ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

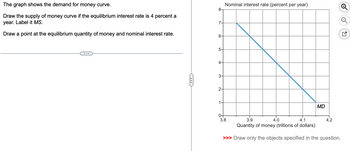

Transcribed Image Text:The graph shows the demand for money curve.

Draw the supply of money curve if the equilibrium interest rate is 4 percent a

year. Label it MS.

Draw a point at the equilibrium quantity of money and nominal interest rate.

8-

7-

6-

Nominal interest rate (percent per year)

5-

4-

3-

ო

2-

1

0+

3.8

3.9

4.0

4.1

MD

☑

4.2

Quantity of money (trillions of dollars)

>>> Draw only the objects specified in the question.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the equilibrium price of bonds increases, what happens to the associated interest rate? A. Interest rate increases B. Interest rate declines C. Interest rate does not changearrow_forwardK The graph shows the demand for money curve. Draw a point to show the interest rate and quantity of money demanded when the interest rate is 5 percent a year. Draw an arrow to show the effect of an increase in the interest rate above 5 percent a year. Label it 1. Draw an arrow to show the effect of a decrease in the interest rate below 5 percent a year. Label it 2. When the interest rate rises, other things remaining the same, the opportunity cost of holding money and A. rises; the demand for money decreases B. falls; the demand for money increases O C. falls; the quantity of money demanded increases OD. rises; the quantity of money demanded decreases 8- 6- 4 2- 0+ Interest rate (percent per year) 2.7 MDO 2.9 3.1 3.3 Real money (trillions of 2007 dollars) >>> Draw only the objects specified in the question. 3.5 € Garrow_forwardIn the graph you've just explored, by how much does the quantity of money demanded change if the interest rate rises from 5 percent to 6 percent? A. $9 trillion B. $1 trillion C. $10 trillionarrow_forward

- What is the term structure of interest rates and what can it tell you about the outlook for the economy? ting For you! Edit View Insert Format Tools Table 12pt ✓ Paragraph✓ BIUAV | р 2 T² : V | i I 0 words # ✓arrow_forwardFill in the blanks to complete the following passage regarding the U.S. savings rate. Drag word(s) below to fill in the blank(s) in the passage. It generally fell for nearly three decades before reaching a In 1982, the savings rate rose above low of 2008-2009, the savings rate climbed as high as range. in 2005. Yet as real estate and stock prices fell in the aftermath of the Great Recession of in 2012, before falling to about the 6-8% 0% 6% 10% 30% 12% 2.2%arrow_forwardRefer to Figure 11.1. All of the following events can cause a movement from Point E to Point A EXCEPT Group of answer choices an increase in real output and income. a decrease in the interest rate. an increase in the nominal aggregate output. an increase in the aggregate price level.arrow_forward

- Don't use Aiarrow_forwardFor the next 5 questions, assume that the economy starts in equilibrium: -the output is 1 million -the equilibrium price of a one-year, $100 bond is $96 -the money supply is 1 trillion -the price level is 125 What is the interest rate in this economy? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a 4.67% b 4.00% 5.03% d. 4.17%arrow_forwardMONEY INTEREST RATE (Percent) Suppose the Federal Reserve implements a restrictive monetary policy by selling bonds through open-market operations. Assume that this policy is unanticipated. The following graph shows the money demand and money supply curves for the economy. Is The Money Market Money supply ciples of Money demand O Money'supply ack Money demand 3-48 PM 85°F Partly sunny 8/2/2021 pe here to searcharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education