ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

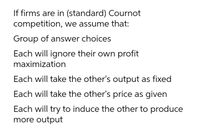

Transcribed Image Text:If firms are in (standard) Cournot

competition, we assume that:

Group of answer choices

Each will ignore their own profit

maximization

Each will take the other's output as fixed

Each will take the other's price as given

Each will try to induce the other to produce

more output

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider a standard Cournot oligopoly with n ≥ 2 identical firms, P(x) = a - bX, X ≥ 0, and C(x) = cx2. a. Find the Cournot equilibrium output and profit. b. If m firms wish to merge, what would be their cost function, assuming that they can use all their m production plants but that they otherwise do not have any eciency gains as a result of the merger? c. Given the cost function from part b, when is an m-firm merger profitable to the merged entity? To the non merging firms? d. Give a precise economic intuition explaining your answer relative to the usual (linear cost) case.arrow_forwardConsider two firms in the Australia market. The table below depicts each firm’s profits, depending on what price both firms charge. a. Find (if any) each firm's dominant strategy. b. Which strategy does each firm choose in equilibrium when collusion (joint agreement) is not allowed? c. Suppose that collusion is allowed between the two firms. Could these firms benefit from collusion? Why or why not?arrow_forwardQ8arrow_forward

- Suppose two firms, Firm A and Firm B, are competing by setting quantities (Cournot competition). Firm A has a constant marginal cost of $10 per unit; Firm B has a constant marginal cost of $15 per unit. Assume fixed costs are equal to 0 for both firms. Hint: since fixed costs are zero and the marginal cost is constant, MC = AC. The two firms choose between producing 50 units or 100 units. If the total output is 100 units, the price is $20 per unit; if total output is 150 units, the price is $15 per unit; if total output is 200 units, the price is $10 per unit. Based on the information provided, fill in the firms’ profits in the payoff matrix below with Firm A choosing the row and Firm B choosing the column. QB=100 QB=50 QA=100 , , QA=50 , , The resulting equilibrium is for Firm A to produce ____ (50 or 100)units and Firm B to produce_____ (50 or 100) units.arrow_forwardQuestion 1 Suppose the romaine lettuce industry is a Cournot duopoly with the following two firms: Amalgamated Romaine (a) and Best Romaine (b). The (inverse) market demand schedule is: p = 262 -0.5Q Amalgamated Romaine has the following cost structure: MCATC₁ = $6 Best Romaine has a different cost structure: MC₁ = ATC₁ = $8 Find the following in Cournot-Nash equilibrium. a. Output of Amalgamated Romaine = b. Output of Best Romaine = c. Cournot duopoly equilibrium price = $ units units 3 ptsarrow_forwardThe demand for a product is Q = a - P/2. If there are 4 firms in an industry and marginal cost is MC = 20, then the price in Nash equilibrium is P = 56. What is a?arrow_forward

- Suppose that there are two firms producing a homogenous product and competing in Cournot fashion and let the market demand be given by 0 = 240 -5 Assume for simplicity that each firm operates with zero total cost. Find Cournot Nash equilibrium total surplus 72400 ৪9600 76800 81200arrow_forwardThe market for smartphones is an Oligopoly market. Illustrate how equilibrium price and quantity is determined in this market.arrow_forwardConsider a Stackelberg duopoly:There are two firms in an industry with demand Q = 1 − Pd.The “leader” chooses a quantity qL to produce. The “follower” observes qL and chooses a quantity qF.Suppose now that the cost function is Ci(qi) = qi2 for i = L, F. (a) Find the subgame perfect equilibrium. (b) Compare the equilibrium you found with the Nash equilibrium if the game was simultaneous (i.e., Cournot competition). Is the Nash equilibrium of the Cournot game also a Nash equilibrium of the sequential game? Why or why not?arrow_forward

- Please solve it complete with details and explanationarrow_forwardTwo firms operating in the same market must decide between charging a high price or a low price. The Payoffs are as below. Firm A's profit is listed before the comma, B's profit after the comma. Firm B Firm A Low Price High Price Low Price 16, 17 7, 28 High Price 28, 7 22, 22 If each firm tries to choose a price that is optimal, regardless of the other firm's price, what is the Nash equilibrium? Does either firm have a dominant strategy?arrow_forwardThe following integrated series of questions relates to several sections in the text. Scenario 2: Suppose a stream is discovered whose water has remarkable healing powers. You decide to bottle the liquid and sell it. The market demand curve is linear and is given as follows: P = 30 -Q The marginal cost to produce this new drink is $3. Refer to Scenario 2. What will be the price of this new drink in the long run if the industry is a Cournot duopoly? A. $3 В. $9 C. $13.50 D. $12 E. None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education