Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting question

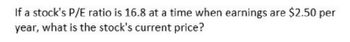

Transcribed Image Text:If a stock's P/E ratio is 16.8 at a time when earnings are $2.50 per

year,

what is the stock's current price?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If a stock's P/E ratio is 13.5 at a time when earnings are $3 per year and the dividend payout ratio is 40%, what is the stock's current price?arrow_forwardIf a company has a forward (forecasted) EPS of 5.242 and a forward PE of 76.495, what is the forecasted price of that stock? (forecasted)arrow_forwardA stock had the following year-end prices and dividends: Year Price Dividend 0 $ 58.75 — 1 68.56 $ 1.14 2 61.78 1.33 3 70.20 1.49 What was the arithmetic average return for the stock?arrow_forward

- What is the required return on preferred stock, rPS, if the stock has an annual dividend of $9 and a price of $100?arrow_forwardIf a company has a forward (forecasted) EPS of 0.757 and a forward (forecasted) PE of 86.995, what is the forecasted price of that stock? Yarrow_forwardWhat are the arithmetic and geometric (Answer in that order.) average returns for a stock with annual returns of 9.4 percent, 8.2 percent, -8.3 percent, 4.1 percent, and 9.5 percent?arrow_forward

- 1. A stock has had the following year-end prices and dividends: Year Price ($) Dividend ($) 94.17 92.21 1.05 96.1 1.2 96.3 1.57 94.16 1.66 96.46 1.69 What is the geometric average return for the stock? Answer as a percentage to two decimals (if you get -0.0435, you should answer -4.35).arrow_forwardIf a stock's P/E ratio is 13.5 at a time when earnings are $3 per year and the dividend payout ratio is 40%, what is the stock's current price? a. $24.30 b. $18.00 c. $22.22 d. $40.50arrow_forwardprovide ans..arrow_forward

- what are the two type parts of most stocks expected total return? if D1=$2.00, g= 6% and po $40.00, what are the stocks expected dividend yield, capital gains yield, and total expected return for the coming year?arrow_forwardWhat is the dividend yield if the annual dividend per share is $7.50 and the market price of a share of stock is $97?arrow_forwardA stock has had the following year-end prices and dividends: TIT Year Price Dividend $16.25 1 18.43 $ .15 2 19.43 .30 3 17.93 .33 4 20.27 .34 23.38 .40 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Arithmetic return |% Geometric returnarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning