ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

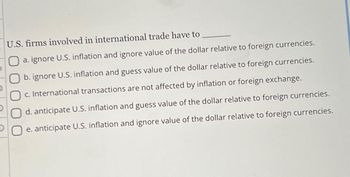

Transcribed Image Text:U.S. firms involved in international trade have to

a. ignore U.S. inflation and ignore value of the dollar relative to foreign currencies.

b. ignore U.S. inflation and guess value of the dollar relative to foreign currencies.

Oc. International transactions are not affected by inflation or foreign exchange.

O d. anticipate U.S. inflation and guess value of the dollar relative to foreign currencies.

e. anticipate U.S. inflation and ignore value of the dollar relative to foreign currencies.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If domestic interest rate is higher than foreign countries interest rates, then there will be _____________ ."A) a capital outflow and supply of domestic currency will increase. B)a capital outflow and demand for domestic currency will increase.C) a capital inflow and demand for domestic currency will increase.D) a capital inflow and demand for domestic currency will fall.arrow_forwardA 216.arrow_forwardWhich of the following will most likely cause a nation's currency to appreciate on the foreign exchange market? a. A decrease in domestic interest rates O b. An increase in foreign interest rates c. Stable domestic prices while the nation's trading partners are experiencing 10 percent inflation O d. Domestic inflation of 10 percent while the nation's trading partners are experiencing stable pricesarrow_forward

- What effect would a devaluation of a country's currency most likely have on its export volumes? A. Export volumes would decrease, as goods become more expensive in foreign markets. B. Export volumes would increase, as goods become cheaper in foreign markets. C. Export volumes would remain unchanged, as currency value does not affect trade. D. Export volumes would initially decrease, but then increase over time due to adjustments in trade agreements.arrow_forwardTopics 6.2-6.5 New Currency Problems. Each of the determinants is used once. 1. Residents and businesses of the US are asked to boycott goods made in Iran due to political tensions between the two countries. Besides oil, the US receives plastics, iron, fruits and vegetables, salt, and copper from Iran. Graph the Dollar and Iranian Rial markets as a result of the boycott. What happens to future US exports to Iran after the currency values change? 2. Assume that the US does go into a mild recession. Assume that the Euro zone avoids a similar recession and continues its growth rate. Graph the Dollar and Euro markets. From the US perspective.arrow_forwardIf the exchange rate moves from $1 for one Euro to $1.50 for one Euro, then Select one: a. it becomes more expensive for a European to buy a European product. b. it becomes more expensive for an American investor to save at an American bank. c. it becomes more expensive for an American to buy a Mexican product. d. it becomes more expensive for an American to buy a European product.arrow_forward

- A. Canada produces natural resources (coal, natural gas, and others), the demand for which has increased rapidly as China and other emerging economies expand. i. Explain how growth in the demand for Canada's natural resources would affect the demand for Canadian dollars in the foreign exchange market. Explain how the supply of Canadian dollars would change. ii. iii. Explain how the value of the Canadian dollar would change. iv. Illustrate your answer with a graphical analysis. 1arrow_forwardonly typed solutionarrow_forwardDue to the increase in the productivity of Omanis in the technology sector, the rate of exports of technological services has increased. How will this affect the value of the Omani Rial and the US dollar? a. Stronger rial and weaker dollar b. weaker rial and stronger dollar С. both currencies will increase in value d. the increase will be cancelled out by each otherarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education