ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

In 1992, 18.6 million Canadians visited the United States, but only 11.8 million U.S. residents visited Canada. By 2002, roles had been reversed: more U.S. residents visited Canada than vice versa.

Why did the tourism reverse direction? Canada didn’t get any warmer from 1992 to 2002 – but it did get cheaper. The reason is a large change in the exchange rate: in 1992 Canadian dollar was worth $0.80, but by 2002 it had fallen in the value by 20% to about $0.65. This means that Canadian goods and services, particularly hotel rooms and meals, were about 20% cheaper for Americans in 2002 compared to 1992. American vacations had become 20% more expensive for Canadians. Canadians responded by vacationing in their own country or in other parts of the world.

Foreign travel is an example of a good that has a high price elasticity of demand: elasticity=4.1.

One reason is that foreign travel is a luxury good for most people – you may regret not going to Paris this year, but you can live without it. A second reason is that a good substitute for foreign travel typically exist – domestic travel. A Canadian who finds it too expensive to vacation in San Francisco this year is likely to find that Vancouver is a pretty good alternative.

Give an example of a good that has a high price elasticity of demand.

Transcribed Image Text:+

/courses/185189/discussion_topics/838206?module_item_id=6045692

S

Canvas

BIOL 111 Textbook SMATH 140 Textbook PAGEC 105 Textbook

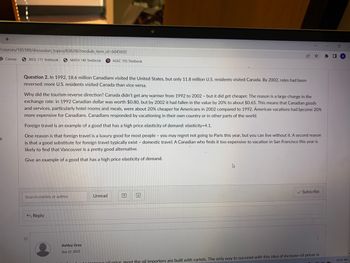

Question 2. In 1992, 18.6 million Canadians visited the United States, but only 11.8 million U.S. residents visited Canada. By 2002, roles had been

reversed: more U.S. residents visited Canada than vice versa.

Why did the tourism reverse direction? Canada didn't get any warmer from 1992 to 2002 - but it did get cheaper. The reason is a large change in the

exchange rate: in 1992 Canadian dollar was worth $0.80, but by 2002 it had fallen in the value by 20% to about $0.65. This means that Canadian goods

and services, particularly hotel rooms and meals, were about 20% cheaper for Americans in 2002 compared to 1992. American vacations had become 20%

more expensive for Canadians. Canadians responded by vacationing in their own country or in other parts of the world.

Foreign travel is an example of a good that has a high price elasticity of demand: elasticity=4.1.

One reason is that foreign travel is a luxury good for most people - you may regret not going to Paris this year, but you can live without it. A second reason

is that a good substitute for foreign travel typically exist - domestic travel. A Canadian who finds it too expensive to vacation in San Francisco this year is

likely to find that Vancouver is a pretty good alternative.

Give an example of a good that has a high price elasticity of demand.

Search entries or author

O

Reply

Ashley Gray

Sep 12, 2022

Unread

♫

✓ Subscribe

il price most the oil importers are built with cartels. The only way to succeed with this idea of increase oil prices is

* □

0

10:55 AM

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- We noted that in 1900, the fixed exchange rate between the British pound and the U.S. dollar was 1 pound equals $5. What is the exchange rate today? Whose currency has gained the most in purchasing power? What caused this dramatic change in the exchange rate?arrow_forwardChina is one of the U.S.’s most important trading partners. (Consider how many goods are “Made in China”). What might happen to the value of the U.S. dollar, the U.S. economy, and the trade relationship between the two countries if China was experiencing unusually high inflation?arrow_forwardEthiopia's GDP is 300 billion birrs and its population is 60 million. The exchange rate with the U.S. dollar is $1 = 40 birrs. Find GDP per capita in U.S. dol your answer to the nearest dollar. Answer $ Kearrow_forward

- The following paragraphs discuss the impact of various economic events on the exchange rate. Complete the paragraphs by filling in the blanks. Use any of the words from the following list (you can use each of these words as many times as you wish but choose carefully - your sentence must make grammatical sense):demand supply left right buy sell imports exports rise fall increases decreases What happens to the current account balance and the exchange rate when the following happens? Suppose that New Zealand firms become more profitable relative to foreign firms and so increase their payment of dividends (everything else held constant). The value for net foreign income therefore ________ and the value of the current account balance will _______. Payment of NZ dividends to foreign owners affects the _______ or/of $NZ while payments of foreign dividends to NZ owners of foreign companies affects the _______ for/of $NZ. Therefore the impact of the change in profit of NZ firms is…arrow_forwardWhen you write an exchange rate in terms of how many units of a foreign currency it takes to buy one US dollar, we call that: a)a direct quote b) the real price c) an indirect quote d) a depreciationarrow_forwardHow does the fluctuating value of the Euro affect the price of German cars sold in the United States?arrow_forward

- The following table contains hypothetical data for Canada's balance of payments in a particular year. Exports of goods and services $160 Imports of goods and services $140 Primary income (investment income received from abroad) $15 Primary income (investment income paid from abroad) $25 Secondary income (Net transfers) $10 Foreign investment in Canada $220 Canadian investment abroad $240 Refer to the information above to answer this question. Which of the following reflects the state of Canada's capital account? Multiple Choice It has a deficit of $10 billion. It has a deficit of $20 billion. It has a surplus of $5 billion. It has a surplus of $30 billion.arrow_forwardAn exchange rate is the domestic price to purchase one unit of a foreign currency. For example, how much does it cost in Canadian dollars to buy one US dollar? There are various economic theories to predict exchange rates. The simplest theory is known as the Law of One Price or also known as Absolute Purchasing Power Parity (PPP). Use absolute PPP and the price of a Big Mac in different countries to complete the table below and to predict whether the local currency is over or undervalued compared to the US dollar. Country USA Canada Saudi Arabia Brazil Italy Source: The Economist Big Mac Price in Local Currency $4.62 $5.54 SR 10 R$ 12 €3.75 Current Market Exchange Rate e 1.10 3.75 2.27 0.74 Exchange Rate Predicted by PPP and Big Mac ê According to the table above, an arbitrageur in Brazil could make money by If the Big Mac Index were accurate for other tradeable goods and services, Brazil's AD curve would O Local Currency should... the US. 수 + 8°C. Clouarrow_forwardA country has been experiencing a persistent deficit in its current account balance due to high levels of imports compared to exports, along with significant outflows of income payments and transfers. To address this issue, the government is considering implementing a range of policies, including devaluation of the currency, imposition of tariffs, and promotion of export industries. The goal is to correct the balance of payments imbalance and improve the country's international financial position. The question is: In this scenario, the primary objective of the government's policies is to: A) Increase the country's reliance on imports B) Decrease foreign investment in the country C) Correct the balance of payments deficit D) Eliminate all forms of international tradearrow_forward

- Using data from The Economist's Big Mac Index for 2019, the following table shows the local currency price of a Big Mac in several countries as well as the actual exchange rate between each country and the United States. At the time of the data collection, a Big Mac would have cost you $5.74 in the United States and GBP 3.29 in the United Kingdom. The actual exchange rate between the British pound and the U.S. dollar was $1.25 per pound. The dollar price of a Big Mac purchased in the United Kingdom was, therefore, computed as follows: Dollar price of a Big Mac in the United KingdomDollar price of a Big Mac in the United Kingdom = = GBP 3.29×$1.25GBP 1.00GBP 3.29×$1.25GBP 1.00 = = $4.11$4.11 For the price you paid for a Big Mac in the United States, you could have purchased a Big Mac in the United Kingdom and had some change left over for fries! Complete the final column of the table by computing the dollar price of a Big Mac for the countries where this amount is…arrow_forwardAssuming that the Euro-U.S. dollar exchange rate is .9. If a German buys an American automobile for $30,000, then what would the automobile cost in Euros? What would the automobile cost if the dollar depreciated by 20 percent?arrow_forwardSo, what has happened to the USD-EUR exchange rate over the past year or two? Can you tell anything about what you would do from looking at the trends? Has the USD appreciated or depreciated vs. the EURarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education