FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

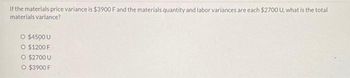

Transcribed Image Text:If the materials price variance is $3900 F and the materials quantity and labor variances are each $2700 U, what is the total

materials variance?

O $4500 U

O $1200 F

O $2700 U

O $3900 F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Q3: From the following data prepare a unit cost statement showing the prime cost of product X and Y together with analysis of variances: Material Labor Standard Actual Standard Actual Product X 500 kgs @ Rs.3.00 450 kgs @ Rs.3.60 120 hours @ Rs.3.00 138 hours @ Rs.2.25 Required: Do material and labor variances analysis. Product Y 80 kgs @ Rs.5.00 85 kgs @ Rs.4.75 60 hours @ Rs.2.10 56 hours @ Rs.2.00arrow_forwardcalculate the variances (f) Total Fixed Overhead Variance (d) Total Manufacturing Overhead Variance (a) Total Flexible Budget Product Cost Variance Total Flexible Budget Product Cost Variance (a) Total Direct Total Direct Total Manufacturing Materials Variance Labor Variance Overhead Variance (b) (c) (d) Direct Materials Direct Materials Direct Labor Direct Labor Total Variable Total Fixed Cost Variance Efficiency Variance Cost Variance Efficiency Variance Overhead Variance Overhead Variance $180 F $145 U $360 U $555 F (e) (f) Variable Overhead Variable Overhead Fixed Overhead Cost Variance Efficiency Variance Cost Variance…arrow_forwardi need the answer quicklyarrow_forward

- Use the information provided to answer the questions. Actual Price Paid Per Pound of Material: $14.50 Total Standard Pounds for Units Produced This Period 12,500 Pounds of Material Used 13,250 Direct Material Price Variance Favorable $4,637.50 All material purchased was used in production. A. What is the standard price for materials? B. What is the direct materials quantity variance? C. What is the total direct materials cost variance? D. If the direct materials price variance was unfavorable, what would be the standard price?arrow_forwardThe total manufacturing cost variance is a.the flexible budget variance plus the time variance b.the difference between actual costs and standard costs for units produced c.the difference between planned costs and standard costs for units produced d.None of these answers are correct.arrow_forwardanswerarrow_forward

- Material Material Actual Standard Actual Standard Price Usage Total Supplier Price Price Quantity Quantity Var Var Variance Current $7.50 $7.50 25,000 24,240 $0 Alternative #1 $7.35 $7.50 25,500 24,240 $0 Alternative #2 $7.58 $7.50 24,400 24,240 $0 Standard Quantity is 2.02 components Quantity produced is 12,000 You are a plant manager and have been approached by your purchasing manager about swapping out one of your suppliers. The manager has identified a vendor who will supply a key component at a 2% discount to your current supplier. At the same time, the supervisor of the group approaches you to indicate that the current supplier is not consistently meeting tolerances. The supervisor suggests a second vendor who promises better quality. You decide to run three batches, each with a different component. Results are in the table above. Task 1 Calculate the Material Price Variance for each component. Task 2 Calculate the Material Usage Variance for each component. Task 3 Based on the…arrow_forwardPlease solve a and barrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education