FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

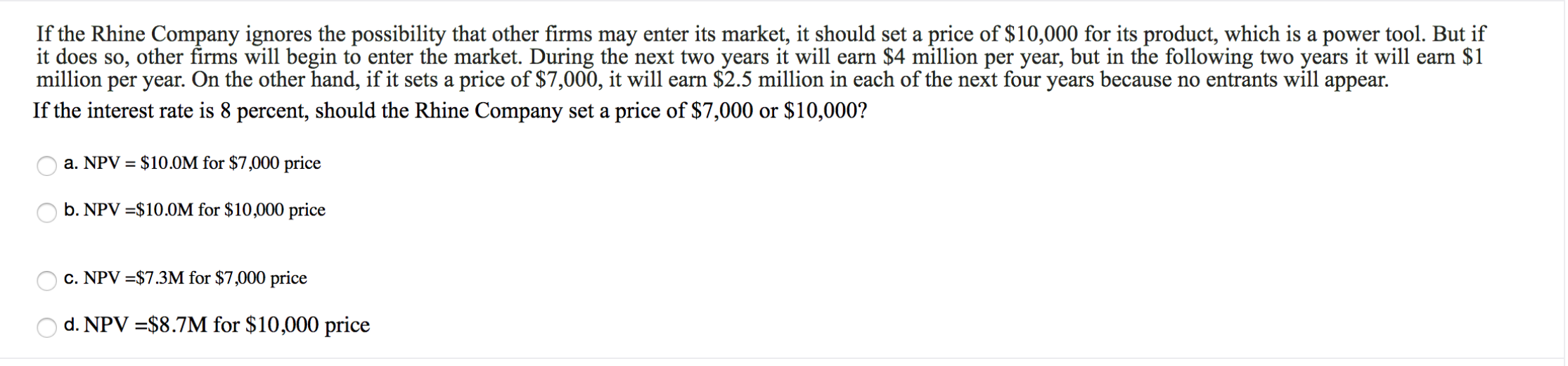

Transcribed Image Text:If the Rhine Company ignores the possibility that other firms may enter its market, it should set a price of $10,000 for its product, which is a power tool. But if

it does so, other firms will begin to enter the market. During the next two years it will earn $4 million per year, but in the following two years it will earn $1

million per year. On the other hand, if it sets a price of $7,000, it will earn $2.5 million in each of the next four years because no entrants will appear.

If the interest rate is 8 percent, should the Rhine Company set a price of $7,000 or $10,000?

a. NPV $10.0M for $7,000 price

b. NPV $10.0M for $10,000 price

c. NPV $7.3M for $7,000 price

d. NPV $8.7M for $10,000 price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- BioTech needs to sell crude oil in six months. The management has estimated that the firm would go bankrupt if the price of oil were to decrease to $60 per barrel. The current price of oil is $75 per barrel. The firm’s chief financial officer believes that the price of gold will either rise to $100 or fall to $50 a barrel over the next six months. Management wishes to eliminate any risk of the firm going bankrupt. BioTech can borrow and lend at the risk-free effective annual rate of 8.00 percent. Should the company buy a call option or a put option on crude oil? To avoid bankruptcy and to minimize the cost of hedging, what strike price and time to expiration would the company like this option to have? Explain.arrow_forwardplease help mearrow_forwardA US multinational corporation has operations in Bolivia through which it plans to sell a new product of 500,000 cans of beans per year for the next 3 years, at a price of BOB 4 per can after incurring a variable cost of BOB 2.50 per can. The company will also incur a fixed cost of BOB 120,000 per year. The company has invested BOB 900,000 today in manufacturing equipment for its Bolivian operations, which will be depreciated at $300,000 annually over its 3-year life. The corporation's required rate of return (WACC) is 20% and has a tax rate of 25%. The spot rate was BOB 6.91/$ before it unexpectedly changed to BOB 7.25/$. What is the value of the Bolivian operations prior to the unexpected change in the spot rate assuming that the operations have a 3-year life only? (round to the nearest dollar) US$237,699 US$107,453 US$159,076 88 US$166,903arrow_forward

- Poisson Calculators has found that it is indifferent between purchasing a high-capacity vacuum component assembly machine or a lower capacity machine as long as sales are above 1,900 units per month. The price of each calculator is $70. The high-capacity machine has cash expenses of $100,000 per month and depreciation and amortisation expenses of $30,000 per month, while the alternative has cash expenses of $30,000 per month and depreciation and amortisation expenses of $5,000 per month. Under the low-capacity alternative, variable costs per unit are $60. If the company bases its decisions on the Accounting Operating Profit Break-even, then what is the variable cost per unit under the high-capacity alternative? a. $10 b. $47 c. $60 d. $70arrow_forwardFountain Corporation’s economists estimate that a good business environment and a bad business environment are equally likely for the coming year. The managers of the company must choose between two mutually exclusive projects. Assume that the project the company chooses will be the firm’s only activity and that the firm will close one year from today. The company is obligated to make a $5,300 payment to bondholders at the end of the year. The projects have the same systematic risk but different volatilities. Consider the following information pertaining to the two projects: Economy Probability Low-Volatility Project Payoff High-Volatility Project Payoff Bad .50 $ 5,300 $ 4,700 Good .50 6,400 7,000 a. What is the expected value of the company if the low-volatility project is undertaken? The high-volatility project? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) b. What is the expected value of the…arrow_forwardAs part of their investment strategy, the Carringtons have decided to put $100,000 into stock market investments and also into purchasing precious metals. The performance of the investments depends on the state of the economy in the next year. In an expanding economy, it is expected that their stock market investment will outperform their investment in precious metals, whereas an economic recession will have precisely the opposite effect. Suppose the following payoff matrix gives the expected percentage increase or decrease in the value of each investment for each state of the economy. Stock market investment Commodity investment Expanding Economic economy recession -10t 10 commodities 15 5 (a) Determine the optimal investment strategy for the Carringtons' investment of $100,000. (Round your answers to the nearest dollar.) stocks $ $ PRACTICE ANOTHER (b) What profit can the Carringtons expect to make on their investments over the year if they use their optimal investment strategy?…arrow_forward

- Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell 42,700 units a year at a price of $64 each. If the new product is a bust, only 22,200 units can be sold at a price of $41. The variable cost of each ball is $27 and fixed costs are zero. The cost of the manufacturing equipment is $5.92 million, and the project life is estimated at 9 years. The firm will use straight-line depreciation over the 9-year life of the project. The firm's tax rate is 35% and the discount rate is 13%. Now suppose that Hit or Miss Sports can expand production if the project is successful. By paying its workers overtime, it can increase production by 20,100 units; the variable cost of each ball will be higher, equal to $32 per unit. By how much does this option to expand production increase the NPV of the project? Assume that the firm decides whether to expand production after it learns the first-year sales results. (Round…arrow_forwardI need help with this question please! Thank youarrow_forwardYou are considering adding a new product to one of your firm’s existing product lines which will generate an additional $200,000 in sales per year and will have a margin of 50% (same as the existing group margin). This will entail an increase in Net Working Capital of $10,000 and an investment in property, plant, and equipment of $50,000 per year. Assuming the company pays no tax and any depreciation in that year is negligible, the annual change in Unlevered Free Cash Flows resulting from the addition of the product is: a $40,000 b $50,000 c $90,000 d $100,000 e $10,000arrow_forward

- You are contemplating the replacement of an old printing machine with a new model costing $63,000. The old machine, which originally cost $40,000, has 6 years of expected life remaining and the current book value of $14,000 versus the current market value of $21,000. The firm's corporate tax rate is 24 percent. If the company sells the old machine at the market value, what is the initial after-tax cash outlay for the new printing machine purchase?arrow_forwardJ&R Construction Company is an international conglomerate with a real estate division that owns the right to erect an office building on a parcel of land in downtown Sacramento over the next year. This building would cost $40 million to construct. Due to low demand for office space in the downtown area, such a building is worth approximately $38 million today. If demand increases, the building would be worth $42.3 million a year from today. If demand decreases, the same office building would be worth only $35 million in a year. The company can borrow and lend at the risk-free annual effective rate of 5.5 percent. A local competitor in the real estate business has recently offered $821,000 for the right to build an office building on the land. What is the value of the office building today? Use the two-state model to value the real option. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education