ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

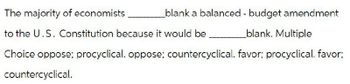

Transcribed Image Text:The majority of economists

_blank a balanced - budget amendment

_blank. Multiple

to the U.S. Constitution because it would be

Choice oppose; procyclical. oppose; countercyclical. favor; procyclical. favor;

countercyclical.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Using examples from 2008-currently, explain fiscal policy. In your answer be sure to include what Fiscal Policy is and how some of the recent policies have impacted the economy (GDP and Budgets) in both the short term and the long term.arrow_forwardWhen the total revenues in the federal government are greater than the total expenses in a given year, the budget: A. is balanced. B. has a profit. C. has a deficit. D. has a surplus.arrow_forwardProvide solutions to all parts.....arrow_forward

- what role does taxation and budget process play in government decisions?arrow_forwardWhich of the following statements about the Canadian federal budget is FALSE? A. Currently, Canada has a federal budget deficit. B. The Minister of Finance presents the federal bugdet to the Canadian Parliament. C. The largest source of federal government revenues are personal income taxes. D. The largest source of federal government outlays are transfer payments to persons and other levels of government. E. Canada has not had federal budgetary surpluses in any fiscal year over the 2000 to 2020 period.arrow_forwardAll of the following, except one, would result from expansionary fiscal policy. Which is the exception? Multiple Choice O O O Increased price level. Increased GDP. Decreased budget deficit. Decreased unemployment. 4arrow_forward

- An amendment to the Texas Constitution requires a balanced budget. This means that _____. A. any increase in government spending must be offset by a decrease in the total funds allocated to the General Revenue budget B. the legislature cannot approve a budget if it exceeds the projected revenues for the state by more than 30 percent C. the legislature cannot approve a budget if it exceeds the projected revenues for the state by more than 10 percent D. any increase in government spending must be offset by an increase in revenue and/or cuts in spending elsewhere in the budgetarrow_forwardDo you agree or disagree with this statement: “It is in the best interest ofoureconomy forCongress and the President to run a balanced budget each year.” Explain your answer.arrow_forwardCountry D experiences a recession due to a decrease in consumer confidence. There are two economists, Andrew and Betty. Betty suggests the government to do nothing. Andrew suggests the government to implement fiscal policies to revive the economy as soon as possible. If the government adopts Betty’s policy, draw an AD-AS graph to show what happens to the economy in short run and then long run after the decrease in consumer confidence. Suppose the government adopts Andrew’s policy. (i) Will the government increase or decrease spending? (ii) The government cuts the income tax rate. After cutting the income tax rate, the total income tax revenue collected increases. Explain why. (iii) Will Andrew’s policy be more effective if MPC is smaller? Give one advantage of Betty’s policy over Andrew’s policy.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education