FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

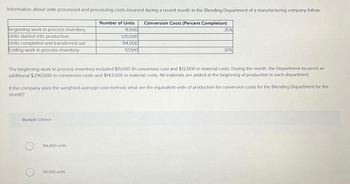

Transcribed Image Text:Information about units processed and processing costs incurred during a recent month in the Blending Department of a manufacturing company follow:

Number of Units Conversion Costs (Percent Completion)

11,000

120,000

114,000

17,000

Beginning work in process inventory

Units started into production

Units completed and transferred out

Ending work in process inventory

The beginning work in process inventory included $11,000 of conversion cost and $12,000 in material costs. During the month, the Department incurred an

additional $290,000 in conversion costs and $143,000 in material costs. All materials are added at the beginning of production in each department.

Multiple Choice

35%

If the company uses the weighted-average cost method, what are the equivalent units of production for conversion costs for the Blending Department for the

month?

114,000 units.

30%

119,100 units.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The cost per equivalent unit of direct materials and conversion in the Bottling Department of Beverages on Jolt Company is $0.50 and $0.20, respectively. The equivalent units to be assigned costs are as follows: Inventory in process, beginning of period Started and completed during the period Transferred out of Bottling (completed) Inventory in process, end of period Total units to be assigned costs Direct Materials 52,120 0 52,120 3,010 55,130 LA LA Conversion The beginning work in process inventory had a cost of $3,020. Determine the cost of completed and transferred-out production and the ending work in process inventory. When required, round your answers to the nearest dollar. Completed and transferred out production Inventory in process, ending 3,110 52,120 55,230 2,700 57,930arrow_forwardIncome Statements under Absorption Costing and Variable Costing Fresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1 and operated at 100% of capacity (70,400 units) during the first month, creating an ending inventory of 6,400 units. During February, the company produced 64,000 units during the month but sold 70,400 units at $90 per unit. The February manufacturing costs and selling and administrative expenses were as follows: Manufacturing costs in February 1 beginning inventory: Variable Fixed Total Manufacturing costs in February: Variable Fixed Total Selling and administrative expenses in February: Variable Fixed Total Number of Units Cost of goods sold: 6,400 $36.00 6,400 14.00 64,000 64,000 Unit Cost 70,400 70,400 Total Cost $230,400 89,600 $50.00 $320,000 $36.00 $2,304,000 15.40 985,600 $51.40 $3,289,600 $18.20 $1,281,280 7.00 492,800 $25.20 $1,774,080 a. Prepare an income statement according to the absorption…arrow_forwardI need to finish with these three questions and need help please. Journalize the entries for costs transferred from Milling to Sifting and the costs transferred from Sifting to Packaging. 2. Determine the increase or decrease in the cost per equivalent unit from June to July for direct materials and conversion costs. 3.Discuss the uses of the cost of production report and the results of part (c).arrow_forward

- Owearrow_forwardDaosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Required: Using the FIFO method: a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory. d. Determine the cost of units transferred out of the department during the month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent…arrow_forwardRequired: 1. Determine the unit product cost under: a. Absorption costing. b. Variable costing. 2. Prepare variable costing income statements for July and August. 3. Reconcile the variable costing and absorption costing net operating incomes.arrow_forward

- Use the information given below to prepare the Income Statement for March 2022 according to theabsorption costing method.arrow_forwardSelected production and cost data of Amy's Craft Co. follow for May: View the production and cost data. On May31the Mixing Department ending Work-in-Process Inventory was 758omplete for materials and 25%omplete for conversion costs. The Heating Department ending Work-in-Process Inventory was 65%omplete for materials and 30%omplete for conversion costs. The company uses the weighted-average method. Read the requirements. Requirement 1. Compute the equivalent units of production for direct materials and for conversion costs for the Mixing Department. Complete the partial production cost report below for the Mixing Department, showing the equivalent units of production for direct materials and for conversion costs. Amy's Craft Co. Production Cost Report - Mixing Department (Partial) Month Ended May 31 UNITS Units accounted for: Total units accounted for Physical Units Equivalent Units Direct Materials Conversion Costs Production and Cost Data Units to account for: Beginning…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education