ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

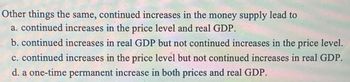

Transcribed Image Text:Other things the same, continued increases in the money supply lead to

a. continued increases in the price level and real GDP.

b. continued increases in real GDP but not continued increases in the price level.

c. continued increases in the price level but not continued increases in real GDP.

d. a one-time permanent increase in both prices and real GDP.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The demand for money increases and the demand for money curve shifts rightward if a. the price level falls. b. the nominal interest rate increases. the real interest rate increases. O C. O d. the inflation rate increases. O e. real GDP increases.arrow_forwardTyped plzzz and Asap Thanksarrow_forwardInterest rate 3 The graph below illustrates the money demand and investment demand for the economies of Pabst and Kokanee. Pabst Kokanee a. If money supply is increased by 25, what will be the new interest rate? Round your answers to one decimal place. Pabst: % Kokanee: % b. What will be the increase in investment spending as a result of this new interest rate? Pabst: Kokanee: c. If the multiplier is 2 in each economy, what will be the increase in GDP? Pabst: Kokanee: d. In which economy would monetary policy be more effective in closing a recessionary gap? PabstKokanee 3 2 1 10 9 8 MD MS 33 Interest rate 2 1 7 6 (110,1.5) 0 70 80 90 100 110 120 10 20 30 40 50 60 70 80 90 100 Quantity of money Quantity of investment MS MD Kokanee Interest rate 3 10 9 8 2 1 70 90 100 110 120 130 0 Quantity of money 10 20 30 40 50 60 70 80 90 100 Quantity of investmentarrow_forward

- 3. If the economy is at the natural rate of unemployment with the level of real GDP at potential output, what would expansionary fiscal or monetary policy do to the economy? How would the economy be affected in the short run and long run?arrow_forwardWhat is the effect of a rise in the money wage rate when the economy is at potential GDP? A rise in the money wage rate when the economy is at potential GDP A. does not change potential GDP but increases real GDP along the AS curve. B. decreases potential GDP because the full-employment quantity of labor decreases C. does not change aggregate supply but decreases production D. decreases aggregate supply because a rise in the money wage rate increases costs, so firms employ fewer workers Click to select your answer.arrow_forwardThe short-run effect of an increase in the money supply is to Part 2 A. increase the price level only. B. increase both real GDP and the price level. C. increase nominal GDP but decrease the price level. D. increase real GDP only.arrow_forward

- In the short run, a rise in the federal funds rate shifts the a. AD curve leftward. b. SAS curve leftward. c. LAS curve leftward. d. None of these because a decrease in the quantity of money does not shift a curve.arrow_forwardSuppose the economy is in long-run equilibrium. If there is a sharp decline in the stock market combined with a temporary increase in oil price, then we would expect that in the short run, a. real GDP will rise and the price level might rise, fall, or stay the same. b. real GDP will fall and the price level might rise, fall, or stay the same. c. the price level will rise, and real GDP might rise, fall, or stay the same. d. the price level will fall, and real GDP might rise, fall, or stay the same. 20. Suppose the economy is in long-run equilibrium. If there is a sharp decline in the stock market combined with a temporary increase in oil price. then we would expect that in the short run, real GDP will rise and the price level might rise, fall, or stay the same. real GDP will fall and the price level might rise, fall, or stay the same. c. the price level will rise, and real GDP might rise, fall, or stay the same. d. the price level will fall, and real GDP might rise, fall, or stay the…arrow_forwardIn the medium run, if government purchases are increased and nominal money supply is decreased, we can expect that a. the interest rate will increase while aggregate demand and prices may increase, decrease, or remain the same b. aggregate demand and prices will increase but interest rates will not change c. aggregate demand and interest rates will decrease but prices will increase d. aggregate demand, prices, and the interest rate will all decrease e. the AD-curve will shift to the right and the AS-curve will shift to the leftarrow_forward

- All else equal, suppose the interest rate rise from 3% to 3.5%. What will happen in the supply of money? a. Shifts to the right. b. Shifts to the left. c. An upward movement along the supply curve. d. An downward movement along the supply curve. e. The supply will remain unchanged.arrow_forwardThe Aggregate Demand line slopes down for a few reasons, one of which is ... Group of answer choices a. When consumers feel prices going up the purchase more b. When price levels go up, it reduces the purchasing power of savings c. When price levels go up, it increases the purchasing power of savings d. When suppliers feel prices going up the supply morearrow_forwardIf the velocity of money is assumed to be constant in the short run, the quantity theory of money contends that a decrease in the money supply will lead to a proportional ____ a. Increase in unemployment rate b. Increase in nominal interest rate c. Increase in price level d. Decrease in nominal outputarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education