ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

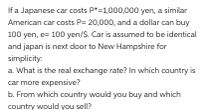

Transcribed Image Text:If a Japanese car costs P*=1,000,000 yen, a similar

American car costs P= 20,000, and a dollar can buy

100 yen, e= 100 yen/$. Car is assumed to be identical

and japan is next door to New Hampshire for

simplicity:

a. What is the real exchange rate? In which country is

car more expensive?

b. From which country would you buy and which

country would you sell?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The same pair of shoes costs $200 in the U.S., 22,000 Japanese Yen, £130 British pounds and 190 Euros. What are the Yen/$, £/$ and €/$ exchange rates if the Law of One Price holds?arrow_forwardPresently, the dollar is worth 140 Japanese yen in the spot market. The interest rate in Japan on 90-day government securities is 4 percent; it is 8 percent in the United States. a. If the interest-rate parity theorem holds, what is the implied 90-day forward exchange rate in yen per dollar? b. What would be implied if the U.S. interest rate were 6 percent?arrow_forwardWe noted that in 1900, the fixed exchange rate between the British pound and the U.S. dollar was 1 pound equals $5. What is the exchange rate today? Whose currency has gained the most in purchasing power? What caused this dramatic change in the exchange rate?arrow_forward

- If a U.S. dollar purchases 1.2 Euros, and a gallon of milk costs $3 in the U.S. and 5 Euros in Spain what is the real exchange rate? Group of answer choices 1.8 .93 2 .72arrow_forwardCountry A’s goods have become relatively less expensive for Country B’s buyers due to a change in the exchange rate between those two country’s currencies. All other things remaining constant, this could be because Country B’s currency has __________ relative to Country A’s currency. a) shifted b) appreciated c) stagnated d) depreciatedarrow_forwardThe current spot exchange rate is $1.20/euro. The current 90-day forward exchange rate is $1.18/euro. You expect the spot rate to be $1.22/euro in 90 days. a. According to your expectation, is the dollar appreciating or depreciating against the Euro? b. How would you speculate using a forward contract? c. If many people speculate the way you have responded in part b., what pressure will that place on the value of the current 90-day forward exchange rate?arrow_forward

- If a "Big Mac costs $4.00 in the United States and 200 yen in Japan, then the implied "purchasing-power-parity" exchange rate using the "Big Mac" is __________. If the actual exchange rate in the market is 120 yen = $1, then an economist would say that the actual Japanese yen is __________ in comparison with its "purchasing-power-parity" rate.arrow_forwardIf a French car costs 10,000 euros, a similar American car costs 15000 dollars, and a euro can buy 1.2 dollars. what is real exchange rates ( you may assume any currency as the “domestic currency”) If a French car costs 10,000 euros, a similar American car costs 15000 dollars, and a euro can buy 1.2 dollars. what is real exchange rates ( you may assume any currency as the “domestic currency”) ???arrow_forwardIf to ship any amount of gold between New York If to ship any amount of gold between New York and London costs 1 percent of the value of the gold shipped, define the U.S. gold export point or upper limit in the exchange rate between the dollar and the pound (R = $/£). Why is this so? If to ship any amount of gold between New Yorkarrow_forward

- Discuss three factors that would impact the values of the major currencies in foreign exchangearrow_forwardThe table below shows hypothetical prices of a tall Starbucks latte in countries around the world. Using the data, and the fact that a latte costs $3 in the United States, calculate how much a country's currency is under- or overvalued according to purchasing power. First, calculate the implied exchange rate for each country. Next, calculate the "latte index" for each country using the Big Mac index formula from the chapter. Instructions: Round your answers to two decimal places. Country Thailand Argentina United Kingdom Japan Price 60 baht 15 peso (s) 2 pound (s) 450 yen Official exchange rate 30 baht/dollar. 6 pesos/dollar 0.5 pounds/dollar se yen/dollar Implied exchange rate if PPP holds baht/dollar pesos/dollar pounds/dollar yen/dollar 20.67 4.00 .67 145.00 Cost of U.S. latte *% 20.50 42.86 40.30 % % 27arrow_forwardConsider the appreciation of a currency. What effects might this have on international companies exporting overseas? What actions could companies take to minimize these effectsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education