends be subtracted in the statement of retained earnings?arrow_forward#4 In looking at the ABC Company, you find that they reported net income of They had incurred cost of goods sold in the amount of There were cash dividends paid in the amount of The common shares outstanding at the time were What were the addition to Retained Earnings? $456,897 $102,954 $235,678 $100,000arrow_forward

- How did retained earnings become 5,900?arrow_forwardIf a company receives $12,600 from a stockholder, the effect on the accounting equation would be: Multiple Choice Assets decrease $12,600 and equity decreases $12,600. Assets increase $12,600 and liabilities decrease $12,60. Assets increase $12,600 and liabilities increase $12,600, Liabilities increase $12,600 and equity decreases $12,600. Assets increase $12,600 and equity increases $12,600. Type here to searcharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education