SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Net Income for the Year?

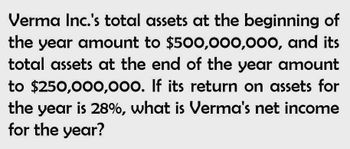

Transcribed Image Text:Verma Inc.'s total assets at the beginning of

the year amount to $500,000,000, and its

total assets at the end of the year amount

to $250,000,000. If its return on assets for

the year is 28%, what is Verma's net income

for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- C Company has the following data for the year ending 12/31/2020 (dollars are in thousands): Net income = $600; EBIT = $1,184; Total assets = $3,000; Short-term investments = $200; Total capital employed = $2,193; and tax rate = 30%. The company’s WACC is 11.07%. What was its Economic Value Added (EVA) for the year 2020? Round your answer to the nearest dollar. Group of answer choices: $583 $586 $577 $572 $580arrow_forwardNational Company's net income last year was P65,000 and its interest expense was P15,000. Total assets at the beginning of the year were P630,000 and total assets at the end of the year were P650,000. The company's income tax rate was 25%. The company's return on total assets (based on adjusted net income) for the year was closest to?arrow_forwardRollins Corp's total assets at the end of last year were $300,000 and its EBIT was $75,000. What was its basic earning power (BEP)?arrow_forward

- The following year-end data pertain to Adan Corporation: Earnings before interest and taxes 800,000 Current assets 800,000 Non-Current assets 3,200,000 Current Liabilities 400,000 Non-current liabilities 1,000,000 Adan corporation pays an income tax rate of 30%. Its weighted average cost of capital is 10%. What is Adan corporations Economic value added (EVA)?arrow_forwardBranch Corp.'s total assets at the end of last year were $310,000 and its net income after taxes was $22,750. What was its return on total assets? Select the correct answer. a. 8.34% b. 7.34% c. 6.84% d. 7.84% e. 6.34%arrow_forwardDuring 2020, Jacks Inc. had sales revenue $1,328,000, gross profit $728,000, operating expenses $398,000, cash dividends $90,000, other expenses and losses $40,000. Its corporate tax rate is 30%. What was Jacks income tax expense for the year?arrow_forward

- Fragile Express Delivery Company’s earnings before interest and taxes (EBIT) was $725 million. Assuming Fragile Express Delivery’s tax rate is 37%, what is their net operating profit after taxes (NOPAT) for 2019 expressed in millions of dollarsarrow_forwardIn 2021, Noble Tech Inc. reported that the company's Return on Assets (ROA) was 10%, and its net profit margin was 6%. Calculate the company's total asset turnover (round your answer to two decimal places).arrow_forwardWhat is Net income?arrow_forward

- Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of goods sold was 240,000, its operating expenses were 50,000, its interest revenue was 2,000, and its interest expense was 12,000. Brandts income tax rate is 30%. Prepare Brandts multiple-step income statement for the current year.arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardthe income statement of x ltd for the year ended was as follows: net sales 4032000, cost of sales 3168000, depreciation 96000, salaries and wages 384000, opex 128000, provision for taxation 140800, net operating profit 11520. compute net profit before working capital changesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning