Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

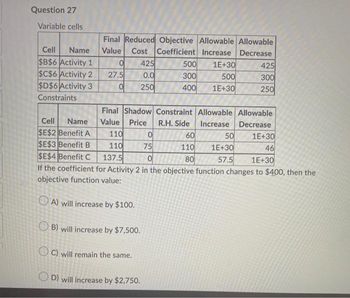

Transcribed Image Text:Question 27

Variable cells

Final Reduced Objective Allowable Allowable

Value Cost Coefficient Increase Decrease

Cell Name

$B$6 Activity 1

0

425

500

1E+30

425

$C$6 Activity 2

27.5

0.0

300

500

300

$D$6 Activity 3

0 250

400

1E+30

250

Constraints

Final Shadow Constraint Allowable Allowable

Value Price R.H. Side

Increase

Decrease

Cell Name

$E$2 Benefit A

110

0

60

50

1E+30

$E$3 Benefit B

110

75

110

1E+30

46

$E$4 Benefit C

137.5

0

80

57.5

1E+30

If the coefficient for Activity 2 in the objective function changes to $400, then the

objective function value:

A) will increase by $100.

B) will increase by $7,500.

OC) will remain the same.

D) will increase by $2,750.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please show work using matrices, thank you!arrow_forwardAn oil company is considering two sites on which to drill. The sites are described in the foliowing table. Complete parts (a) through (b) below. Site A Profit if ol is found: $120 million Loss if no oil is found: $20 million Probablity of finding oil: 0.2 Site B: Profit if ol is found: $180 million Loss if no oil is found: $30 milion Probability of finding oil: 0.1 a. Which site has the larger expected profit? Site A has the larger expected profit. Site B has the larger expected profit. The expected profits for both sites are the same. b. If the expected profit for both sites is not the same, by how much is the expected profit larger? milion (Round to the nearest tenth as needed.)arrow_forwardplease do not give solution in image format thankuarrow_forward

- Bob and Dora Sweet wish to start investing $1,000 each month. The Sweets are looking at five investment plans and wish to maximize their expected return each month. Assume interest rates remain fixed and once their investment plan is selected they do not change their mind. The investment plans offered are: Fidelity 9.1% return per year Optima 16.1% return per year CaseWay 7.3% return per year Safeway 5.6% return per year National 12.3% return per year Since Optima and National are riskier, the Sweets want a limit of 30% per month of their total investments placed in these two investments. Since Safeway and Fidelity are low risk, they want at least 40% of their investment total placed in these investments.Formulate the LP model for this problem, using the standard LP format. Remember to define the objective function, the decision variables, and label the constraint functions. There is no need to solve the problem. Note:- Do not provide handwritten solution. Maintain…arrow_forward14. Given the following sequential decision tree, determine which is the optimal investment, A or B: 55 .40 $300,000 (-$20,000) 7 .30 .60 $60,000 $45,000 Investment A .70 $75,000 20 $200,000 (-$70,000) (-$17,000) .80 $70,000 1 $60,000 .15 .35 $105,000 (-$9,000) .55 6 .65 $40,000 Investment B (-$50,000) 3 $55,000 .30 $80,000arrow_forwardAssume that the Wisconsin Cheese Factory currently operates a large facility in Madison, WI. The owner, however, is concerned about concentration of risk and has decided to open up two new facilities to lessen that concentration, one in St. Cloud, MN, and the other in Iowa City, IA. Total production, while slightly less profitable overall because of additional operational costs, remains the same, with 1/3 at each location. This action is an example of _______. profit maximization loss reduction loss prevention risk avoidancearrow_forward

- Three different objectives relate to a firm's profit, which is often measured in terms of return on investment. One objective, known as when a firm sets a OCcurs profit goal, usually determined by its board of directors. Select one: O a. managing for long-run profits O b. minimizing risk Oc. target return O d. break-even strategy O e. maximizing current profitarrow_forward1 A firm has prepared the following binary integer program to evaluate a number of potential locations for new warehouses. The firm's goal is to maximize the net present value of their decision while not spending more than their currently available capital. Max 25x, + 15x2 +25x3+ 15x4 s.t 5x1 + 11x2 + 4x3 + 5x4 $ 11 {Constraint 1) x1 + x2 + x3 + X4 2 2 {Constraint 2) X1+x2 s 1 {Constraint 3) X1 +x3 2 1{Constraint 4) x2 = X4 {Constraint 5) 1, if location jis selected 0, otherwise Solve this problem to optimality and answer the following questions: a. Which of the warehouse locations will/will not be selected? Location 1 will Location 2 will Location 3 will Location 4 willarrow_forwardoperations managementarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.