Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Answer give me Fast As Possible

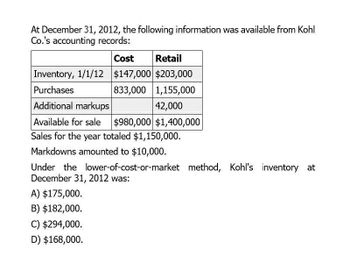

Transcribed Image Text:At December 31, 2012, the following information was available from Kohl

Co.'s accounting records:

Cost

Retail

Inventory, 1/1/12 $147,000 $203,000

Purchases

833,000

1,155,000

Additional markups

42,000

Available for sale

$980,000 $1,400,000

Sales for the year totaled $1,150,000.

Markdowns amounted to $10,000.

Under the lower-of-cost-or-market method, Kohl's inventory at

December 31, 2012 was:

A) $175,000.

B) $182,000.

C) $294,000.

D) $168,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 12. RS Inc. sold a total of $23,000 of its products. As of the end of the year, a total of $9,600 of these sales had still not yet been collected. The original cost of products sold was $8,100. n Transactio Transactio Cash Asset + n Noncash Assets Cash Asset + Balance Sheet Noncash Assets = II Liabil- ities Balance Sheet = 13. On December 13, 2020, RS Inc. signed a contract with the organizer of the International Fair for Electronic Consumer Products for 100 units of RS's smaller spray cans, which are intended to be given away to visitors of the trade show. The selling price specified in the contract is $5 per unit. RS Inc. promised to deliver the units on March 10, 2021. IFECP has up to 30 days after delivery to pay for the spray cans. II Contrib. Capital Liabil- ities + Contrib. Capital Earned Rev- Capital enues + Income Statement Earned Rev- Capital enues Expen ses Expen = ses II Income Statement Net Incom e Net = Incom e IIarrow_forwardThe following information is related to Dickinson Company for the year ended December 31, 2020. Retained earnings balance, January 1, 2020 $980,000 25,000,00 Sales revenue 16,000,00 Cost of goods sold Gain on life insurance proceeds 70,00-| Selling, general, and administrative expenses 4,700,000 Write-off of goodwill 820,000 Gain on the sale of investments 110,000 Loss due to write-down of inventory to NRV Loss on the disposition of the wholesale division 390,000 530,000 Income tax rate 30% Dividends declared on common stock 250,000 Dividends declared on preferred stock Common shares outstanding 80,000 500,000 Dickinson Company decided to discontinue and sell its entire wholesale operations. The disposal is considered a discontinued operation. Instructions: Prepare a retained earnings statement.arrow_forwardThe accounting records of Uniontown Industries, Inc., provided the data below for the year endedDecember 31, 2020:Sales $1,000,000Cost of goods sold 500,000Depreciation expense 15,000Insurance expense 6,000Selling, general and administrative expenses 140,000Interest expense 20,000Income tax expense 125,000Net income 194,000Decrease in inventory 2,000Increase in accounts receivable 1,400Amortization of bond discount 5,000Decrease in prepaid insurance 300Cash dividends paid 20,000Required: In good form, prepare the operating activities section of the statement of cash flows for 2020using the direct method. Show all work for partial credit.arrow_forward

- The following information relates to Hardin Limited's year-ended 31 December 2020: The statement of comprehensive income shows profit for the year of R154 000. The calculation of this profit included the following income and expenses: Impairment of building: R64 000 (before tax: R74 000) Profit on sale of plant: R23 200 (before tax: R32 000) • Inventory write-down: R10 000 (before tax: R15 000) • The statement of changes in equity reflected preference dividends of R3 450. 12 000 shares in issue throughout the year. Required: Calculate the basic earnings and the headline earnings and disclose the headline earnings per share for the year-ended 31 December 2020 The following information is provided for Present limited for the year ended 31 December 2020. Present Limited had basic earnings for 2020 of R520 000. This basic eamings figure was equal to its profit for the year. It had no components of other comprehensive income. Present Limited had 2 200 000 ordinary shares in issue throughout…arrow_forwardThe following transactions for Fortitude Enterprises during the second quarter of 2024: Sales amounted to P5,000,000 and related cost of goods sold was P3,000,000 Selling expenses for the given period was P250,000. Depreciation is usually recorded at annual amount of P1,200,000. Real property taxes for the year in the amount of P600,000 were paid on April 1, 2024. An inventory loss arising from a temporary market decline of P400,000 had occurred on June 30, 2024. Ignoring income taxes, net income for the second quarter ending June 30, 2024 should be?arrow_forwardPresented below is information related to Anderson Company for 2022. Sales revenue 25,000,000Cost of goods sold 16,000,000Interest expense 70,000Selling and administrative expenses 4,700,000Loss from write-off of goodwill. 820,000Gain on the sale of investments 110,000Loss due to flood damage 390,000Loss on the disposition of the wholesale division 8 00,000Loss on operations of the wholesale division 150,000Dividends declared on ordinary shares 250,000Dividends declared on…arrow_forward

- On January 1, 2018, UE Realty Company sold property carried in inventory at a cost of P1,312,710 for P2,100,000. A 20% down payment was made and the balance payable in 4 equal installments of P420,000, payable semi-annually every June 30 and December 31. Expenses related with sale, P100,000. (Market rate of interest-12%). How much is the net income related with the installment sales for the year ended December 31, 2018?arrow_forwardThe following information is related to Dickinson Company for 2020. Retained earnings balance, January 1, 2020 $ 980,000 Sales revenue 25,000,000 Cost of goods sold 16,000,000 Interest revenue 70,000 Selling and administrative expenses 4,700,000 Write-off of goodwill 820,000 Income taxes for 2020 1,244,000 Gain on the sale of investments 110,000 Loss due to flood damage 390,000 Loss on the disposition of the wholesale division (net of tax) 440,000 Loss on operations of the wholesale division (net of tax) 90,000 Dividends declared on common stock 250,000 Dividends declared on preferred stock 80,000 Dickinson Company decided to discontinue its entire wholesale operations (considered a discontinued operation) and to retain its manufacturing operations. On September 15, Dickinson sold the wholesale operations to Rogers Company. During 2020, there were 500,000 shares of common stock outstanding all year. Instructions Prepare a multiple-step income statement…arrow_forwardAshavinbhaiarrow_forward

- The 2009 records of Coleman Company showed beginning inventory,$100,000; cost of goods sold, $450,000; and ending inventory, $80,000. Thepurchases for 2009 equal: A. $450,000 B. $410,000 C. $430,000 D. $420,000arrow_forwardConsider the following financial information and answer the questions that follow:Sales : $250,000Costs : $134,000Depreciation : $10,200Operating expenses : $6,000Interest expenses : $20,700Taxes : $18,420Dividends : $10,600Addition to Retained Earnings : $50,080Long term debt repaid : $9,300New Equity issued : $8,470New fixed assets acquired : $15,000 1) Calculate the cash flow from assets 2) Calculate net capital spending 3) Calculate change in NWC PLEASE TYPE AS OPPOSED TO WRITING ON PAPER. I MIGHT NOT UNDERSTAND THE HAND WRITING. PLEASE DO EACH QUESTION SEPARATELY. I HAVE ASKED THIS QUESTION MULTIPLE TIMES BECAUSE I COULD NOT UNDERSTAND THE RESPONSE. THANK YOUarrow_forwardAn entity reported the following information for the year ended December 31, 2020: Sales 7,750,000 Cost of goods sold 2,400,000 Administrative expenses 700,000 Loss on sale of equipment 100,000 Sales commissions 500,000 Interest revenue 450,000 Freight out 150,000 Loss on early extinguishment of long-term debt 200,000 Doubtful accounts expense 150,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning