ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

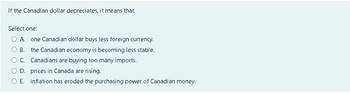

Transcribed Image Text:If the Canadian dollar depreciates, it means that

Select one:

A. one Canadian dollar buys less foreign currency.

B. the Canadian economy is becoming less stable.

C. Canadians are buying too many imports.

D. prices in Canada are rising.

O E. inflation has eroded the purchasing power of Canadian money.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 14 According to the principle of purchasing power parity, the 2001 devaluation of the Argentine peso: a. had no impact on the Argentine inflation rate. b. made Argentine imports from the United States cheaper. c. decreased the inflation rate in Argentina relative to the inflation rate in the United States. d. increased the inflation rate in Argentina relative to the inflation rate in the United States. QUESTION 15 An increase in the money supply _____ the interest rate in the short run but _____ the interest rate in the long run. a. lowers; does not affect b. does not affect; lowers c. raises; lowers d. does not affect; raisesarrow_forwardA car costs $20,000 in the U.S. The exchange rate between the euro and the dollar is 0.813 euros per dollar. Ignoring transportation and other similar costs, what would be the euro price of the same car in France? Select one: O a. 28,000 euros O b. 16,260 euros O c. 24,600 euros O d. 15,300 euros Checkarrow_forwardSuppose the price level and value of the U.S. dollar in year 1 are 1 and $1, respectively. Instructions: Enter your answers rounded to 2 decimal places.a. If the price level rises to 1.25 in year 2, what is the new value of the dollar? $______b. If, instead, the price level falls to 0.50, what is the value of the dollar?$______arrow_forward

- Proper answering pleasearrow_forward2. Analyze the data from China, Japan, Switzerland, Indonesia, Ukraine, and Taiwan (6 countries), and fill in the table as follow showing overvalued and undervalued currencies. (10%) Write a conclusion stating why PPP doesn't hold true according to the actual data. (10%) Country Local dollar Implied PPP Actual of the dollar price 1 United States China Indonesia Switzerland Ukraine Taiwan 5 20 30000 6.5 54 69 exchange rate 1 6.8 14000 0.9 28 30 Under/over against the dollar 0% valuationarrow_forwardQUESTION 5 How can a central bank support a fixed exchange rate? Note: Multiple answers are possible. O A. by buying and selling foreign currency O B. by changing the interest rate O C. by increasing government spending O D. by investing in infrastructurearrow_forward

- Over time, a real depreciation in the value of a nation's currency should result in Select one: a. exports rising and imports falling. O b. exports falling and imports rising. O. both imports and exports rising. O d. both imports and exports falling.arrow_forwardI need all answers plsarrow_forwardQuestion 2 of 25 In which situation is a country most likely to choose a flexible exchange rate for its currency? O A. A country believes that its currency will be in low demand in global markets. B. A country worries that the value of its currency could rise and fall unpredictably. C. A country has a reputation for having a strong and stable economy over time. O D. A country wants to make sure that its currency is stable in all economic situations.arrow_forward

- In the short run, all of the following are disadvantages of a fixed exchange rate regime except: O A. macroeconomic shocks must be addressed with fiscal policy. O B. open market operations are overused. OC. they can lead to future exchange rate crises. O D. interest rates are constant. According to Robert Mundell, for countries to constitute an optimal currency area, such as adopting a common currency, they must have: O A. a different composition of industries. O B. high factor mobility. O C. similar per capita GDP. O D. all of the above.arrow_forwardA 216.arrow_forwardIn the foreign exchange market, an increase in the U.S. interest rate leads to in the exchange rate because the supply of dollars a fall; increases O b. no change; does not change Ос a rise; decreases O d. a rise; increases O . a fall; decreasesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education