ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

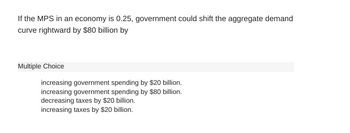

Transcribed Image Text:If the MPS in an economy is 0.25, government could shift the aggregate demand

curve rightward by $80 billion by

Multiple Choice

increasing government spending by $20 billion.

increasing government spending by $80 billion.

decreasing taxes by $20 billion.

increasing taxes by $20 billion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- my choice is incorrectarrow_forwardIf the MPC in an economy is 0.6, government could shift the aggregate demand curve rightward by $30 billion by Multiple Choice decreasing taxes by $20 billion. increasing government spending by $20 billion. increasing government spending by $18 billion. decreasing taxes by $30 billion.arrow_forwardA government's debt is reduced when it Group of answer choices runs a surplus. runs a deficit. balances is budget. sells more bonds.arrow_forward

- Automatic stabilizers have the effect of Group of answer choices eliminating all recessions. inflation. increasing the long-run supply curve. reducing recessionary gaps.arrow_forwardWhich of the following statements about automatic stabilizers in Canada is the most accurate? They are the responsibility of the provinces since they, unlike the federal government, do not face lag problems. They are controlled by the Bank of Canada to help manage the business cycle. They are able to completely eliminate all the lag problems associated with fiscal policy. They are changes in government transfer payments and tax revenues that vary automatically and inversely to business cycle changes.arrow_forwardThe government lowers $0.9 trillion in taxes, restoring GDP from $10 trillion to its potential level of $11.2 trillion. What is the value of the tax multiplier? A -1.33 B -0.9 C -0.75 D -1 E -1.2arrow_forward

- income taxes and government spending during a recession. Automatic stabilizers increase; increase increase; decrease decrease; increase decrease; decreasearrow_forwardDescribe the problems with passing a balanced budget amendment.arrow_forwardGovernment spending in Robok is $140 billion, and its only tax is an income tax with a marginal tax rate of 0.2. a. The balance on the government's budget at a GDP level of $450 billion is a (Click to select) : of $ billion. b. The balance on the government's budget at a GDP level of $800 billion is a ( (Click to select) : of $ billion. C. At what level of GDP will the economy of Robok have a balanced budget? Robok will have a balanced budget at a GDP level of $ [ ]billion.arrow_forward

- Suppose that an economy is in equilibrium at a level of output of $600 million. Suppose further that the full employment level output is $2000 million. What can the President along with Congress do in order to attain the full employment output? Group of answer choices Increase the taxes. Decrease the taxes. Sell government securities. Decrease the government spending.arrow_forwardSuppose the economy is in a recession. In this case automatic stabilizers will Group of answer choices cause the government's budget to move toward a surplus. cause the government's budget to move toward a deficit. not cause the government's budget to move in any particular direction. cause the government's budget to move toward a balanced budget.arrow_forwardIf the MPS in an economy is 0.2. What is the tax multiplier? Group of answer choices a. 4 b. 5 c. -4 d. -5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education