ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

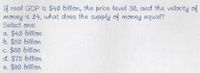

Transcribed Image Text:If real GDP is $40 billion, the price level 30, and the velocity of

money is 24, what does the supply of money equal?

Select one:

a. $40 billian

6. $50 billion

c. $60 billion

d. $75 billien

e. $80 billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Typed plzzzz And Asap thanksarrow_forwardOther things the same, continued increases in the money supply lead to a. continued increases in the price level and real GDP. b. continued increases in real GDP but not continued increases in the price level. c. continued increases in the price level but not continued increases in real GDP. d. a one-time permanent increase in both prices and real GDP.arrow_forwardK The graph shows the demand for money curve. Draw a point to show the interest rate and quantity of money demanded when the interest rate is 5 percent a year. Draw an arrow to show the effect of an increase in the interest rate above 5 percent a year. Label it 1. Draw an arrow to show the effect of a decrease in the interest rate below 5 percent a year. Label it 2. When the interest rate rises, other things remaining the same, the opportunity cost of holding money and A. rises; the demand for money decreases B. falls; the demand for money increases O C. falls; the quantity of money demanded increases OD. rises; the quantity of money demanded decreases 8- 6- 4 2- 0+ Interest rate (percent per year) 2.7 MDO 2.9 3.1 3.3 Real money (trillions of 2007 dollars) >>> Draw only the objects specified in the question. 3.5 € Garrow_forward

- In the graph you've just explored, by how much does the quantity of money demanded change if the interest rate rises from 5 percent to 6 percent? A. $9 trillion B. $1 trillion C. $10 trillionarrow_forwardplease helppppparrow_forwardThe pandemic caused the economy to slow down. Which one of the following is correct to speed up recovery. a. Tax cuts, increase money supply, raise the interest rates. b. Tax cuts, increase money supply, increase government spending. c. Tax cuts, decrease money supply, raise the interest rates. d. Tax cuts, decrease money supply, increase government spending.arrow_forward

- When the supply of money increases, what happens to the interest rate? A. the interest rate decreases B. the interest rate increases Thanks z zarrow_forward1arrow_forwardThe Fed raises the interest rate when it Oa. fears inflation. O b. wants to increase the quantity of money. O C. cannot change the quantity of money. O d. wants to encourage bank lending. O e. fears recession.arrow_forward

- If the price level decreases, OA. there is a movement up along a stationary money demand curve. OB. the money demand curve shifts to the right. C. the money demand curve shifts to the left. D. there is a movement down along a stationary money demand curve.arrow_forward1. The curves showing the various quantities of goods and services that domestic consumers, businesses, the government, and foreign buyers collectively want to buy, at each price level, are the curves for:Choose:a. money supply and money demand b. money supply and aggregate demand c. money demand and aggregate supply d. aggregate demand and aggregate supply 2. Which of the following is an essential factor for the continuous growth process in the economy?Choose:a. research and development of new technologies and investment in new capital b. the absence of private property c. government planning for what the country will produce d. government intervention in economic activity 3. Gross domestic product excludes:Choose: a. consumption and exports b. imports of goods and services c. the inventory of accumulated capital not sold during the year d. the purchase and sale of shares in the financial marketarrow_forwardWhen the Federal Reserve increases the money supply, people spend more because they now have more money. O True O Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education