FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

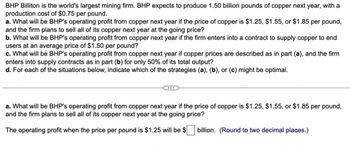

Transcribed Image Text:BHP Billiton is the world's largest mining firm. BHP expects to produce 1.50 billion pounds of copper next year, with a

production cost of $0.75 per pound.

a. What will be BHP's operating profit from copper next year if the price of copper is $1.25, $1.55, or $1.85 per pound,

and the firm plans to sell all of its copper next year at the going price?

b. What will be BHP's operating profit from copper next year if the firm enters into a contract to supply copper to end

users at an average price of $1.50 per pound?

c. What will be BHP's operating profit from copper next year if copper prices are described as in part (a), and the firm

enters into supply contracts as in part (b) for only 50% of its total output?

d. For each of the situations below, indicate which of the strategies (a), (b), or (c) might be optimal.

a. What will be BHP's operating profit from copper next year if the price of copper is $1.25, $1.55, or $1.85 per pound,

and the firm plans to sell all of its copper next year at the going price?

The operating profit when the price per pound is $1.25 will be $ ☐ billion. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Company ABC invests in a long-term project that will start generating cash flows 10 years from now (and will then continue generating cash flows forever). The first cash flow is going to be equal to $22 million. Cash flows will then grow 2% per year forever. If the project costs $460 million today, is it a good investment if interest rates are (and are going to be forever) equal to 5%?arrow_forwardTannen Industries is considering an expansion. The necessary equipment would be purchased for $12 million, and the expansion would require an additional $3 million investment in net operating working capital. The tax rate is 40%. What is the initial investment outlay? Write out your answer completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar. Enter your answer as a positive value.$arrow_forward10arrow_forward

- Anadarko Petroleum must choose between two mutually exclusive oil-drilling projects, which each have a cost of $12 million. Under Plan A, all oil would be extracted in one year, producing a cash flow at t=1 of $14.6 million. Under Plan B, cash flows would be $2.1 million for 20 years. The firm's WACC is 12%. At what rate are the NPVs for these two plans the same? That is, what is the crossover rate where the two projects' NPVs are equal?Your answer should be between 12.25 and 17.15, rounded to 2 decimal places, with no special characters.arrow_forwardAl_Tech plc is considering investing in a new company, New_tech plc. It has estimated that the new tech company will cost £440,000. Cash flows from increased sales will be £160,000 in the first year. These cash flows will increase by 5% every year. Al_Tech plc estimates that New_tech plc will lose all its technological advantages in five years from now and will lose all its value. Assume that the initial cost is paid now, and all the revenues are received at the end of each year. The company requires a 12% p.a. return for such an investment. a) Calculate the NPV of the investment project. b) Calculate the profitability index and the discounted payback period. c) Should Al_Tech plc consider investing in New_tech plc? What can you say about the internal rate of return to that project? Explain. d) Explain why it is theoretically correct to assume that accepting a project with a positive NPV should increase the value of a company by the NPV of the project.arrow_forwardABC mines copper with fixed costs of $0.50/lb and variable cost of $0.40/lb. The 1-year forward price of copper is $1/lb. The 1-year continuously compounded interest rate is 6%. If ABC does nothing to hedge copper price risk, what is its profit 1 year from now (per pound of copper)? If, on the other hand, ABC sells forward its expected copper production, what is its estimated 1-yearprofit from now? In both scenarios, assume the spot price of copper in 1 year can be $0.80, $0.90, $1.00, $1.10, and $1.20. 2) Compute ABC’s estimated profit in 1 year if it buys a put option with a strike of $1.00 and a premium of $0.04. Assume the spot price of copper in 1 year can be $0.80, $0.90, $1.00, $1.10, and $1.20.arrow_forward

- Atech Industries has initial resources of 150 million USD. Optimal operation requires an investment of 200 million USD. The firm must raise 50 million USD additional capital borrowing from the markets. Management projects 200 million USD investment (Optimal time 1 investment required) will generate 330 million USD cash flow at time 2. Market interest rate is 8%. Assume no dividend is paid at time 1. What is the closest present value of the Atech Industries in millions USD with this project at time 1 with the investment taking place in full?A -256 B-330 -276 -50 -300arrow_forward24. You are evaluating a project that will cost $534,000, but is expected to produce cash flows of $128,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 11% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? a. What is the payback period of this project? The payback period is ____years. b. If you want to increase the value of the company you (will/will not) take the project since the NPV is (negative/positive) **round to two decimal places**arrow_forwardNonearrow_forward

- Question: You have an investment opportunity in the United Kingdom that requires investment of $500,000 today and will produce a cash flow of 320,000 euros and one year with no risk. Suppose the risk free rate of interest in the UK is 6% and the current competitive exchange rate is one point 70 per euro. What is the NPV of this project? Would you take the project?arrow_forwardA firm is considering investing in a new project with an upfront cost of $300 million. The project will generate an incremental free cash flow of $50 million in the first year and this cashflow is expected to grow at an annual rate of 5% forever. If the firm's WACC is 11%, what is the value of this project? A. $833.3 million B. $875.0 million C. $575.0 million D. $533.3 millionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education